Ever questioned how distinguished crypto billionaires and buying and selling moguls are navigating the market? The altcoins they’re buying and selling, their exercise in DeFi protocols, and the methods they implement to develop their wealth?

On-chain information sheds mild on how the wealthiest people within the crypto market behave. Therefore, it offers beneficial insights into their funding methods, danger administration, and profitable alternatives.

Andrew Kang: Crypto Billionaire Instincts

Andrew Kang makes it to the crypto billionaires record. He is likely one of the founders of Mechanism Capital and boasts a internet value of greater than $200 million. In consequence, insights into his on-chain methods might be gleaned by monitoring his public wallet address.

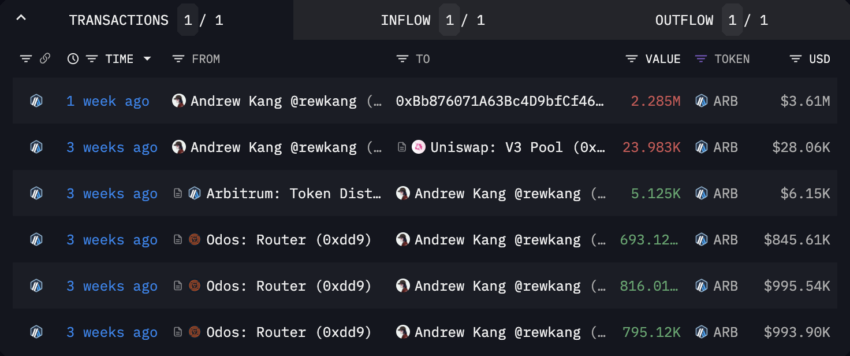

Kang made a big preliminary buy of 795,120 ARB tokens value practically $1 million on April 4. Subsequently, he purchased 816,010 and 693,120 ARB value round $1.84 million on April 5.

Earlier than Arbitrum Basis unveiled two new governance proposals on April 6, Kang had acquired 2.31 million ARB tokens. Then, he bought all his ARB holdings on April 19, producing a formidable 40% return on funding.

Lafa: Investing in Solidly and Ve(3,3) Tokens

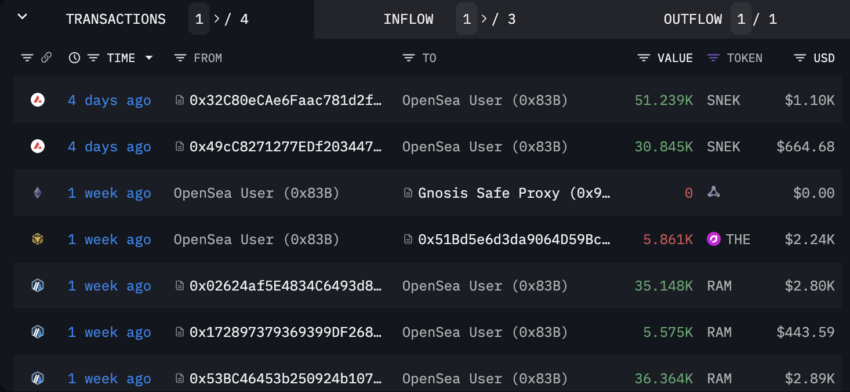

Lafa, the founding father of DeFi protocol DEUS, has a internet value surpassing $5 million. The public wallet address of this crypto billionaire reveals investments in varied DeFi tokens, particularly Solidly and Ve(3,3).

- $2 million in SOLID

- $560,000 in THE

- $185,000 in SNEK

- $372,000 in RAM

- $35,000 in EQUAL

These tokens haven’t carried out properly just lately. Nonetheless, Lafa appears to have positioned his bets on Solidly and Ve(3,3) tokens.

Justin Solar: DeFi Actions within the TRON Ecosystem

Justin Solar is likely one of the youngest crypto billionaires. He’s the founding father of TRON and has a internet value of greater than $400 million.

Monitoring his public wallet address reveals his investments in varied tokens:

- $850,000 in AAVE

- $286,000 in CRV

- $173,000 in COMP

- $165,000 in MULTI

- $156,000 in CVX

- $146,000 in MATIC

- $105,000 in KCS

- $103,000 in SUSHI

Solar actively participates in DeFi actions to develop his crypto wealth. By offering liquidity in DeFi, he contributes his assets to liquidity pools that facilitate transactions and buying and selling on decentralized crypto exchanges. Consequently, he earns charges or rewards in return for liquidity, contributing to his funding returns.

Arthur Hayes: Keen on $GMX

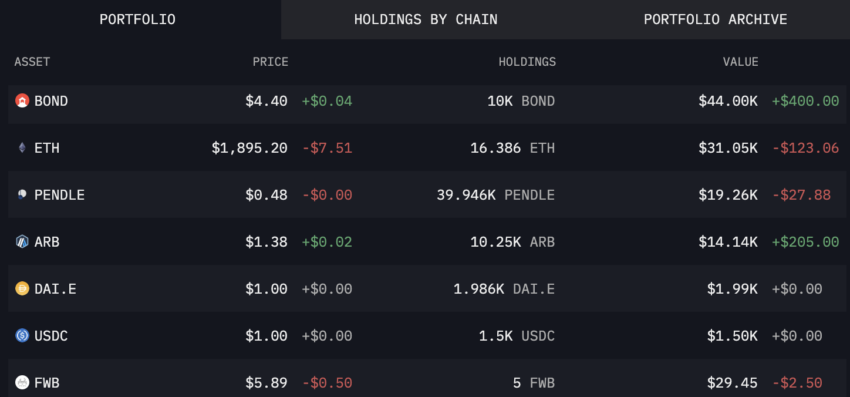

Arthur Hayes is one other profitable analyst who made the record of prime crypto billionaires. He co-founded BitMEX and has a internet value exceeding $500 million.

Monitoring his public wallet address exhibits his investments in varied tokens:

- $44,000 in BOND

- $31,000 in ETH

- $19,000 in PENDLE

- $14,000 in ARB

A more in-depth have a look at his DeFi actions reveals that he depends closely on the decentralized crypto exchange GMX. Certainly, Hayes has staked a big quantity of funds in GMX and earns returns from it:

- Staking $15.70 million in GMX

- Staking $1 million in Escrowed GMX (esGMX)

At a minimal, GMX offers Hayes with a 4.32% APR, paid totally in Ethereum (ETH), value between $3,000 and $5,000 each day.

Hayes has had a worthwhile efficiency by staking most of his holdings in GMX. Due to this fact, keeping track of this crypto billionaire’s on-chain exercise and shopping for habits may present vital alternatives.

Crypto Billionaires 2023: Shopping for and Staking May Be the Reply

Monitoring the on-chain actions of crypto billionaires unveils invaluable insights into their funding methods, danger administration, and the alternatives they seize to develop their wealth. Certainly, these influential figures stay on the forefront, actively collaborating in varied protocols and experimenting with new methods.

Understanding how these people commerce the market can provide a wealth of data for buyers and crypto fanatics. Due to this fact, one should study from their accomplishments and failures to develop a extra knowledgeable and sturdy method to investing in cryptocurrencies.

Whereas it’s essential to keep in mind that each investor’s danger tolerance and objectives differ, understanding the actions of probably the most profitable gamers is usually a guiding mild within the complicated and sometimes risky crypto trade.

Disclaimer

Following the Belief Challenge tips, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making choices primarily based on this content material.