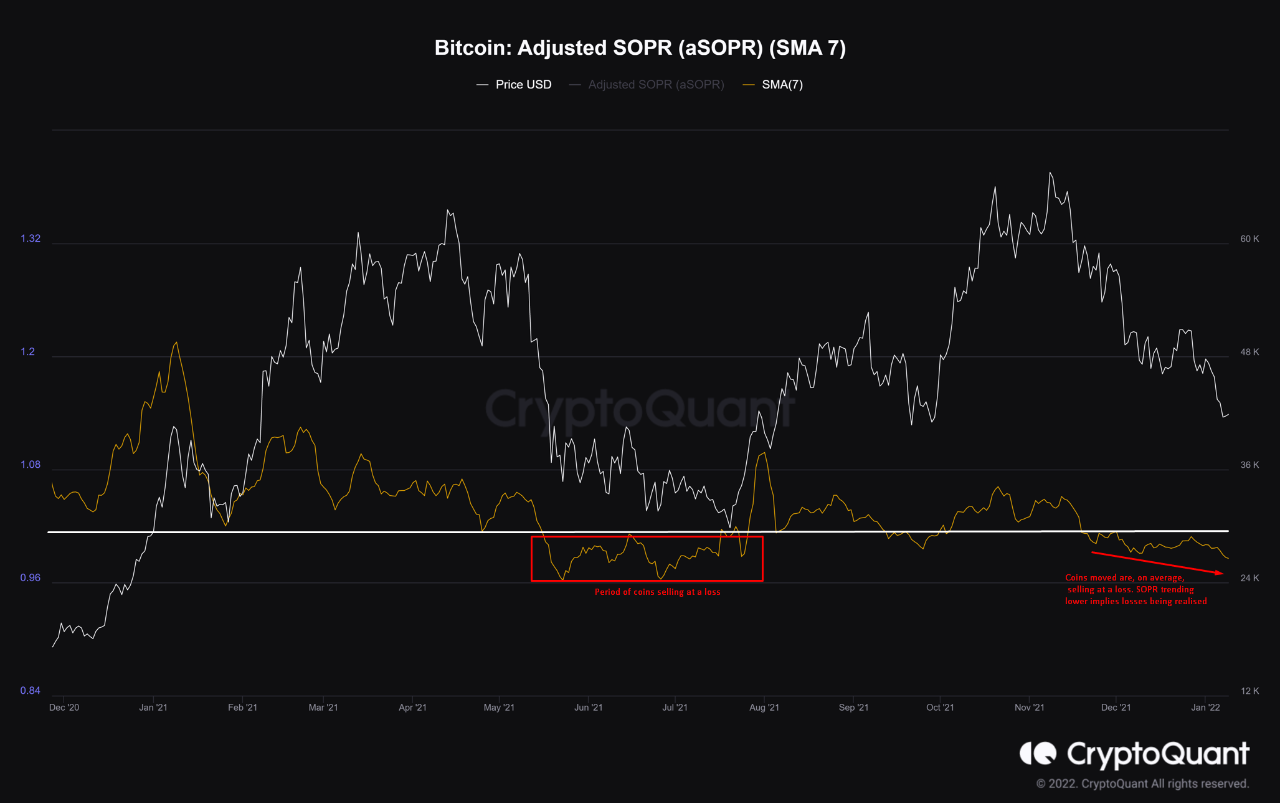

The on-chain indicator SOPR means that Bitcoin holders have continued to promote at a loss for some time now. This conduct is much like what was seen through the Could-June 2021 mini-bear interval.

Bitcoin Buyers Have Continued To Dump At A Loss For A Month Now

As identified by an analyst in a CryptoQuant post, the BTC SOPR reveals that holders are at the moment promoting at a loss.

The “Spent Output Profit Ratio” (or SOPR briefly) is an indicator that tells us whether or not cash moved on a given day had been offered at a revenue or a loss.

The metric measures so by every coin on the chain and checking what the worth the coin was final moved at. After that, the indicator calculates the ratio between this value and the present value.

When the worth of the indicator is above one, it implies that holders are at the moment promoting, on a median, at a revenue.

Then again, when the SOPR has values lower than one, it implies traders are shifting their Bitcoin at a loss general.

Lastly, there may be the case when the worth of the indicator is precisely equal to 1. Throughout such a interval, the market is breaking even on BTC gross sales.

Associated Studying | Is The Bitcoin Hashrate Recovering From Kazakhstan’s Crisis? Fear Abides

Now, here’s a chart that reveals the pattern within the worth of the Bitcoin SOPR over the previous yr:

Seems like the worth of the indicator has stayed under one lately | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin SOPR at the moment has a price lower than one, which implies holders are promoting at a loss.

Associated Studying | Bitcoin Open Interest Continues To Rise, Short Squeeze Incoming?

Such a pattern has been there for a month now. An identical state of affairs was there after the Could 2021 crash the place the indicator stayed under one for a chronic time frame.

It’s doable that the present pattern of low SOPR values will proceed for some time, identical to again then. The interval round Could-June was marked by a mini-bear market, and so if the pattern does repeat, an analogous bear atmosphere might observe within the close to future.

BTC Worth

Yesterday, Bitcoin’s price briefly declined under the $40k mark, however since then has jumped again up. On the time of writing, the worth of the coin floats round $41.7k, down 10% within the final seven days. Over the previous month, the crypto has misplaced 13% in worth.

The under chart reveals the pattern within the value of BTC over the past 5 days.

BTC's value has continued to maneuver sideways above $40k in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com