The Spot Bitcoin ETFs have change into a major headliner not too long ago on account of heightened ranges of market inflows. In response to data from SoSoValue, these ETFs have attracted over $5 billion in investments over the previous three weeks coinciding with a formidable Bitcoin worth rally of over 23%. Nonetheless, amidst this euphoria, macro funding researcher Jim Bianco says these Spot ETFs have contributed no important development to the Bitcoin market.

Spot Bitcoin ETFs Carry In No New Cash, Solely Recycled Investments

In a series of X posts on November 2, Bianco claimed the Spot Bitcoin ETFs regardless of their spectacular influx report don’t entice any new investments to the underlying asset. Firstly, The analyst applauds the efficiency of those institutional funds some of which rank as the best-performing ETFs of 2024 following their launch in January.

Nonetheless, Bianco highlights BTC has did not surpass its all-time excessive worth of 73,750 set eight months in the past regardless of the Spot Bitcoin ETFs accruing over $12 billion in inflows since BTC inside the identical interval.

Slightly than being lower than 4% down from its ATH, the analyst defined that such excessive inflows ought to have since pushed premier cryptocurrency past the $100,000 mark particularly contemplating different constructive indicators comparable to Fed charge cuts, the halving, and public endorsement by Republican Presidential candidate Donald Trump.

For context, Bianco references the Gold ETFs with a report of over $6 billion in inflows since March 13, leading to a 25% improve in gold’s market worth throughout that interval. The market analyst postulates that this worth development might be attributed to the “new cash” flowing into the Gold ETFs. Nonetheless, recycled funds shifted from on-chain wallets or centralized exchanges account for almost all of the investments in Spot Bitcoin ETFs.

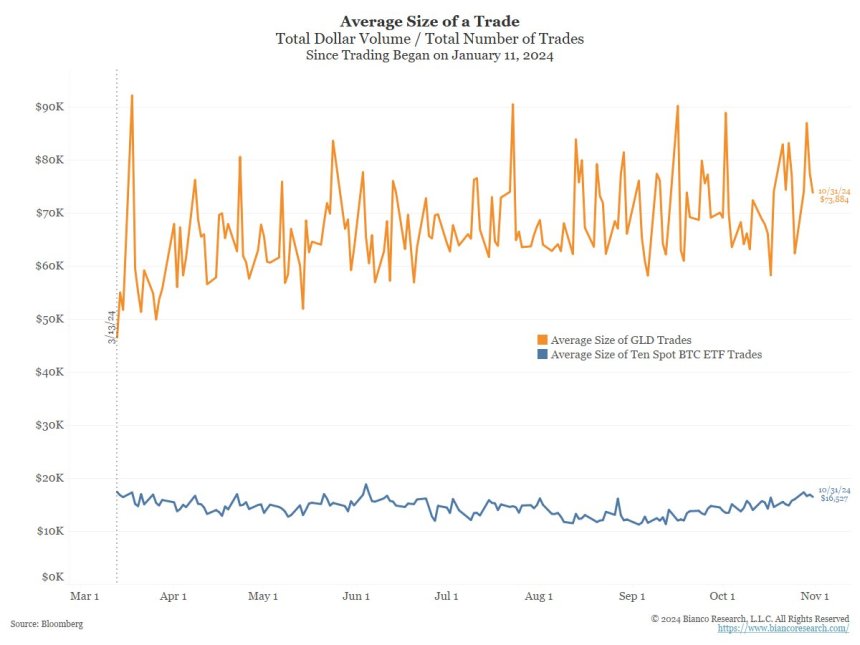

Jim Bianco backs this idea with a report from Coinbase CFO Alesia Haas which highlighted a decline within the change’s bitcoin retail merchants over the previous few months. Moreover, he additionally factors to the typical Spot BTC ETF commerce of $16,000 in comparison with the typical gold ETF commerce of $72,000 which is per investments from wealth managers and establishments.

In conclusion, Jim Bianco states the Spot Bitcoin ETFs usually are not attracting any “new cash” however merely circulating present investments in Bitcoin, which he describes as a regarding pattern which will grant conventional monetary establishments (TradFi) extra affect within the crypto market as in opposition to the ethos of decentralization.

Bloomberg Analyst Fires Again At BTC ETF Criticism

Widespread Bloomberg ETF analyst Eric Balchunas has issued a robust rebuttal to Bianco’s tackle the Spot Bitcoin ETFs which he describes as merely “psychological gymnastics”. Balchunas has lauded the performances of those ETFs which he believed have performed a vital function in driving Bitcoin’s worth from $35,000 in January to the current market worth of just about $70,000. The Bloomberg analyst describes the Spot Bitcoin ETFs as “highly effective” on account of their low value, excessive liquidity, and affiliation with a longtime model title and advises in opposition to betting in opposition to them.

On the time of writing, BTC. continues to commerce at $68,100 reflecting a 2.55% decline up to now 24 hours.

Featured picture from Blockzeit, chart from Tradingview