The S&P 500 gained about 3.17 p.c previously 5 days to commerce at round 4,514.87 as of Wednesday’s shut.

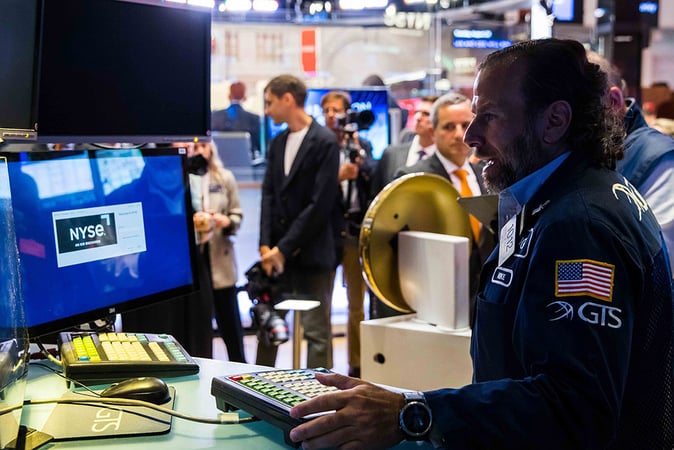

The S&P 500 (SPX) edged greater on Wednesday, closing above essential assist ranges that might see the inventory index revisit its ATH quickly. The Commonplace and Poor’s 500 gained about 0.38 p.c on Wednesday to shut the day buying and selling at round 4,514. Different main inventory indexes led by the Dow Jones Industrial Average (DJIA) and the US 100 Index (NDQ) gained about 0.11 p.c and 0.56 p.c respectively.

The final bullish outlook coincided with most firms reporting spectacular second-quarter earnings. Because of this, traders had extra knowledge to evaluate america’ financial outlook amid shifting world standing led by the BRICS motion. Notably, the BRICS motion led by Russia and China added a number of different members from totally different continents and was perceived to be main oil producers.

The S&P 500 is undeniably headed to revisit its ATH that was set through the 2021/2022 bull market. The unreal intelligence (AI) hype has seen many of the S&P 500 parts thrive previously few months. Nevertheless, the final financial uncertainty has most traders betting on dangerous belongings like digital belongings, and treasured metals.

Key Points that May Influence S&P 500 Volatility

The USA Bureau of Labor Statistics and the Bureau of Financial Evaluation are anticipated to launch high-impact information on Thursday and Friday, which is able to present traders with a vital financial outlook. Later right this moment, traders might be watching the core Private Consumption Expenditures (PCE) value index which launched MoM, and the Unemployment Claims.

On Friday, traders might be looking out for the unemployment charge, additionally known as the jobless charge, which is predicted to be launched with economists forecasting it to come back at 3.5 p.c, much like the earlier one. The Bureau of Labor Statistics will launch the typical hourly earnings MoM, which is predicted to drop to 0.3 p.c from 0.4 p.c. Moreover, the company will launch knowledge on non-farm employment change on Friday, which is estimated to come back in at 169k down from 187k from the earlier one.

Regardless of the traders highlighting weaker-than-expected financial knowledge, the S&P 500 continued to realize and will proceed for the remainder of the yr. Furthermore, the Fed is predicted to proceed with its strict financial coverage to fight the excessive inflation to the specified 2 p.c.

“Merchants and traders alike need to see ‘comply with by’ in right this moment’s market motion, serving to to substantiate that the uptick in market efficiency is a extra viable transfer because the market heads into September,” stated Quincy Krosby, chief world strategist at LPL Monetary.

Let’s discuss crypto, Metaverse, NFTs, CeDeFi, and Shares, and give attention to multi-chain as the way forward for blockchain expertise.

Allow us to all WIN!