When Bitcoin worth motion is sideways and directionless for the higher a part of a yr, bulls and bears argue over which route might be finally chosen.

Nevertheless, contemplating macro situations like rising rates of interest, a sinking inventory market, and mounting ting debt, bears aren’t able to throw within the towel. However they could need to after seeing this chart.

Bitcoin Value Chooses A Path: Up And Away

Bitcoin and different cryptocurrencies are usually notoriously unstable. However volatility has dwindled to subsequent to nothing for the reason that FTX collapse struck.

Few have been prepared to take the danger on BTC and altcoins whereas macro situations are this on the sting of collapse. It resulted in an enormous transfer off the underside, but in addition greater than six months of consolidation and confusion.

However after a number of months of sideways worth motion, Bitcoin seems to have chosen a route and broke out to kind a brand new development. Bears, nevertheless, stay stubbornly quick per market sentiment.

Bearish merchants would possibly need to rethink their positioning after looking on the Directional Motion Index.

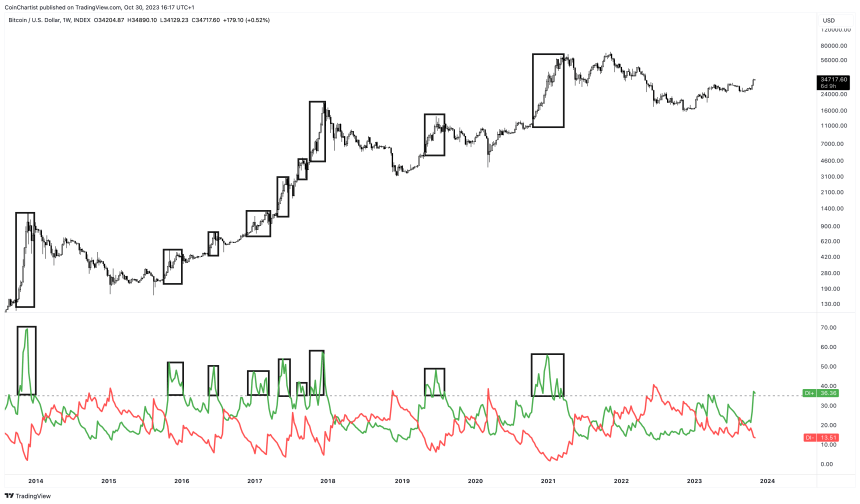

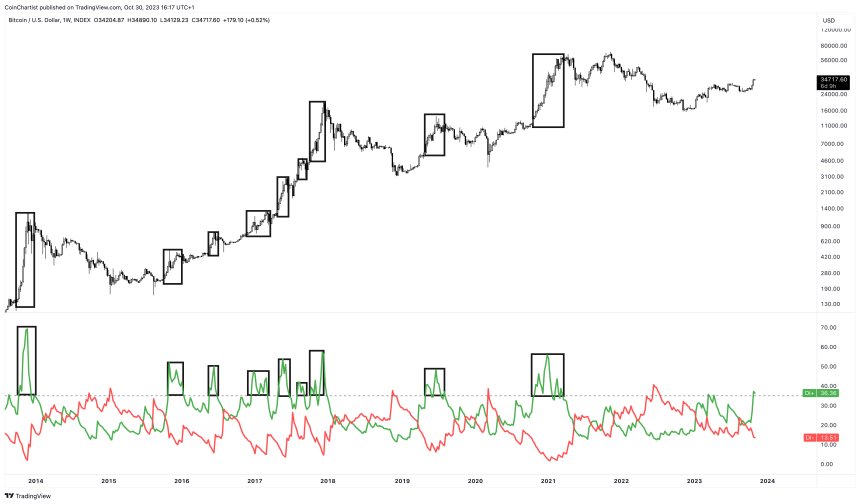

There isn't a denying: Bulls are in cost | BTCUSD on TradingView.com

Bullish Directional Motion Is Something However Common

The Directional Motion Index is usually discovered bundled with the Common Directional Index, and consists of a destructive and a optimistic directional indicator. The software’s premise is easy: when DI+ (inexperienced) is above DI- (pink) the asset is bullish and DI- is above DI+ when bearish.

This technical evaluation indicator is at the moment displaying the DI+ hovering, whereas the DI- is falling and under the 20 line. The 20 line is notable extra for the ADX, which isn’t pictured. When the ADX rises above 20, the software suggests a development is energetic and strengthening.

Bitcoin isn’t above 20 on the weekly but, however has begun to take action on decrease timeframes. With how robust the current transfer was, the ADX may verify above 20 over the subsequent week or two. At that time, bears would possibly lastly be compelled to concede {that a} new bull development has blossomed.