Spot Bitcoin ETFs noticed almost $295 million in web inflows on Monday, recording inflows for 2 consecutive days and beginning the week with huge shopping for. This means institutional traders are shopping for closely regardless of the German govt BTC selloff and key macroeconomic occasions this week.

Spot Bitcoin ETFs Influx Hints At Upcoming Market Rally

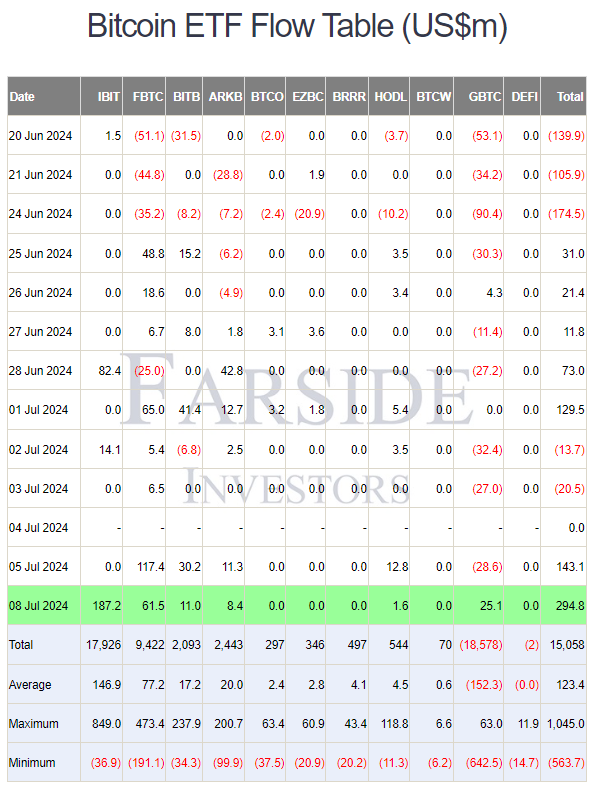

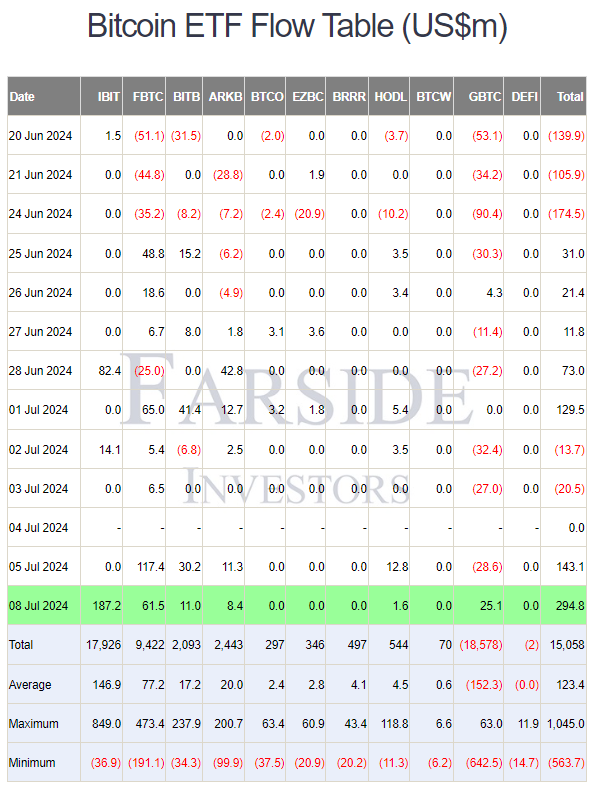

Spot Bitcoin ETFs within the U.S. recorded a complete web influx of $294.8 million, the very best influx in 21 days. It follows as institutional traders proceed to purchase the dip. Crypto asset funding merchandise globally noticed a $441 million influx final week as crypto weak spot by Mt Gox and the German Authorities promoting stress had been seen as a shopping for alternative, reported CoinShares.

In accordance with Bloomberg and Farside Buyers, BlackRock’s iShares Bitcoin ETF (IBIT) recorded $187.2 in influx, the very best influx not seen in the previous few weeks. Following the most recent influx, BlackRock’s web influx hit over $17.9 billion and BTC holding is valued at almost $18 billion.

Constancy Bitcoin ETF (FBTC) noticed $61.5 in influx on Monday, with the overall influx reaching $9.42 billion. Bitwise Bitcoin ETF (BITB), Ark 21Shares (ARKB) Bitcoin ETF, and VanEck Bitcoin ETF (HODL) additionally noticed inflows of $11 million, $8.4 million, and $1.6 million, respectively. Different spot Bitcoin ETFs noticed zero web inflows.

Notably, Grayscale Bitcoin Belief (GBTC) additionally recorded inflows of $25.1 million after consecutive outflows within the earlier days. GBTC buys 450 BTC, indicating robust demand from institutional traders.

Additionally Learn: Matrixport Reveals Ethereum ETF Launch Timeline, Bernstein Targets ETH To $6,600

BTC Worth To Rally Above $60k

Institutional shopping for indicators excessive possibilities of Bitcoin rally to above $60k. Specialists are total bullish on BTC worth and consider Mt. Gox collectors usually are not more likely to promote their Bitcoin on this bull market.

In 6 months, US-listed Bitcoin ETFs introduced in over $14.7B in web inflows. Key takeaway? Curiosity in #Bitcoin and digital belongings stays excessive.

Token costs and market caps fluctuate, however the long-term fundamentals of our business is powerful.

Keep targeted and maintain constructing! 🚀

— Richard Teng (@_RichardTeng) July 9, 2024

BTC price has jumped over 3% within the final 24 hours, with the worth presently buying and selling at $57,603 as merchants adjusted positions primarily based on Wall Avenue’s bullish outlook on fee cuts. The 24-hour high and low are $55,240 and $58,131, respectively. Moreover, the buying and selling quantity has elevated by 36% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Derivatives market knowledge reveals huge shopping for by futures and choices merchants. BTC futures open curiosity throughout exchanges soared 2.60% within the final 24 hours. Shopping for is recorded on CME and Kraken, which means increased demand within the US.

Nonetheless, merchants should stay cautious as a result of Fed Chair Jerome Powell speech, CPI and PPI inflation knowledge due this week.

Additionally Learn: What Could be The Maximum Impact of Mt. Gox Creditors Selling Their Bitcoins?

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: