SUI has develop into the focus after being listed on Robinhood Legend and seeing a large $300 million accumulation by a publicly listed firm.

With record-low transaction charges and big token volumes, SUI reveals sturdy breakout potential. Nevertheless, the important thing problem stays whether or not it could actually surpass the vital $4.3 resistance.

Sponsored

Sponsored

A Chain of Optimistic Fundamentals

In brief, Sui blockchain (SUI)’s story blends bullish news and heavy resistance ranges.

Lately, SUI Group Holdings announced it had bought a further 20 million SUI, elevating its whole holdings to greater than 101.7 million (price round $332 million on the time of disclosure). As well as, Robinhood confirmed that SUI (and HBAR) is now obtainable on Robinhood Legend, broadening entry for retail buyers within the US.

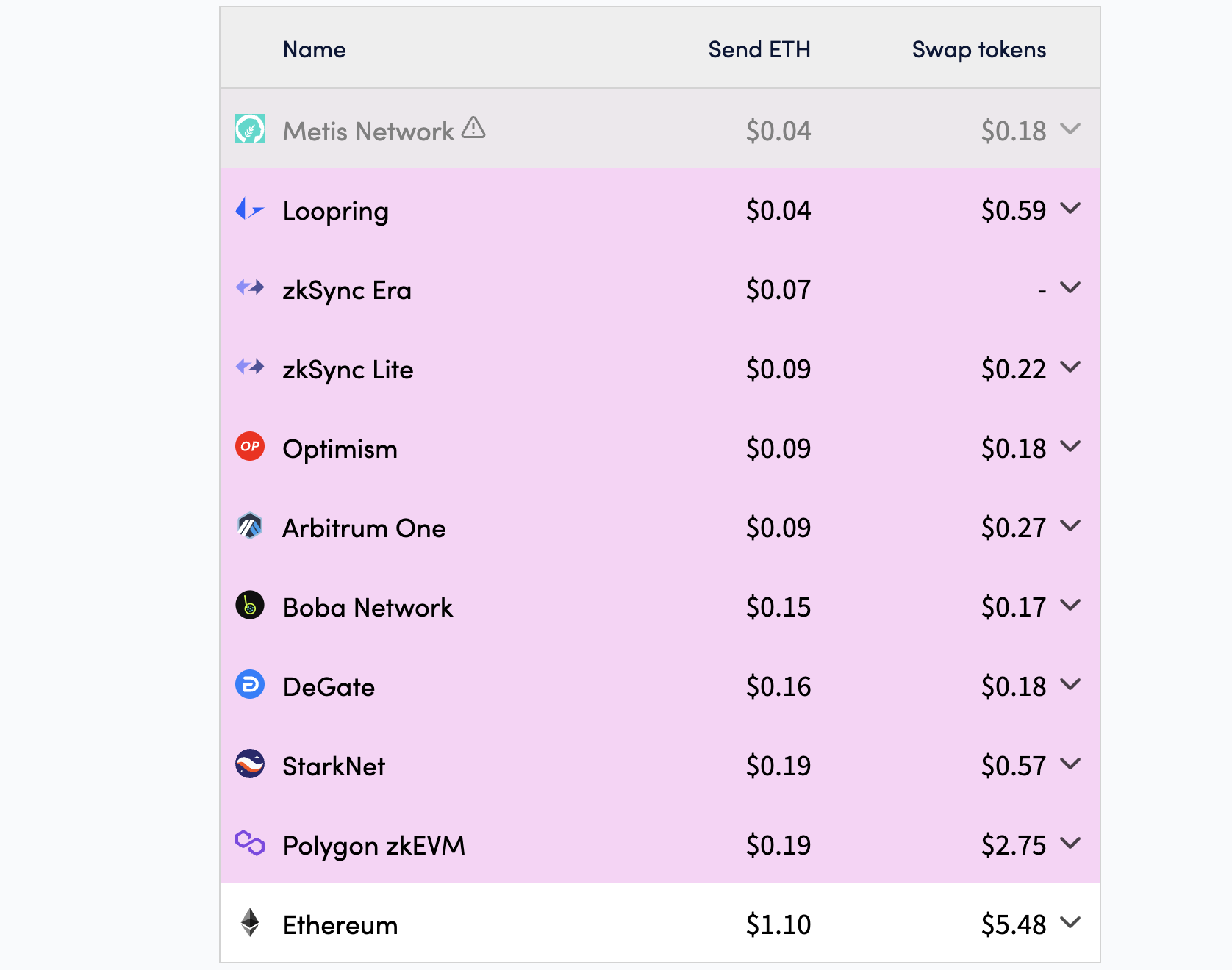

On the basics, transaction charges stand out because the native token’s important power. The average transaction in August cost solely about $0.00799. With ETH transfers on the Ethereum community costing round $1.1, this charge is sort of 140 occasions cheaper. The staff defined in their blog that this charge construction was designed to stay steady throughout epochs, stopping spikes throughout community congestion.

Sponsored

Sponsored

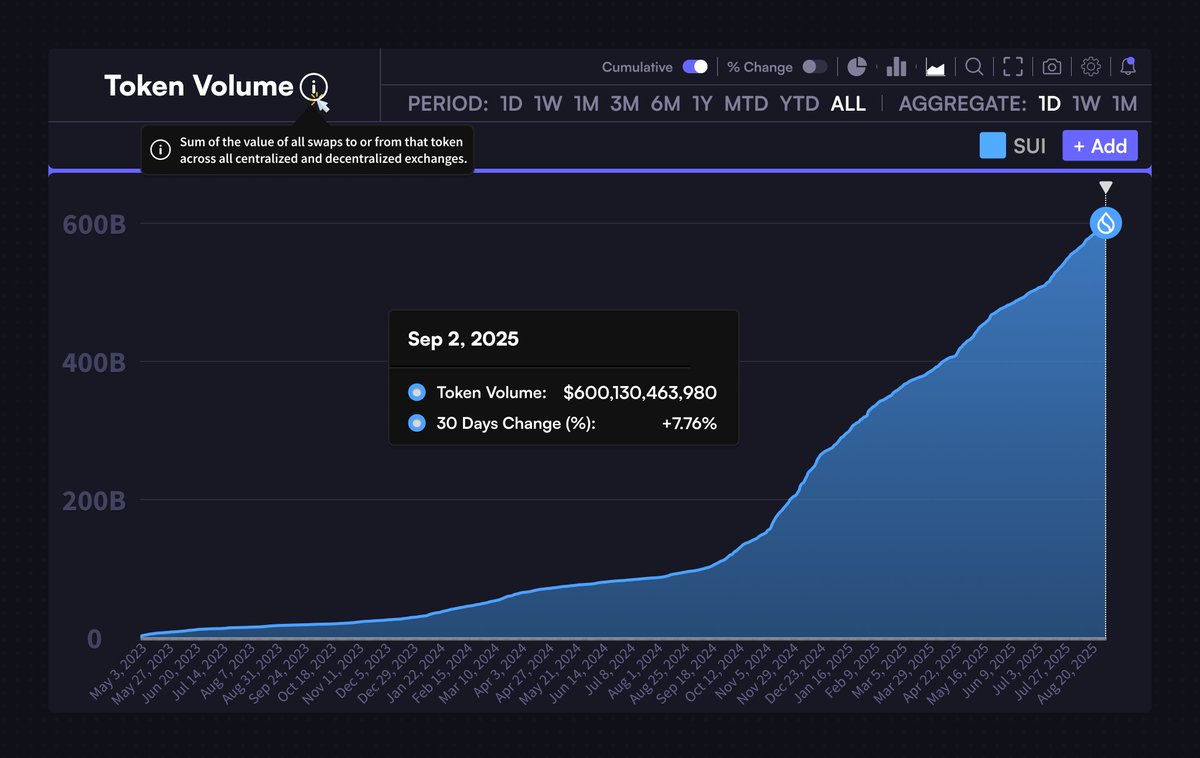

Low and steady charges enhance the end-user expertise and allow high-throughput use instances like gaming, DeFi, or micropayments. Sui’s whole token quantity has reached $600 billion, marking a +7.76% enhance previously 30 days.

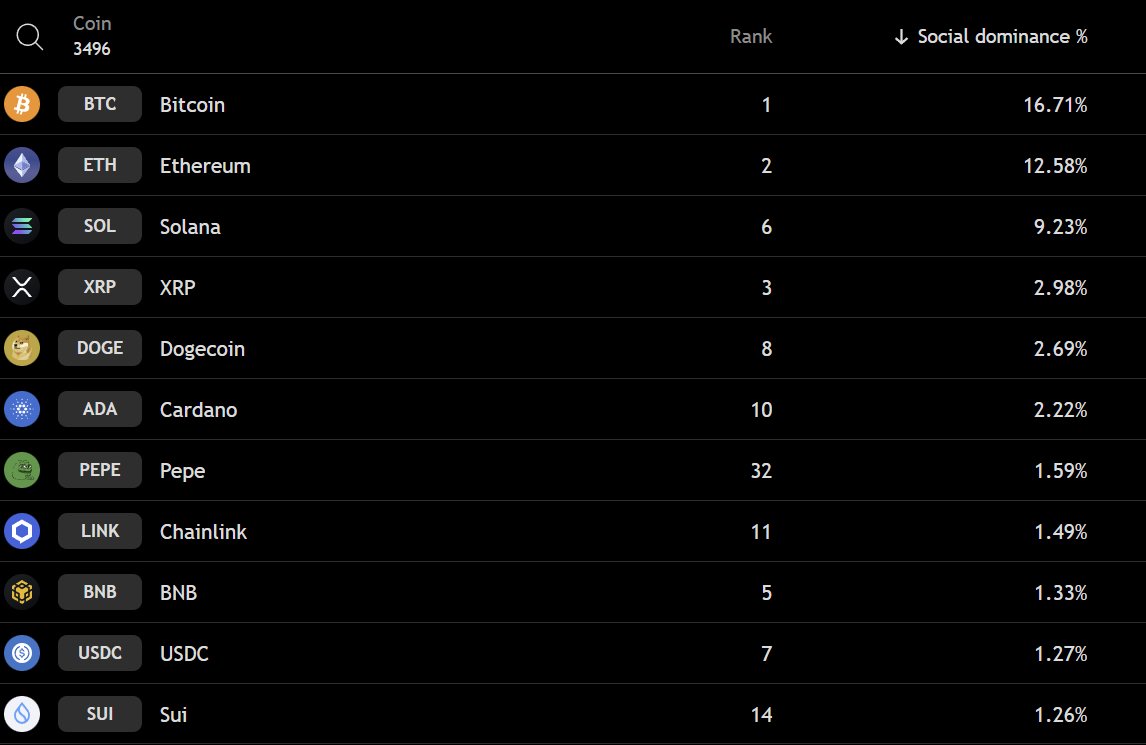

Market sentiment and model visibility additionally present constructive indicators. Knowledge signifies that SUI’s “social dominance” (a metric for dialogue frequency) continues to rise and is now approaching the highest 10.

Breakout or Breakdown at $4.3?

According to BeInCrypto Market, SUI trades round $3.3–$3.4 at present, nonetheless 37% under its January 2025 all-time excessive of $5.35.

Sponsored

Sponsored

From a technical standpoint, the image is each compressed and noisy. Some analysts spotlight an Ascending Triangle with resistance close to $4.3 on the weekly chart. A decisive breakout might set higher-level targets, with some optimistic projections eyeing the $10 mark.

“The longer we keep under the $4.3 Resistance, the higher, nevertheless it’s time to lastly get away,” an analyst commented.

Conversely, on the 4-hour chart, others argue that the altcoin stays trapped in a Descending Triangle, exhibiting weak spot across the 50SMA. This might drag the worth to check $3.42 and even the $3 zone — thought-about the primary central demand space.

In different phrases, the market is awaiting its subsequent “directional transfer.” A weekly shut above $4.3 would affirm a breakout, whereas dropping $3.42 will increase the likelihood of revisiting the decrease accumulation vary.