All spot Bitcoin exchange-traded funds (ETFs) and crypto-related shares opened increased after recording large rise in pre-market hours on Friday as BTC value breaks above $47,000. Specialists assume it’s as a result of buyers, together with whales, are shifting a refund into the crypto market.

Large Pre-Market Buying and selling in Crypto Shares and Spot Bitcoin ETF

Shares resembling Coinbase (COIN) and MicroStrategy (MSTR) opens over 6%, and Robinhood Markets (HOOD) up 2% amid a rally in BTC value.

Furthermore, Bitcoin mining shares resembling Marathon Digital, Riot Blockchain, TeraWulf, CleanSpark Inc, and others additionally rally on bullish sentiment on Bitcoin. CleanSpark inventory value jumped 27% on account of sturdy earnings report and plans to purchase 4 mining amenities.

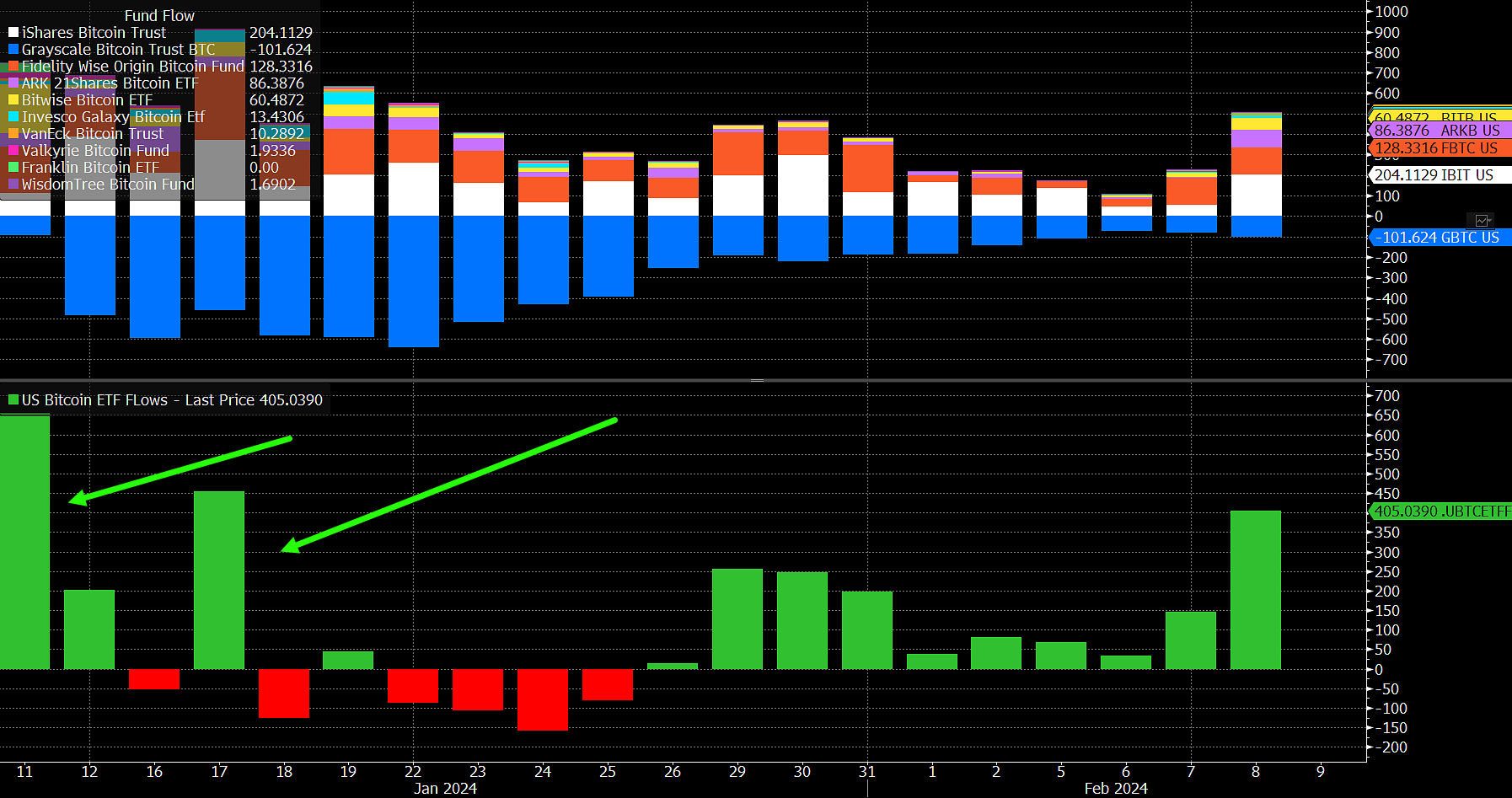

All spot Bitcoin ETFs additionally open a lot increased, indicating large demand for Bitcoin right this moment. Bloomberg ETF analyst James Seyffart famous Thursday was the third greatest influx day for the spot Bitcoin ETFs since their launch. First day influx was over $655 million and Jan 17 was greater than $453 million.

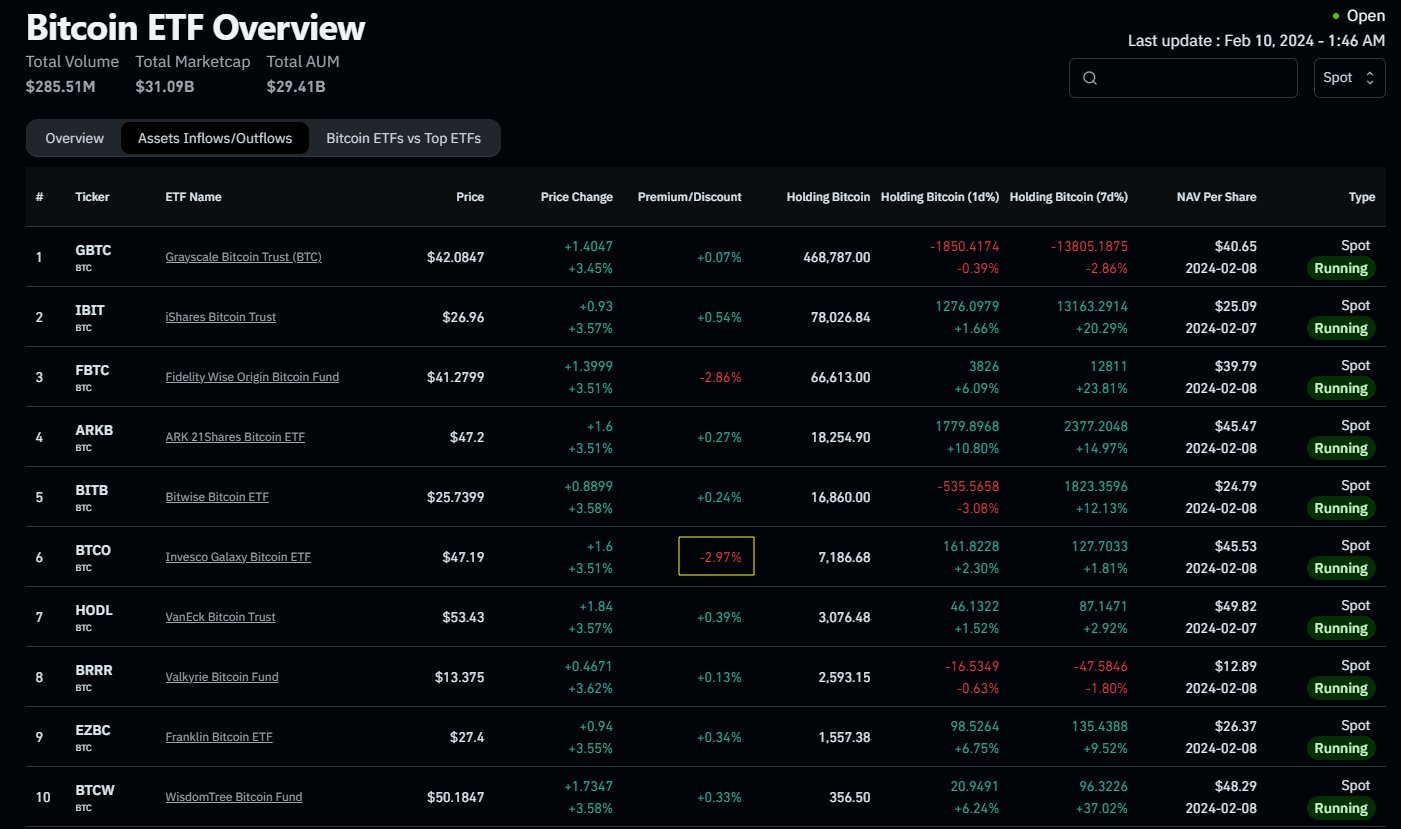

CoinGape reported that Bitcoin price rise past $47,000, with excessive odds of breaking above $48,000, which corresponds with a notable $405 million influx into spot Bitcoin ETFs listed within the US. BlackRock (IBIT) and Constancy (FBTC) spot Bitcoin ETF lead the influx. GBTC outflow rose greater than $100 million.

Including to the bullish sentiment is the surge in Bitcoin Futures Open Curiosity (OI), which has risen by 5.51% within the final 24 hours to achieve 444.81K BTC or $20.74 billion, in accordance with CoinGlass data. Main the cost in OI development is the CME change, which noticed a surge of 9.79% to 117.23K BTC or $5.46 billion. Binance follows carefully behind with a 5.78% improve to 109.76K BTC or $5.12 billion in the identical timeframe.

Additionally Learn: Ethereum Dencun Mainnet Upgrade: ETH Breaks $2,500 As Geth Releases Crucial Update

Bitcoin Value Breaks Above $47,000

Spot flows much more essential right this moment, particularly across the late US session, analyst Skew mentioned. All Bitcoin ETFs by BlackRock, Constancy, Bitwise, Ark 21 Shares, and others open increased after a premarket bounce of over 4%.

He mentioned, “It’s value keeping track of the bigger holders of BTC when there’s a reduction and excessive quantity day.”

BTC price jumped 5% within the final 24 hours, with the value at the moment buying and selling at $47,204. The 24-hour high and low are $44,909 and $47,579, respectively. Moreover, buying and selling quantity has elevated by greater than 28%.

Additionally Learn: Ripple Vs SEC: Judge Torres Grants Ripple’s Request for Remedies-Related Discovery

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: