The Web Capital Markets (ICM) sector is experiencing a steep decline in exercise, elevating questions on its long-term viability. Buying and selling quantity on the Imagine App has plummeted by 80% from the highs seen simply final week.

In parallel, the creation of recent tokens has additionally dropped by 77%, signaling a slowdown in market curiosity.

Is the Finish Close to for Web Capital Markets?

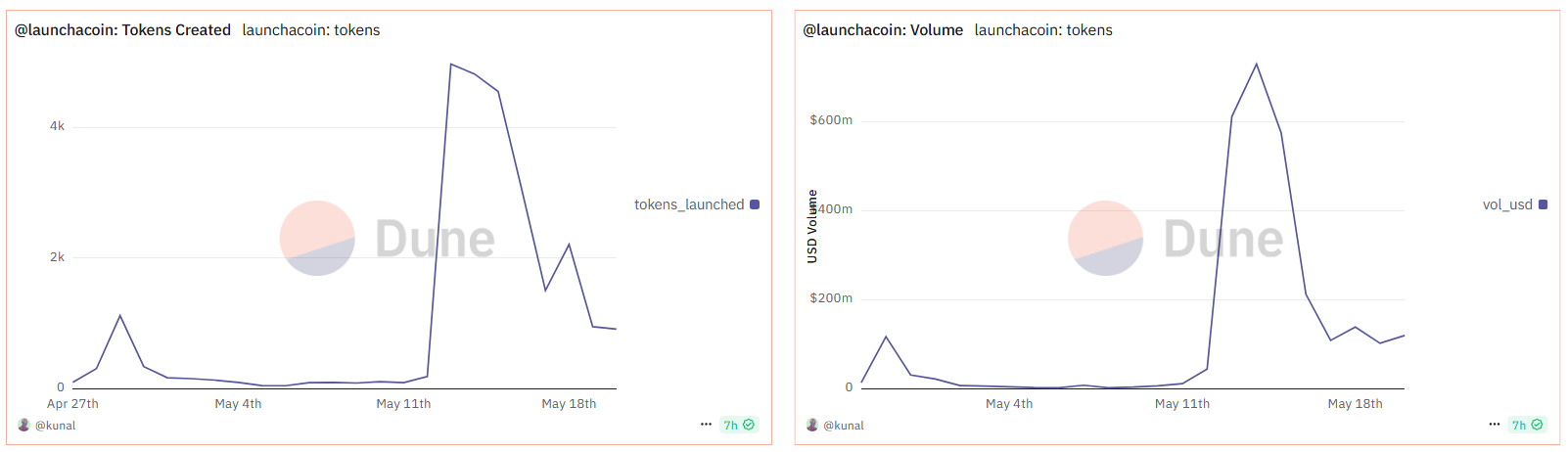

Information from Dune Analytics revealed that ICM tokens’ every day buying and selling quantity has constantly declined since peaking at $729.3 million on Might 14. On Might 20, the buying and selling quantity was recorded at simply $143.6 million.

Equally, the variety of newly created tokens per day has fallen from 4,977 on March 13 to 1,134 by Might 20.

Furthermore, Imagine App has facilitated the creation of over 23,000 tokens thus far. Nonetheless, only 5.3% of these tokens have been activated.

This low activation fee means that many tokens is probably not gaining traction or curiosity from customers. This indicators an oversupply or an absence of utility within the launched tokens.

This pattern has additionally drawn sharp criticism from industry observers. Analyst Mars DeFi not too long ago identified the erosion of person belief in ICMs in a press release on X (previously Twitter). He attributed the decline to an inflow of “empty tokens” pushed by the meme coin craze.

“Customers have been meant to consider in new capital formation. As an alternative, they bought noise. And now, we’ve undoubtedly hit a fatigue level. Not with tokens, however with empty tokens. That is the tipping level — and in addition a wake-up name,” the post learn.

The analyst argued that ICMs’ unique imaginative and prescient of fostering useful, product-driven tasks has been undermined by low-effort launches with little substance. He additionally identified that the period of the meme-driven market is fading.

In response to him, the issue isn’t the memes themselves, however slightly that they not provide the substance or credibility needed to sustain long-term interest.

“The endgame isn’t launchpads. It’s liquid, decentralized capital markets. Not ‘launch a coin and disappear,’ however ‘launch a product and construct it in public.’ That’s the facility of ICMs. And that’s the place that is heading if we proceed to help precise merchandise and never mindless memes,” he wrote.

DYOR co-founder, Hitesh Malviya, had beforehand cautioned that the ICM narrative would possibly solely maintain momentum for 4 to 6 weeks. With the sector displaying indicators of exhaustion only one week after its peak, Malviya’s prediction could also be materializing.

Nonetheless, not all developments level to a everlasting downturn. Ben Pasternak, founding father of Imagine, not too long ago introduced the upcoming launch of the Believe API.

“The purpose of the Imagine API is to make it straightforward for builders to create concord between their product and coin, it doesn’t matter what their product does,” Pasternak stated.

This growth can seemingly appeal to extra builders to the platform. Furthermore, it might additionally spur a revival in token creation and buying and selling quantity by enabling builders to combine higher functionalities into their tasks.

As well as, Base Community can be maintaining an in depth eye on the Web Capital Markets pattern. Jesse Pollak, Head of Base and Coinbase Pockets, informed BeInCrypto that he views the rising token creation and the expansion of decentralized purposes as a part of this rising ICM pattern.

“We’re happy to see a gradual improve in TGEs and new apps on Base. We see all this as web capital markets, and we see the $14 billion+ belongings on Base as the middle of that rising world economic system,” Pollak mentioned.

He additionally emphasised Base’s function in supporting the crypto economy by providing infrastructure and instruments for customers and builders.

“If we wish to convey a billion individuals onchain, then sooner or later quickly, many extra issues will likely be tokenized, and Base offers each the infrastructure and instruments to assist make that simpler for each shoppers and builders to deploy tokens,” he added.

Nonetheless, challenges stay. If the ICM sector hopes to regain person confidence and maintain progress, it should shift its focus from speculative, meme-driven launches to tasks with tangible utility.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.