Within the cryptocurrency market, a brand new technique is rising, promising vital beneficial properties for astute traders. A famend analyst not too long ago shared a complete information for staking a choose group of altcoins, probably unlocking over 100 airdrops.

Whereas this technique is comparatively untested, its potential makes it a compelling topic for traders to analysis and perceive its practicality and potential advantages.

Altcoins Promising Airdrops

An influential X (previously Twitter) person, Rekt Fencer, aims to profit from a number of blockchain ecosystems that promise to yield over “100 airdrops price greater than $1 million this yr.” For the Celestia ecosystem, Fencer suggested staking TIA by means of the Keplr Wallet and on MilkyWay, with a minimal stake of two TIA. This technique is designed to leverage Celestia’s community progress.

“TIA Airdrops are at the moment producing numerous consideration. As of now, there have been 4 confirmed airdrops: Dymension (DYM), MilkyWay (MILK), Motion (MOV), and Doki (DOKI),” Fencer affirmed.

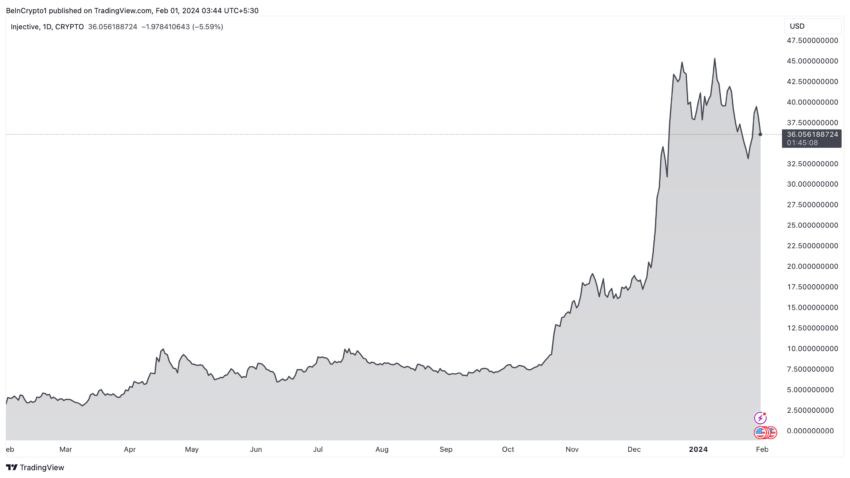

However, within the Injective ecosystem, the technique includes staking INJ through Keplr Pockets. Fencer additionally beneficial delegating to Black Panther and Talis Protocol, and fascinating with tasks like Helix and Hydro Protocol. This method goals to capitalize on Injective’s strong buying and selling platforms and numerous choices.

“Injective is up 1,600% and crushing it this yr, outperforming SOL, BNB, and ATOM. However while you see the ecosystem, it feels so early, and the vast majority of tasks are nonetheless in Testnet. That is the proper time for tasks to difficulty their token and probably do airdrops,” one other X person, Pepesso, said.

Learn extra: Best Upcoming Airdrops in January 2024

The Cosmos ecosystem additionally gives a extra different technique. It includes staking a number of tokens, together with ATOM, OSMO, TIA, JUNO, SEI, and KUJI by means of the Keplr Pockets. This diversified method might probably yield rewards from a number of sources inside Cosmos’s interlinked networks.

In the meantime, for Pyth ecosystem lovers, Fencer prompt staking a minimal of 100 PYTH on the Pyth dApp. Likewise, he beneficial participating in buying and selling on platforms like Drift Protocol and Parcl. This methodology faucets into Pyth’s real-time market knowledge feed and its rising record of ecosystem tasks.

“Pyth dominates as the biggest and fastest-growing oracle community, fueling over 140 dApps. It’s no shock that tokenless dApps powered by PYTH know-how will use PYTH staking as a key criterion for his or her airdrops,” Fencer added.

Extra Airdrops on the Horizon

Within the Eigenlayer ecosystem, the technique contains restaking ETH on Eigen Layer and staking on platforms like Kelp DAO and Swell. In the meantime, the Sui ecosystem technique encompasses staking over 50 SUI on a number of platforms, together with Scallop and NAVI Protocol, and fascinating with dApps like KriyaDEX. This plan goals to leverage the excessive efficiency of those blockchains for important returns.

For the Sei ecosystem, Fencer beneficial staking SEI on platforms, similar to Yaka Finance and Kawa, and buying and selling on vDEX.ai. Lastly, he prompt staking over 5 APT on platforms like Amnis Finance and Pontem Lumio within the Aptos ecosystem. This technique is designed to profit from these scalable infrastructures and the DeFi ecosystem.

“Aptos Labs has efficiently raised a powerful $350 million in two funding rounds, attracting traders similar to a16z, Multicoin Capital, Coinbase, and others. Aptos has solely airdropped 3% of the tokens that had been reserved for the neighborhood. There are nonetheless 480 million APT tokens out there for the neighborhood to say,” one other X person, Ardizor, concluded.

Learn extra: Earning Passive Income with Forks and Airdrops in 2024

Fencer’s information, whereas in depth, requires a deep understanding of the respective ecosystems and their staking processes. Traders ought to conduct thorough analysis and contemplate the dangers of crypto staking, together with market volatility and technological uncertainties.

By following these steps, crypto lovers might probably unlock many airdrops, however warning and due diligence are paramount in navigating this high-reward but high-risk technique.

Disclaimer

In step with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.