Rising nations are the quickest rising areas in crypto adoption and the rising presence of neo-banks performs the largest position on this progress. Might these modern platforms be the answer to monetary inequalities and the dearth of satisfactory banking providers for over one billion folks?

As Satoshi as soon as remarked in his now-stopped social messages, “Bitcoin can be handy for individuals who don’t have a bank card or don’t need to use the playing cards they’ve”. Rising nations whether or not in Africa, Latin America or South East Asia might resonate extra actually to this assertion than others. Over the previous half-decade, the expansion of neo-banks in creating nations has triggered a revolutionary change in how the populous work together of their economies and a radical change of their monetary methods.

Crucially, the billions of unbanked and underbanked are lastly built-in into the worldwide monetary methods, regardless of the dearth of environment friendly banking buildings of their respective nations.

This text will break down how cryptocurrency is benefiting the unbanked (and underbanked) and the position neo-banks play in offering monetary providers to nations with little hope of getting a secure banking infrastructure. The piece additional appears to be like on the position creating nations play in rising the crypto ecosystem and varied technological developments within the business because of fast adoption throughout Sub-Saharan Africa, Latin America and Southeast Asia areas.

Monetary Inequality in Underserved Economies

In keeping with World Financial institution stories, over 1.2 billion people across the world are either unbanked or underbanked. Creating nations stay essentially the most affected nations with over 50% of the inhabitants having little to no entry to stable banking infrastructure or fundamental monetary providers reminiscent of loaning amenities, financial savings accounts, and many others.

The arrival of blockchain expertise and cryptocurrencies sparked a drastic change within the international monetary system, offering beforehand unavailable monetary methods to residents of those nations. The emergence of this decentralized business is changing into a drive within the international monetary panorama, redefining conventional foreign money, transactions, and monetary methods.

Cryptocurrencies, powered by blockchain expertise and cryptographic rules, are opening up the monetary world to creating nations, permitting beforehand unbanked and underbanked residents to take part within the monetary ecosystem. These property have opened up new avenues to transact and retailer worth by giving everybody entry to quick and low-cost digital money that may be spent anyplace.

The Rise of Neo-Banks and Decentralized Finance (DeFi)

The worldwide monetary disaster in 2008 introduced rise to a number of improvements within the business, majorly the expansion of neo-banking. Neo-banks consult with monetary expertise corporations which can be redefining how banking providers are delivered to shoppers, from seamless digital experiences to decrease transaction charges and accessibility through smartphones, and many others.

Essentially the most outstanding type of neo-banking arose in Kenya, with the launch of M-Pesa, a mobile-based monetary service that allowed anybody with a SIM card and a cellphone to ship and obtain cash. Through the years, such improvements have advanced into formidable gamers within the monetary sector, as they revolutionize conventional banking and monetary providers.

Lately, decentralized finance (DeFi) apps have come to the fore, offering digital and decentralized alternate options that supply personalised user-centric providers that resonate with crypto-savvy shoppers. However, crypto alternate apps have sprouted quickly providing anybody internationally a chance to entry cryptocurrencies instantly on their smartphones. These apps guarantee superior safety measures, and seamless integration of fintech options, setting them aside from conventional finance providers.

As such, developed nations have been capable of be a part of the worldwide monetary methods, signifying a paradigm shift within the transformative energy of crypto for the trendy shopper.

Crypto Exchanges Could Problem The Standing Quo

As alluded to, crypto exchanges are diversifying to wider markets, shifting from easy on-ramp and off-ramping enterprise fashions to changing into neo-banks and difficult the standard finance system – international, low-cost and really accessible to the unbanked. Crypto adoption is changing into extra outstanding for the 1.2 billion and monetary providers and merchandise are extra refined and accessible. Might this pose a menace to the standard banking methods?

The jury remains to be out on that however the options supplied by these “decentralized neo-banks” are having a fantastic impact on rising nations’ economies – monetary inclusion, low-cost remittance charges, and quick and safe transactions have pushed the expansion of crypto in these economies.

Boxwind, a digital asset alternate platform set to launch later within the yr, brings these options to the 1.2 billion who want such providers. From buying and selling to lending, saving, buying and selling, and a channel to affordably switch crypto cryptocurrencies into and round rising economies. The alternate is designed with superior functionalities for brand new and skilled buyers, offering spot and derivatives buying and selling of over 300+ digital property, on-ramp and off-ramp options, staking providers, borrowing/lending and far more.

The platform additionally options its brainchild, PIP World, a service that goals to empower customers through Edutech packages, gamified buying and selling, and AI-powered gaming. PIP Trader, one of many gamefied and educative platforms, permits customers to group up, battle in buying and selling video games, and earn rewards on an AI-powered recreation.

Trying Forward

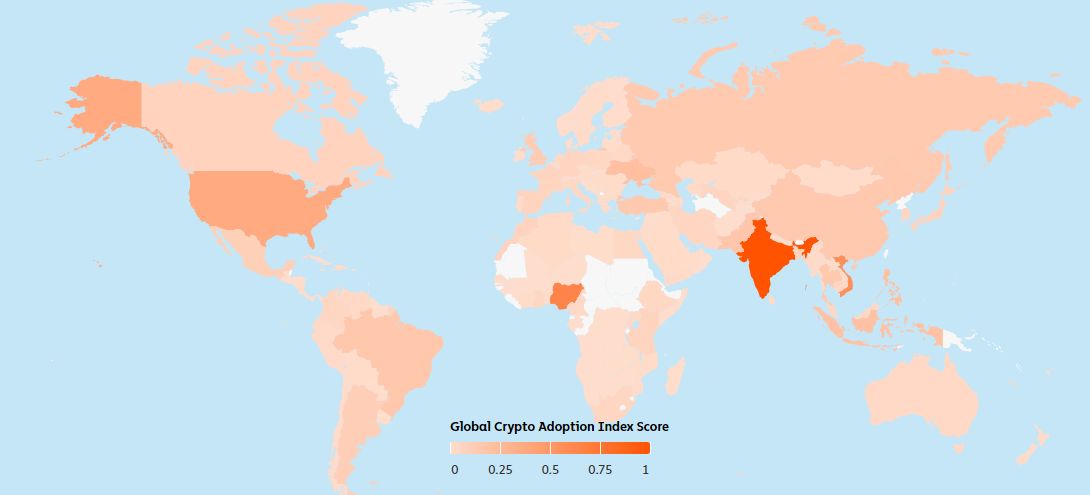

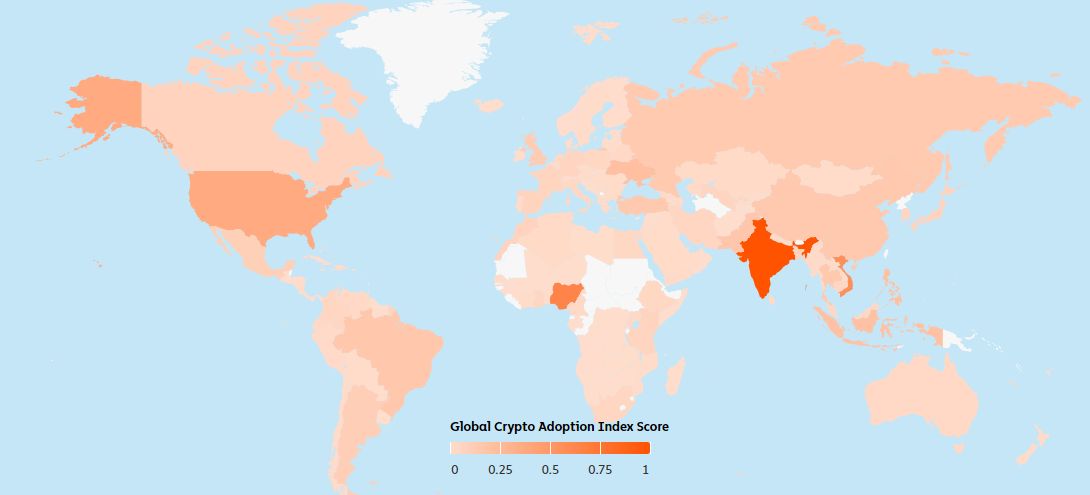

Chainalysis’ 2023 Crypto Report confirmed that over 40% of the world’s cryptocurrency customers reside in lower-middle-income nations (LMICs), with the quantity rising yearly. This spectacular progress is closely influenced by CEXs and the huge providers they provide. Regulated crypto exchanges could possibly be the primary driver of sustained adoption charges by facilitating neo-banking providers to the underbanked.

Crypto adoption in rising economies presents a novel alternative to empower people, improve expertise and monetary literacy, and supply options to monetary inequalities. For the business to essentially develop, nevertheless, a number of issues should be put in place together with establishing safe platforms, regulatory compliance, customers’ funds safety, simply accessible platforms, and educating the lots on the expertise.