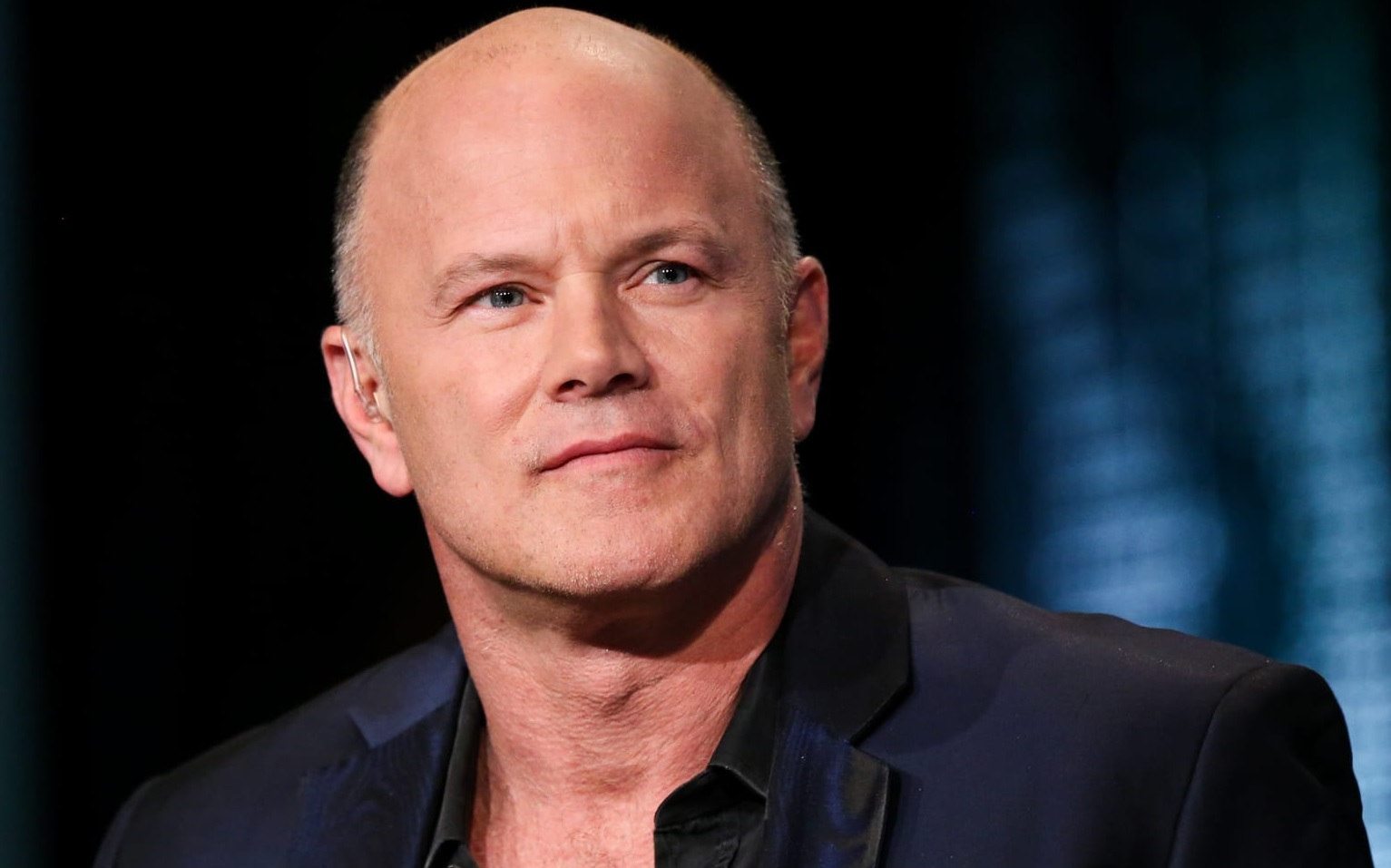

Crypto billionaire Mike Novogratz says markets at the moment are in bear territory after current sell-offs.

In December final yr, Galaxy Digital CEO Mike Novogratz said Bitcoin wanted to carry help on the $42,000 degree or threat additional declines beneath $40,000. In a bullish outlook for crypto, the crypto billionaire famous that the pullback would nonetheless current an honest shopping for alternative for institutional traders.

This week has seen the broader crypto market observe sell-off stress within the equities, with Bitcoin and Ethereum each sliding beneath key help ranges.

In accordance with Novogratz, the tumbling shares have exacerbated the adverse outlook throughout crypto and the drawdown seen in Nasdaq and different inventory indexes means the bear market is right here.

Commenting on the crypto market outlook in addition to the sell-off on Wall Road, he famous:

“The Russel index broke a significant help and right now’s roll over confirmed it’s damaged. That is now a bear market. There may be 1.2tr of dangerous fairness longs above the market. Promote rallies. Don’t purchase dips.”

Earlier, he had pointed to the retreating yields and the overall downturn within the bond market and the upcoming rate of interest hikes as spelling dangerous information for Nasdaq and cryptocurrencies.

Nevertheless, he stated that the inventory market and crypto would stay susceptible to additional rot if charges went up. To him, greater charges would see the 10-year Treasury yields bounce to 2%, squeezing crypto and shares decrease.

Regardless of this projection, the Galaxy Digital chief believes cryptocurrencies have an opportunity at bouncing from current lows. He notes that the crypto area has already felt the ache and at the moment appears set for “some shopping for stress.”

However he warns the anticipated upside won’t come until the inventory market stems the slide seen year-to-date. If the shares proceed to tank, Novogratz forecasts a “arduous time.” He believes {that a} situation the place inventory markets sink even deeper would restrict any potential rally for crypto.

2) crypto may have a tough time rallying till shares discover a base. That mentioned, crypto already had an honest unload and is working into some shopping for help.

Lastly, one of the best merchants get good at gallows humor 😂

— Mike Novogratz (@novogratz) January 20, 2022

All the highest ten cryptocurrencies by market cap are at the moment down double digits. The sell-off has wiped billions off the whole crypto market capitalisation, reducing it by 11% to push it beneath the $2 trillion mark.

In accordance with Stash CEO Brandon Krieg, the sharp declines throughout crypto supply a “perfect” opportunity for retail traders to get publicity to cryptocurrencies.

In shares, the Nasdaq is down 2.4% on Friday after coming into a correction earlier within the week with a ten% hunch. The S&P 500 can also be monitoring large losses for the week, at the moment 1.4% down.