Standard analyst Michaël van de Poppe shares an inventory of altcoins that would bounce off extra strongly after the final dip. This comes as crypto markets reel from the latest correction that noticed Bitcoin (BTC) take a look at the depths of $49,000.

Portfolio rebalancing is a popular funding technique amongst intentional merchants, particularly during times of market volatility. To successfully handle threat, merchants ought to diversify their investments throughout promising crypto narratives, set up a transparent exit technique, and keep a disciplined dollar-cost averaging method.

Analyst Prime Altcoin Picks as Market Makes an attempt Restoration

Van de Poppe observes how altcoins are doing after the correction. He notes that Ethereum (ETH) DeFi has been bouncing off extra strongly than Solana DeFi tokens, which reveals the potential of the respective ecosystem. He additionally observes the commendable efficiency amongst meme cash, AI, and DePIN classes.

“If we’re wanting on the knowledge, you then wish to be positioned at AI and DePIN, meme cash, otherwise you wish to be positioned into ETH DeFi. You wish to be into the most important bounces as a result of these are possible going to proceed with the momentum as merchants are wanting on the hype cash or the strongest bounces and begin allocating towards these,” van de Poppe noted.

Bittensor (TAO)

An analyst has predicted a 5 to 10X potential for TAO, an AI-driven crypto coin, following its 70% rally from latest lows. This surge has caught the eye of many merchants. Michaël van de Poppe isn’t alone in his optimism; different specialists additionally foresee additional good points for the Bittensor token, contemplating it a powerful funding.

“For those who’re aiming for a big enhance in your portfolio, TAO is likely to be a compelling selection. At the moment, the market cap stands at a formidable $2 billion, reflecting the sturdy efficiency and potential of TAO,” noted Fortunate, a seasoned Bitcoin investor.

In the meantime, TAO is a front-runner for the bogus intelligence (AI) sector, which has shifted market sentiment from bearish to bullish. This shift is attributed to the rising international demand for AI applied sciences. The Relative Power Index (RSI) additionally signifies that bulls keep management, because the RSI stays above the midpoint of fifty.

Learn extra: What Is Altcoin Season? A Comprehensive Guide

Aave (AAVE)

Michaël van de Poppe has additionally pointed to AAVE as a promising asset, noting vital accumulation in opposition to Bitcoin and the formation of upper highs in opposition to the USDT stablecoin, each indicators of rising bullish momentum. He observes that AAVE has been in horizontal consolidation, with no vital worth drops, which he sees as a powerful indicator.

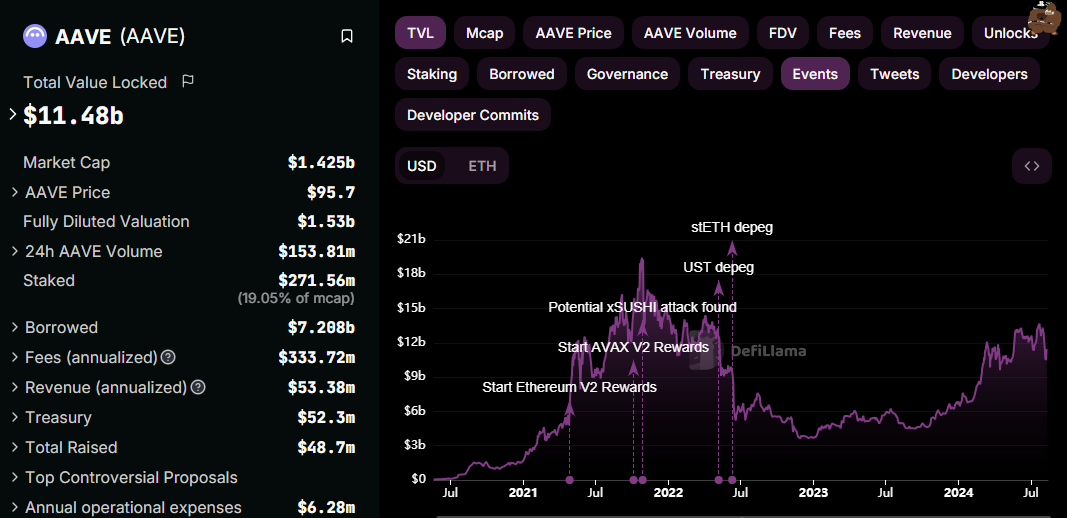

Past the bullish technical outlook, on-chain metrics for AAVE are additionally favorable. The Aave blockchain boasts a complete worth locked (TVL) of round $11.5 billion, in opposition to a market capitalization of over $1.4 billion. This valuation suggests appreciable upside potential, based on van de Poppe.

Notably, the Aave DAO just lately launched the first $100 million yield loan alongside key companions. The transfer, which exemplifies how tokenization and blockchain know-how can revolutionize the issuance and administration of bonds and securities, may bode properly for the AAVE token.

Aevo (AEVO)

Michaël van de Poppe additionally highlights AEVO as a promising purchase, pointing to its predictions and choices market. From a technical perspective, he notes a bullish divergence within the Relative Power Index (RSI), the place the RSI reveals larger lows in opposition to the value’s decrease highs, indicating rising bullish momentum.

Van de Poppe additional identifies a falling wedge sample on AEVO’s one-day chart, which suggests a possible breakout to the upside. This sample is broadly thought to be a bullish reversal sign, confirmed when the value breaks above the higher development line. The revenue goal for this sample is usually calculated by including the utmost distance between the higher and decrease development traces to the breakout level.

Learn extra: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

The analyst didn’t spotlight any tasks on his radar for the DePIN class. However, experts are already looking at Lumerin (LMR), Destra Community (DSYNC), AIOZ Community (AIOZ), StorX Community (SRX), and Storj (STORJ).

Traders are actively making ready for an altcoin season regardless of skepticism that the capital rotations will happen. However, getting forward of issues is a safer choice than succumbing to the concern of lacking out. However, merchants and traders should additionally conduct their personal analysis.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.