Wyckoff Evaluation (WA) goals to know why costs of shares and different market gadgets transfer as a result of provide and demand dynamics. It usually is utilized to any freely traded market the place bigger or institutional merchants function (commodities, bonds, currencies, and so forth.). On this article we are going to apply WA to the cryptocurrency Storj ($STORJ) to make a forecast for approximate future occasions.

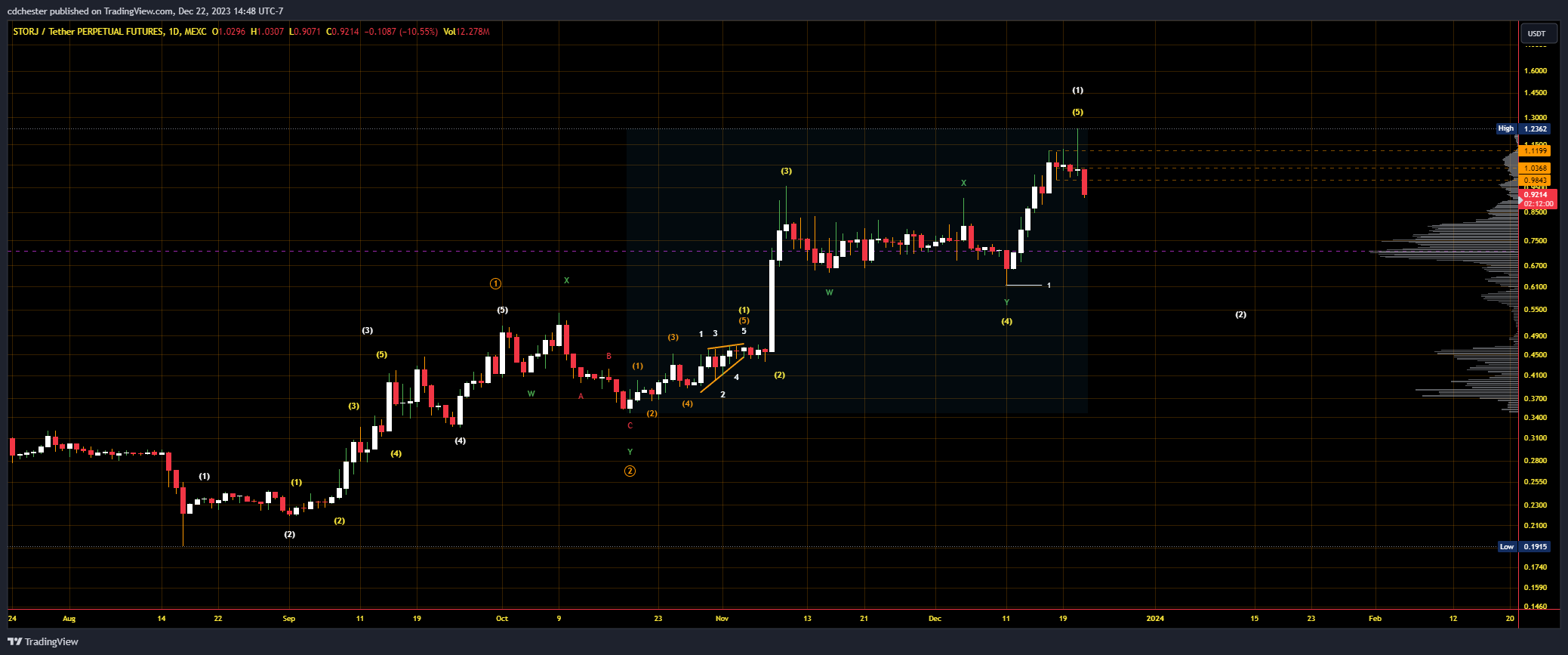

Storj Value Information from MEXC Futures | Supply: STORJUSDT.P on tradingview.com.

Hyperlink to the uncooked picture: https://www.tradingview.com/x/BGsOkzGM

Storj is presently in Part E of a Wyckoff Distribution Schematic #1. StockCharts says this about Part E of their article on the Wyckoff Method:

Part E depicts the unfolding of the downtrend; the inventory leaves the TR and provide is in management. As soon as TR help is damaged on a serious SOW, this breakdown is usually examined with a rally that fails at or close to help. This additionally represents a high-probability alternative to promote quick. Subsequent rallies through the markdown are normally feeble. Merchants who’ve taken quick positions can path their stops as value declines. After a big down-move, climactic motion could sign the start of a re-distribution TR or of accumulation.

The buying and selling vary for Storj was $1 – $1.12 and it has concretely fallen under that. From the image under a serious SOW has occurred, extra so pointing to a Distribution occurring. This additionally coincides with our analyst’s Elliott Wave (EWT) view on Storj. They predict a small rally as Storj continues to fall in its Wave 2. The vast majority of the liquidity (per its related Quantity Profile) is between the 38.2% and 61.8% LFR at $0.56 and $0.76 respectively. A liquidity cluster is usually anticipated between these LFRs in EWT main us to the assume a Wave 2 correction is going on. Moreover, the cluster is within the value vary of the subwave 4, an EWT guideline.

Storj Value Information from MEXC Futures | Supply: STORJUSDT.P on tradingview.com.

Hyperlink to the uncooked picture: https://www.tradingview.com/x/dD8hv9Aj

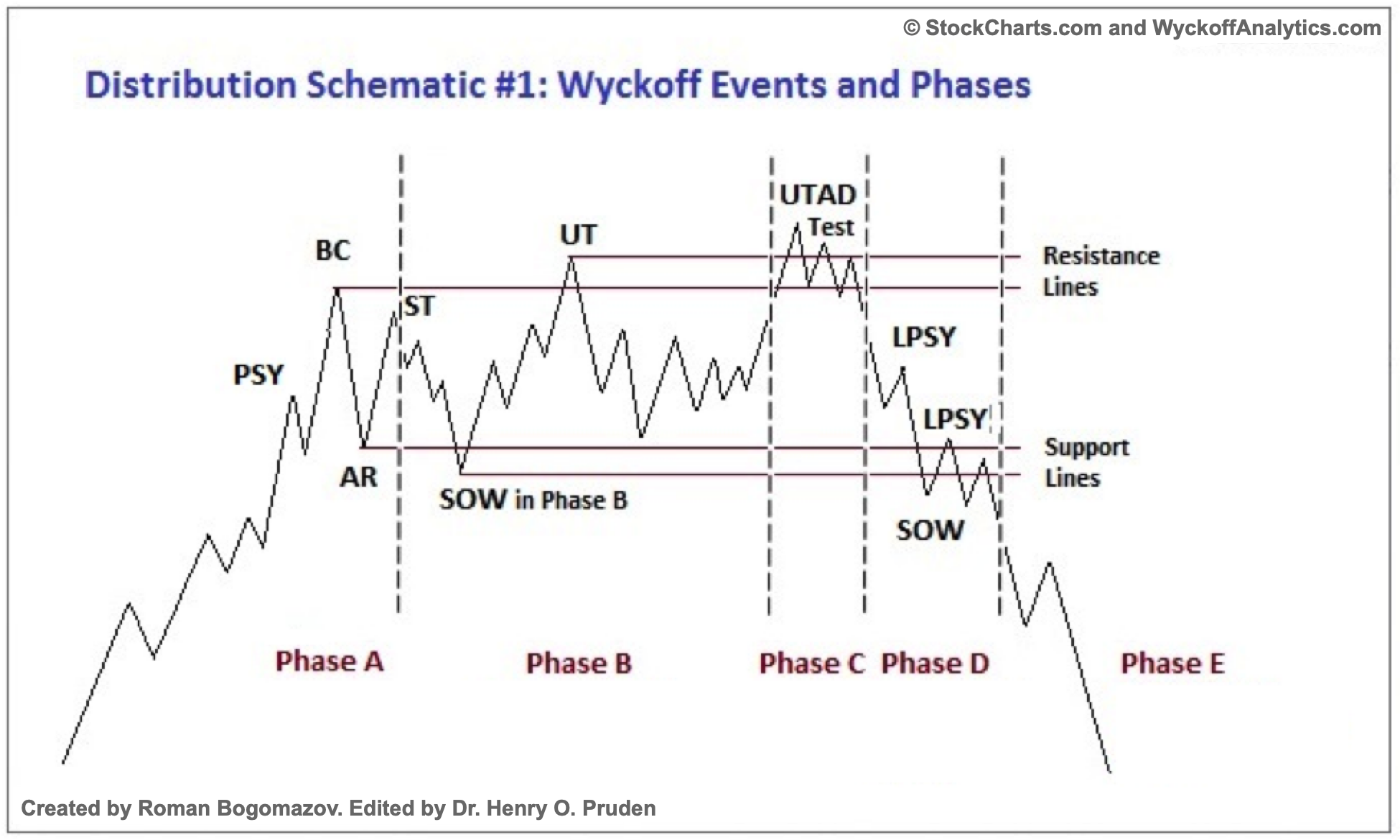

Under is the standard schematic for a Wyckoff Distribution Schematic #1.

Wyckoff Distribution Schematic #1 | Supply: StockCharts.com

Glossary

All quotes are from the primary hyperlink in Supplemental Studying.

Preliminary Provide (PSY) – “the place giant pursuits start to unload shares in amount after a pronounced up-move”

Shopping for Climax (BC) – giant operators promoting their shares whereas the general public buys them at a premium throughout a interval of giant demand

Automated Response (AR) – “With intense shopping for considerably diminished after the BC and heavy provide persevering with, an AR takes place”

Secondary Take a look at (ST) – when “value revisits the realm of the SC to check the availability/demand stability at these ranges”

Upthrust After Distribution (UTAD) – “a definitive take a look at of latest demand after a breakout above TR resistance”

Take a look at – the place bigger merchants “take a look at the marketplace for provide all through a TR”

Signal of Weak point (SoW) – “a down-move to (or barely previous) the decrease boundary of the TR, normally occurring on elevated unfold and quantity”

Final Level of Provide (LPSY) – “exhaustion of demand and the final waves of enormous operators’ distribution earlier than markdown begins in earnest”

Elliott Wave Idea (EWT)

“A idea in technical evaluation that attributes wave-like value patterns, recognized at numerous scales, to dealer psychology and investor sentiment.”

Supply: “Elliott Wave Theory: What It Is and How to Use It” by James Chen (2023)

Logarithmic Fibonacci Retracement (LFR) – A measured correction at sure Fibonacci ratios on a semi-log scale.

Logarithmic Fibonacci Extensions (LFE) – A measured rally at sure Fibonacci ratios on a semi-log scale.

Supplemental Studying

“The Wyckoff Method: A Tutorial” by Bogomazov & Lipsett

“Reaccumulation Review” by Bruce Fraser (2018)

“Jumping the Creek: A Review” by Bruce Fraser (2018)

“Distribution Review” by Bruce Fraser (2018)

“Introduction to Point & Figure Charts” from StockCharts

“P&F Price Objectives: Horizontal Counts” from StockCharts

“The Wyckoff Methodology in Depth” by Rubén Villahermosa (2019)

“Wyckoff 2.0: Structures, Volume Profile and Order Flow” by Rubén Villahermosa (2021)

“Elliott Wave Principle – Key To Market Behavior” by Frost & Prechter (2022)

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.