Stablecoins have turn into an more and more ubiquitous a part of the crypto ecosystem in recent times. However with their rise comes unprecedented scrutiny. In an unique BeInCrypto interview, Wade Guenther, a companion at asset supervisor Wilshire Phoenix, shared his ideas on their long-term prospects.

Stablecoins nowadays are as helpful as they’re controversial. They provide a medium of trade and a retailer of worth for merchants who don’t wish to off-ramp from the crypto ecosystem. In contrast to virtually each different crypto token, they provide stability, no less than in idea. In crypto, a value fluctuation of 10% is frequent. Whereas, on foreign exchange markets, a 2% change in a fiat foreign money’s value over 24 hours is taken into account vital.

How A lot Can You Belief Stablecoins?

Earlier this month, nonetheless, TrueUSD depegged—the phrase denotes an uncoupling from the asset it’s pegged to. On this case, the US greenback. As with all extensively used stablecoins, the depeg stoked panic throughout the market as members nervous about its knock-on results.

The identical occurred in the course of the spring banking disaster in america. In March, as regional banks started to fail, Circle, the issuer of the USDC, revealed a $3.3 billion exposure to Silicon Valley Financial institution. On June 15, the largest stablecoin by market capitalization, Tether’s USDT, depegged after dropping the boldness of buyers. Markets panicked because the USDT stability on Curve’s 3pool rose to 72%.

Given the current crises, can buyers safely “park their money” in stablecoins?

“Conceptually, it may make sense for buyers to park their money in asset-backed stablecoins if the stablecoin firm follows the mandate,” stated Guenther.

“Nonetheless, asset-backed stablecoins have a significant downside when in comparison with different US-issued money or money equivalents. Particularly, they’re circuitously backed by the complete religion and credit score of the US Federal Reserve.”

So the query turns into: whom do you belief extra? The Fed or the stablecoin issuer?

“Asset-backed stablecoins should not decentralized and are run by firms and companies,” continued Guenther. “That is very true for fiat currency-backed stablecoins. The issuer firm manages the fiat foreign money reserves, and there can usually be a scarcity of transparency on precise reserves.”

Issues About Transparency

The shortage of transparency with regard to stablecoin reserves has been a working sore for the business. Tether as soon as held vital short-term debt issued by firms. However the firm didn’t disclose particulars concerning the corporations whose debt it owned. Later, Tether switched to US Treasurys, that are seen as a extra secure asset for its reserves.

In response to widespread business concern about its openness and accountability, Tether employed the accounting agency BDO Italia to publish attestations and assurance reports and reassure the market about its property. Nonetheless, these studies should not as strong or intensive as a full audit.

“The belief is positioned within the stablecoin firm’s inner administration,” stated Guenther. “Tether has skilled a number of investigations into its said reserves. Thus far, USDT has survived these investigations, however the dangers resulting from its centralized management will at all times stay.”

Even so, regardless of widespread concern concerning the stability of stablecoins, together with a report out this week from the Financial institution of Italy saying they “have not proved stable at all,” Guenther sees causes to be optimistic.

“Stablecoins play an vital function inside crypto because the oil that greases the market and likewise serves as main collateral,” he defined.

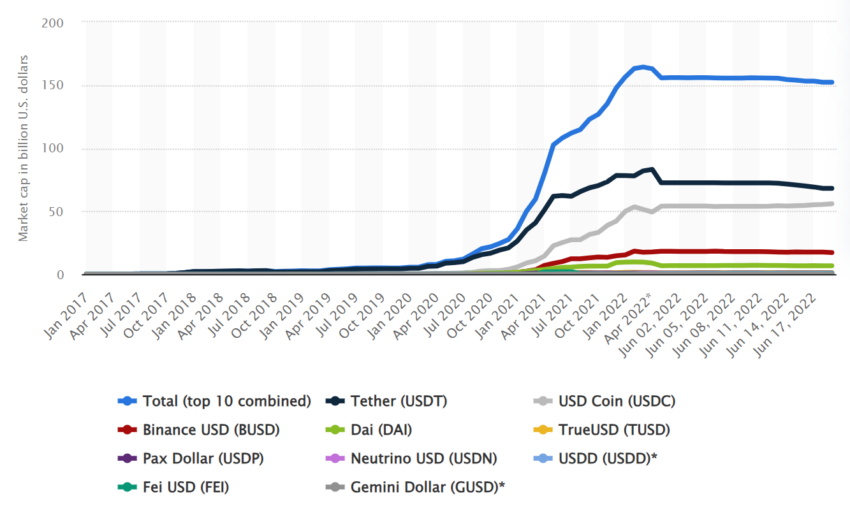

“[They] each strengthen and propel the monetary crypto system. With the restoration and development of crypto going ahead, we count on the stablecoin market to broaden each inside the crypto area and inside conventional finance.”

An Inflation Hedge?

Guenther stated he and his colleagues at Wilshire Phoenix see fiat-backed stablecoin adoption as an rising long-term development. There are lots of advantages right here, he argued. Particularly that regulators can implement transparency. Plus central banks could choose to difficulty their very own fiat-backed stablecoins. This can initiative a flight to high quality, Guenter believes.

“Central financial institution backing of stablecoin reserves may assist scale back the runs on stablecoins that generally happen,” Guenther added.

This shouldn’t be a shock. Using stablecoins may help sustain buying energy. To not point out counter the results of hyper-inflation, given USDT’s peg to the US greenback, he said.

“We consider the biggest development potential is in areas with excessive ranges of inflation. The general public has comparatively simple entry to USDT, whereas this sort of hedging instrument would have been extra of an institutional resolution ten years in the past,” stated Guenther.

Guenther pointed to numerous issues to observe within the stablecoin area. Particularly, adjustments round know-your-customer (KYC) and anti-money laundering (AML) rules. And broader shifts in banking tradition.

“The standard banking system will possible evolve as broad adoption of stablecoins continues,” he added. “Observing the banking system’s evolution as potential stablecoin credit score intermediaries might be an fascinating growth.”

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material.