Key Notes

- The agency’s Bitcoin portfolio reached 640,031 BTC value $80.03 billion, exhibiting a 69% appreciation from unique price foundation.

- Contemporary regulatory readability permits companies to exclude digital asset paper positive factors from different minimal tax obligations.

- Newly issued equity-linked securities on Robinhood attracted $2.47 billion by the STRC providing in the course of the quarter.

Strategy, the world’s largest company Bitcoin

BTC

$125 378

24h volatility:

2.1%

Market cap:

$2.50 T

Vol. 24h:

$68.56 B

holder, accomplished $140 million in dividend funds internet file positive factors in Q3, in keeping with its newest 8-Ok submitting with the SEC.

Whereas no new Bitcoin purchases have been introduced, the firm’s SEC filing displays adjustments within the agency’s crypto investing method.

Technique reviews $3.9 billion in whole Bitcoin honest worth appreciation in Q3 2025. $MSTR $STRC https://t.co/Tcw67JHCSe

— Michael Saylor (@saylor) October 6, 2025

After Nasdaq moved to tighten guidelines on how public corporations increase capital for cryptocurrency acquisitions, Technique launched 4 new most well-liked inventory devices: STRC, STRD, STRF, and STRK, all listed on Robinhood on Friday, October 3.

These derivatives merchandise supply institutional buyers oblique entry to Bitcoin whereas permitting Technique to generate new liquidity with out conventional fundraising channels.

Now you can discover all 4 of our digital credit score devices on Robinhood. $STRC $STRD $STRF $STRK pic.twitter.com/RJXT28hDKn

— Technique (@Technique) October 3, 2025

Throughout Q3 2025, Technique secured $5.09 billion in combination internet proceeds from a mix of underwritten and at-the-market choices. Notably, its STRC Preliminary Public Providing alone raised $2.47 billion, underscoring sustained institutional urge for food for Bitcoin-tied monetary merchandise.

Technique’s Bitcoin Portfolio Climbs to $80B as Unrealized Beneficial properties Hit $3.9B

As of October 6, 2025, Technique holds 640,031 BTC, valued at $80.03 billion, with a mean buy worth of $73,983 per coin, representing a 69% unrealized achieve, or roughly $32.7 billion in greenback phrases.

Technique’s whole Bitcoin holdings crosses $80 billion, October 6 | Supply: SaylorTracker

The corporate additionally recorded a $1.12 billion deferred tax expense on $3.89 billion in unrealized Bitcoin positive factors throughout Q3. Nonetheless, a brand new IRS and Treasury ruling issued on September 30 has given Bitcoin-holding companies a major benefit. Underneath the Interim CAMT Steerage, unrealized crypto positive factors can now be excluded from the 15% company different minimal tax (CAMT) calculation.

This regulatory readability removes a serious overhang on Technique’s steadiness sheet, making certain income on its crypto holdings received’t inflate taxable earnings till realized. Because of this, the agency has acknowledged it now not expects to be topic to CAMT attributable to unrealized Bitcoin positive factors.

With no new BTC purchases made in the course of the week of September 29 to October 5, Technique (MSTR) inventory worth rose 1.5% intraday, as Bitcoin worth rally to $125,500 propelled its BTC holdings above $80 billion.

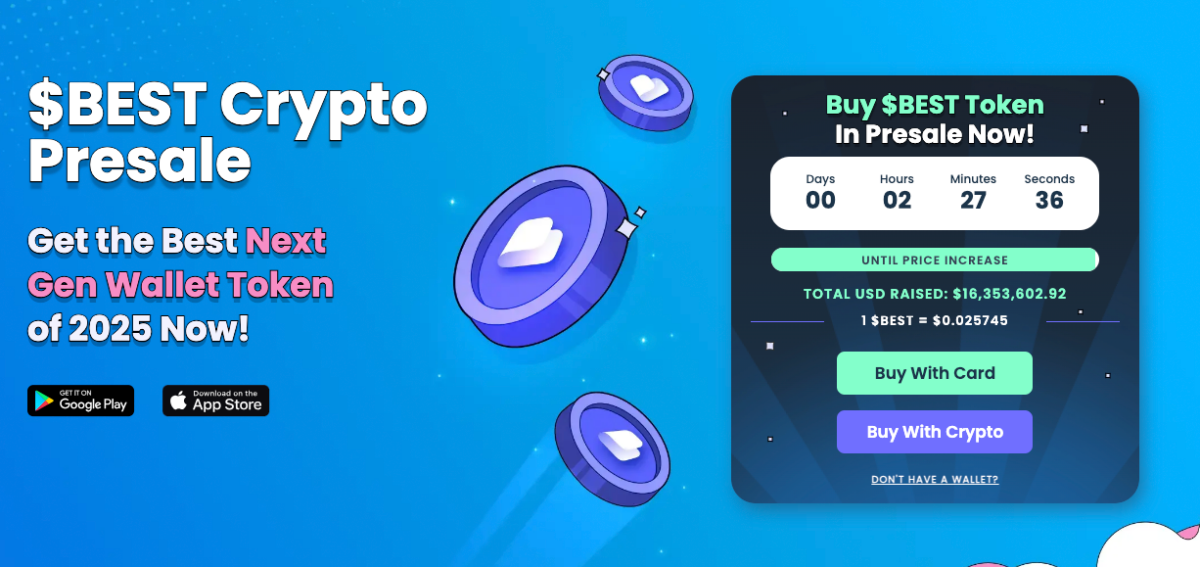

Finest Pockets Presale Nears $16.4M as Technique Counts Q3 Income

With Technique Inc. reporting $3.9 billion in unrealized Bitcoin positive factors for Q3 and pushing BTC into a brand new worth discovery section, buyers are rotating towards promising early-stage tasks like Finest Pockets (BEST), a next-generation multi-chain storage platform providing sensible vaults, multi-sig integrations, and yield optimization instruments tailor-made to each retail and institutional customers.

Early entrants achieve unique entry to staking rewards, governance privileges, and early mainnet integrations forward of the mission’s public rollout.

Finest Pockets Presale

At press time, the Finest Pockets presale has surpassed $16.4 million raised. With lower than 24 hours remaining earlier than the subsequent worth tier, buyers can nonetheless purchase tokens at $0.0257 through the official Best Wallet website.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.