The bitcoin mining cyclicality has been distinguished for some time now. This has adopted the completely different bull and bear cycles within the house. These cycles of abundance and lack have vastly impacted the profitability of those miners. So on this report, we check out this cyclicality and the components that drive it.

What Drives Bitcoin Cyclicality?

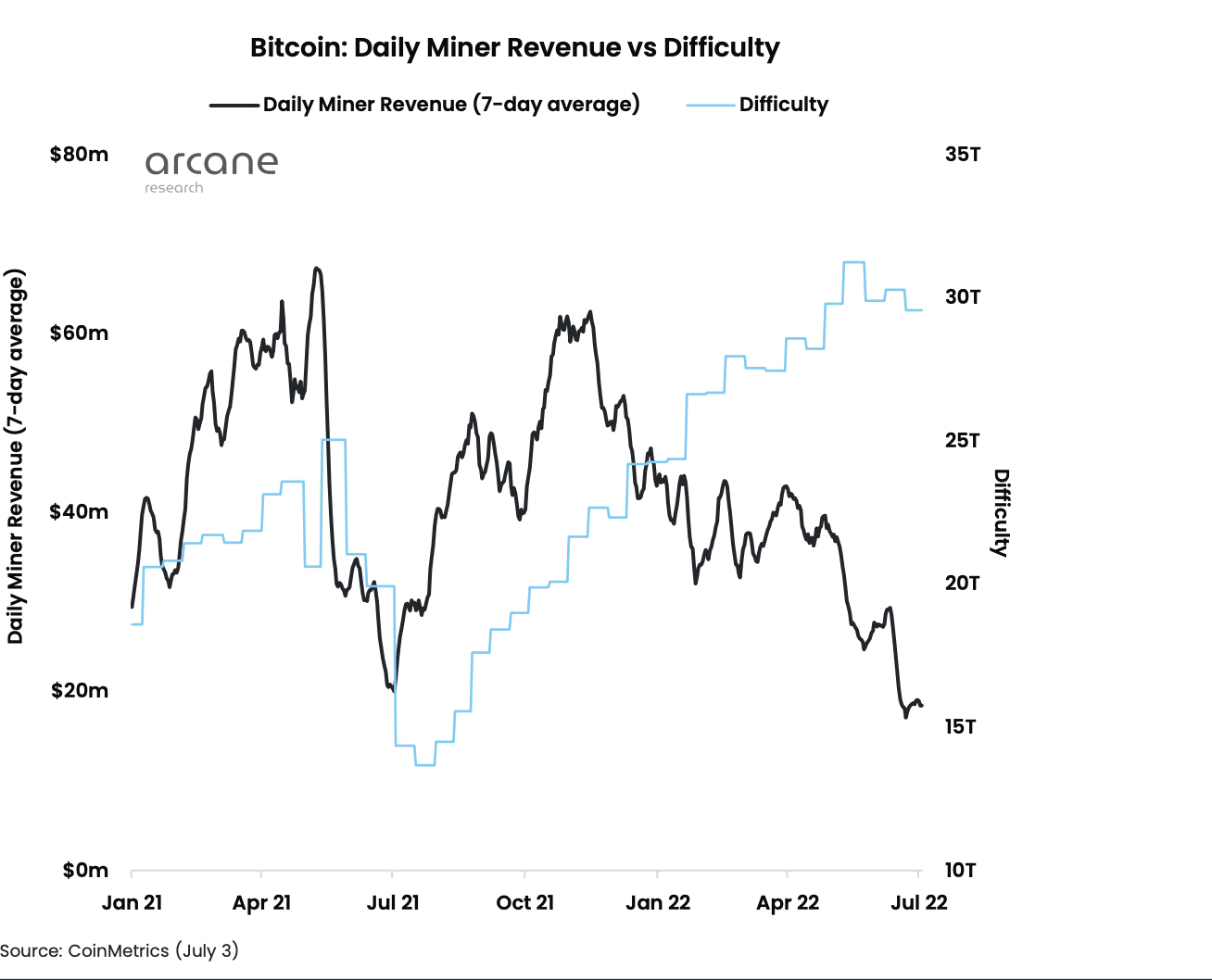

When the market is in a bull pattern, the value of bitcoin surges considerably and that interprets to greater returns for miners when it comes to greenback worth. Since bitcoin had touched a number of new all-time highs again in 2021, revenues had grown drastically, testifying to bitcoin’s nature as a commodity.

Associated Studying | Decline In Bitcoin Active Addresses Suggests Market Is Purging Paperhands

Because the value of BTC was going up, the demand for bitcoin had risen. In response, miners tried to extend their output. This meant putting new orders for infrastructure akin to mining machines, a few of which can arrive over the following couple of months.

This over-investment in infrastructure in new manufacturing infrastructure had begun to overwhelm the market. Add in the truth that extra gamers had made their entrance into the market, and the earnings from mining had gone via a major drawdown.

Miner income declines | Supply: Arcane Research

The decline in earnings, in flip, results in a discount in manufacturing capability. Then earnings start to rise once more, extra gamers enter the house, there may be an over-investment in manufacturing infrastructure and the profitability drops once more. Round and round it goes. Therefore the cyclicality of bitcoin mining.

Months Of Abundance Will Go

2021 was little doubt the most effective yr for bitcoin miners to date. Mining revenues had grown drastically throughout this time and money move was ample for each private and non-private bitcoin miners. These earnings of 2021 had triggered numerous growth plans presumably based mostly on the truth that miners anticipated the big mining earnings to proceed.

BTC recovers above $20,500 | Supply: BTCUSD on TradingView.com

Day by day miner revenues for 2021 had been as excessive as $62 million, popping out at a mean every day income of $46 million. This introduced the typical every day revenues for miners t $46 million for the yr. Nevertheless, 2022 would show to be a lot completely different.

Associated Studying | Inverse Bitcoin ETF Sees 300% Increase In Short Interest

The money move for each bitcoin mined again in 2021 had touched as excessive as $30,000 for some miners, placing corporations in an unbelievable money move place. In 2021, the entire mining income was $16.7 billion, the biggest on document. Whereas, the earlier yr had solely returned $5 billion and 2022’s returns are anticipated to observe that of 2020.

Featured picture from Bloomberg, charts from Arcane Analysis and TradingView.com

Comply with Best Owie on Twitter for market insights, updates, and the occasional humorous tweet…