The crypto market cap within the first week of September moved inside a slim vary round $3.8 trillion, awaiting the subsequent transfer. Will or not it’s a breakout or a sell-off? The market could quickly have a solution. On this context, a number of altcoins recorded sharp declines in trade reserves.

These altcoins carry their very own momentum. If total market sentiment turns constructive, the synergy may benefit early patrons.

1. Ethereum (ETH)

Sponsored

Over the previous two months, information of listed firms accumulating ETH has appeared virtually each day.

Data from Strategic ETH Reserve reveals that as of September 5, firms had bought greater than 4.7 million ETH price over $20.5 billion for his or her strategic ETH reserves.

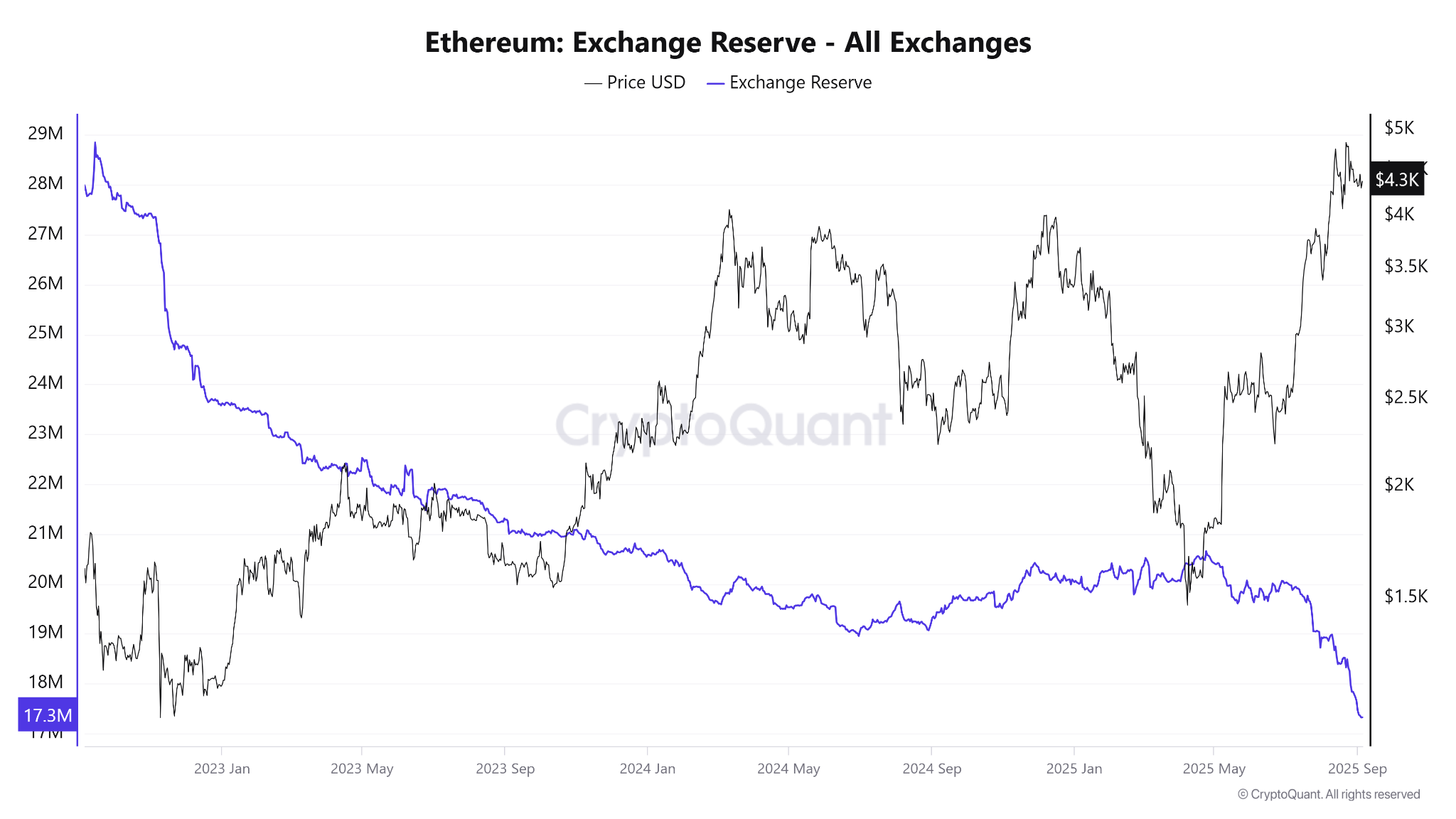

Because of this, the quantity of ETH on exchanges has dropped sharply. The tempo of decline has accelerated in latest months, as proven by the steepening chart.

CryptoQuant information reveals that by the primary week of September, solely about 17.3 million ETH remained on exchanges. A latest BeInCrypto report warned that ETH faces a uncommon provide shock.

In the meantime, Ecoinometrics reported that Ethereum ETF inflows proceed narrowing the Bitcoin hole. This highlights a shift in investor curiosity, as extra consideration appears toward ETH.

Sponsored

“Since mid-July, Bitcoin ETF flows have gone flat. Ethereum, in contrast, is in its strongest influx streak since launch. Whereas Bitcoin nonetheless has a big lead, Ethereum is catching up quick,” Ecoinometrics noted.

2. Euler (EUL)

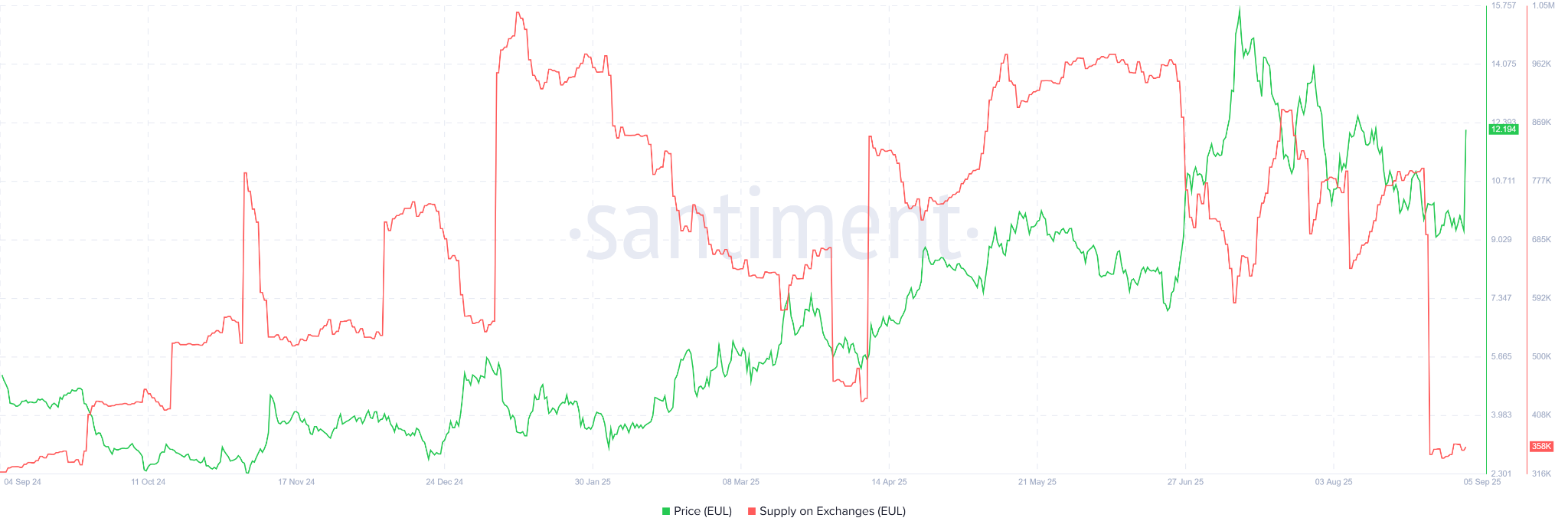

Santiment information reveals that Euler (EUL) trade reserves dropped to a one-year low of 358,000 EUL within the first week of September.

From the late-August peak of 795,000 EUL, greater than 437,000 EUL have been withdrawn from exchanges.

Apparently, this accumulation occurred one week earlier than EUL was listed on Bithumb, which triggered a worth surge of greater than 30%.

Sponsored

On-chain information means that good cash moved early, accumulating EUL forward of the announcement. Nonetheless, the motivation could transcend a easy “promote the information” commerce. It might mirror rising investor confidence within the challenge.

A latest BeInCrypto report reveals that this lending protocol’s whole worth locked (TVL) reached an all-time excessive of over $1.5 billion in September. Furthermore, protocol income and costs surged by greater than 500% in 2025, signaling robust person adoption.

3. Maple Finance (SYRUP)

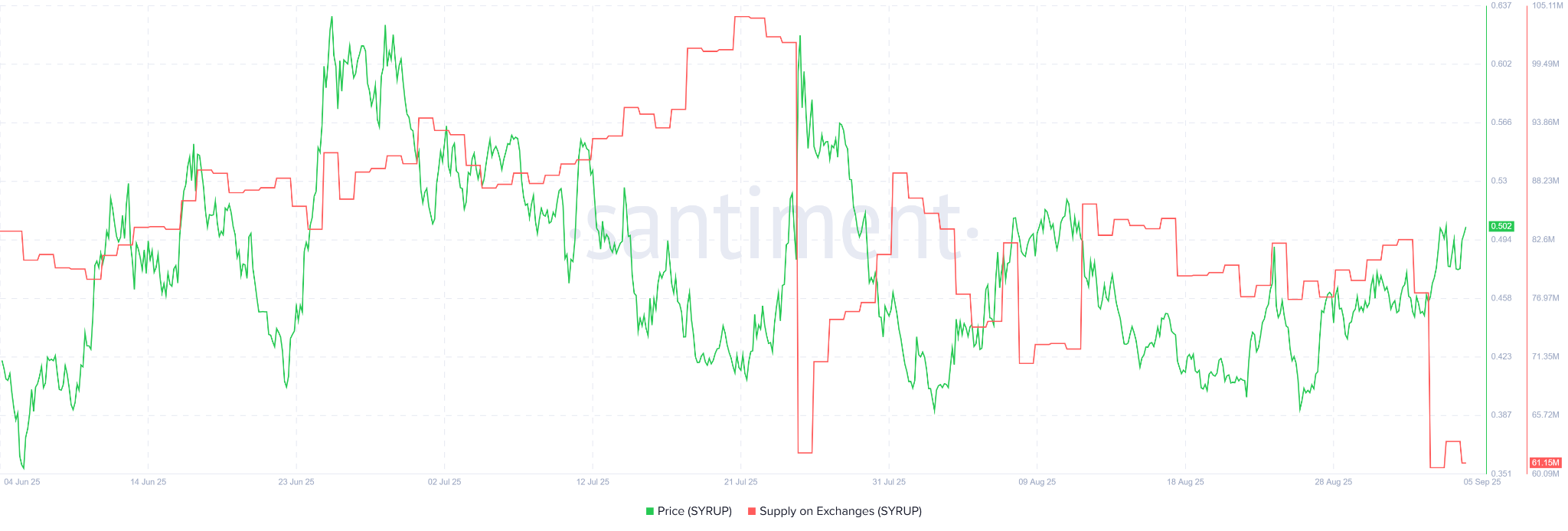

Santiment information reveals that SYRUP’s trade reserves fell to a three-month low of 61.15 million SYRUP. Because the starting of September, greater than 20 million SYRUP have left exchanges.

Sponsored

The chart signifies that this downtrend began in July. But, SYRUP’s worth has remained round $0.5 with out breaking above $0.6.

Sponsored

This accumulation might sign renewed investor confidence in SYRUP, doubtlessly laying the groundwork for a worth rally.

Further information from DeFiLlama shows that Maple Finance’s TVL jumped 600% this 12 months, from $300 million at first of 2025 to an all-time excessive of $2.18 billion in September. The digital asset lending platform now studies property underneath administration (AUM) of $3.35 billion. These figures underscore SYRUP’s upside potential.

All three altcoins share a standard theme: Ethereum and initiatives in its ecosystem. This narrative might change into a significant driving power for the market by the tip of the 12 months.