Ethereum is inclined to discover decrease ranges and is exerting stress on assist at $1,800 as volatility dwindles to historic lows throughout the market. The most important good contracts token, value $219 billion can also be experiencing shrinking buying and selling volumes to $4.5 billion on Wednesday.

Down 1.4% within the final seven days, Ethereum is buying and selling at $1,827. Makes an attempt to weaken resistance at $1,850 have failed quite a few instances however present the probability of an prolonged rout beneath $1,800.

Ethereum Undervaluation Suggests A Swift Rebound

Ethereum has been buying and selling in a spread between $1,600 and $2,000 since March other than a single outburst in mid-April that propelled it to highs barely above $2,100. This rally had been triggered by the launch of the Shapella upgrade, which accomplished the transition to a proof-of-stake (PoS) consensus algorithm making certain traders may withdraw staked rewards from the Beacon Chain.

The shortage of market-moving occasions and a usually dilapidated crypto market construction has restricted Ether actions and continues to take action, particularly with volatility dropping to report lows.

In accordance with insights by CryptoQuant, ETH has from January 1 to August 15 persistently hovered between the 1.5k and 1.6k vary.

Based mostly on the chart, “this line represents the typical “break-even” worth at which Ethereum holders neither achieve nor lose cash,” analyst Woominkyu added. “At any time when the market worth drops beneath the realized worth, it swiftly bounces again, suggesting the market sees Ethereum as undervalued throughout these moments.”

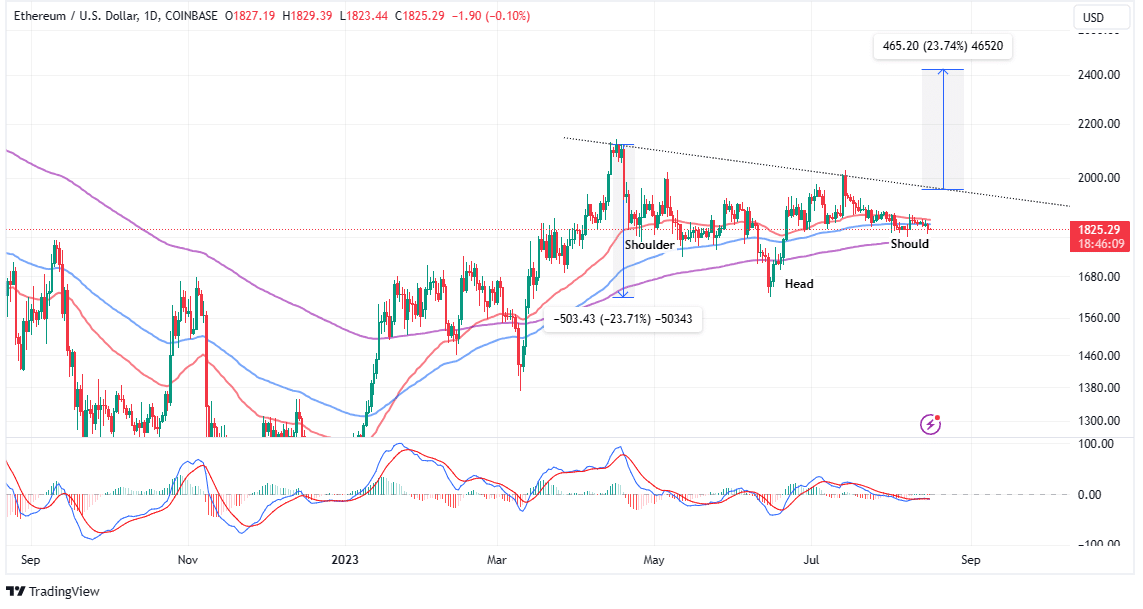

The outlook on the day by day chart affirms the continued consolidation with the Transferring Common Convergence Divergence (MACD) indicator leveling barely beneath the imply line (0.00) with no indicators of momentum both up or down.

ETH worth faces rapid resistance on the 100-day Exponential Transferring Common (EMA) (blue) at $1,840. As stress will increase, assist at $1,800 is stress-tested and should maintain to maintain the bullish outlook intact.

Nonetheless, there’s a obtrusive risk of declines extending beneath $1,800 and subsequently the 200-day EMA (purple) as Ethereum seeks fresh liquidity to bounce out of the upper range limit at $2,000.

Merchants could must be cautious if ETH worth sinks beneath the 200-day EMA as this might implore traders to promote with the concept of shopping for later when the token in the end confirms a pattern reversal.

As mentioned in a earlier evaluation, Ethereum is nurturing a potential inverse head and shoulders breakout, focusing on highs round $2,424 if confirmed. Nonetheless, earlier than this breakout, bulls should try to convey down resistance at $1,850 and $2,000 and this will likely contain a drop to the decrease vary restrict round $1,600 to brush by way of liquidity.

Volatility Shares Plans to Launch Ethereum Futures ETF

The race for a spot Bitcoin exchange-traded fund (ETF) has intensified in the previous couple of months, with specialists believing that its approval by the Securities and Alternate Fee (SEC) could be the issue that triggers the subsequent crypto bull market.

Because the market awaits the SEC’s deliberations, Volatility Shares has announced plans to launch ETH futures ETF trading on October 12. In accordance with Wu Blockchain journalists, the corporate “launched within the SEC submitting on July 28 that the ETF will spend money on cash-settled Ethereum futures contracts traded on the CME, and won’t make investments immediately in Ethereum.”

VolatilityShares asserting they intend to listing their Ether Futures ETF on Oct twelfth (which might be a day or two forward of the remainder of pack (if the 75 days is adhered to).. they did similar factor w $BITX pic.twitter.com/hhFtk32f4X

— Eric Balchunas (@EricBalchunas) August 15, 2023

This growth follows the profitable launch of the primary 2x Bitcoin ETF (BITX) in July. Volatility Shares believes the ETHU will probably be a superb addition to its product choices however has plans for the spot markets.

It’s too early to inform if an Ethereum futures ETF will have an effect on the value, however the growth is critical for the mainstream adoption of the biggest good contracts token.

Associated Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.