Bitcoin’s latest surge to just about $74,000 has been met with a big pullback, dropping roughly 8% and hovering across the $66,000 mark. Notably, the buyers’ sentiment seems divided as some capitalize on income, whereas others tread cautiously forward of the Federal Open Market Committee (FOMC) coverage charges’ resolution subsequent week.

In the meantime, amid this backdrop, standard analysts have supplied insights into BTC’s potential worth actions, key assist, and resistance ranges.

Bitcoin Value May Face Additional Decline

The latest retracement in Bitcoin worth has sparked issues among the many crypto market fanatics. Notably, many of the main altcoins additionally adopted Bitcoin’s worth momentum, leading to a large sell-off within the crypto market.

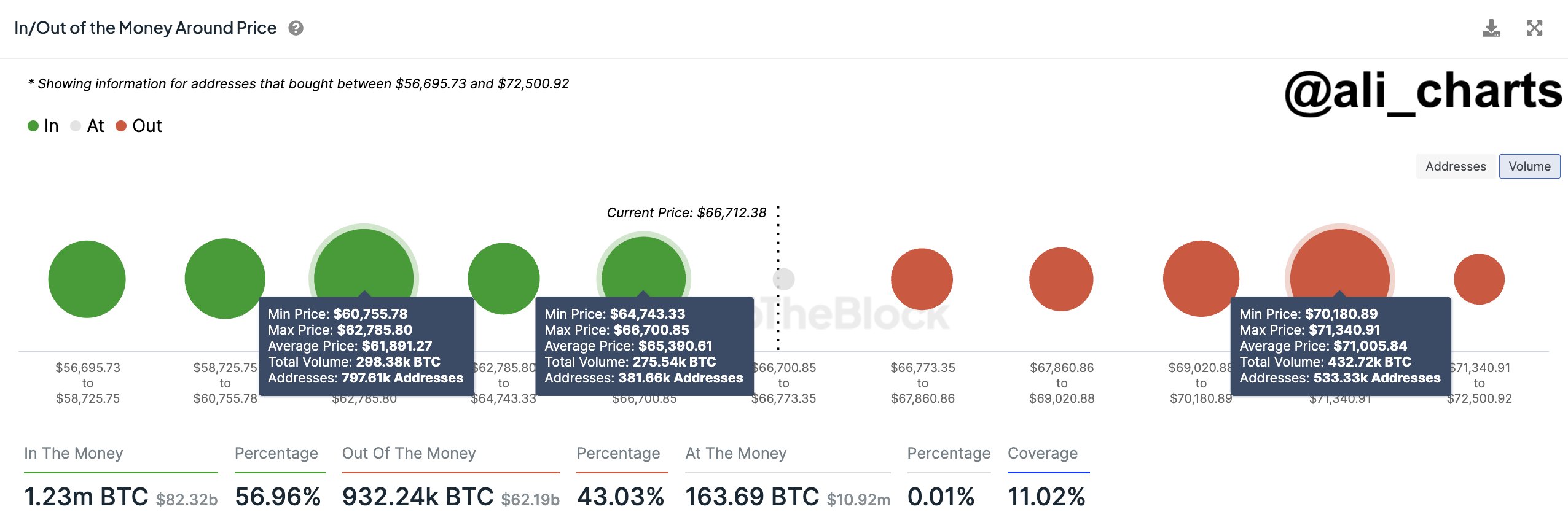

Amid the uncertainties, distinguished crypto analysts have provided key insights on Bitcoin’s worth in a latest X submit. Notably, in line with famend crypto market analyst Ali Martinez, Bitcoin has established a sturdy assist vary between $64,750 and $66,700.

In the meantime, Martinez emphasizes the significance of monitoring this stage carefully, as a breach may result in a shift in the direction of the subsequent vital demand zone between $60,760 and $62,790. Conversely, Bitcoin faces formidable resistance between $70,180 and $71,340, fortified by a considerable variety of addresses holding vital BTC quantities.

Nevertheless, in one other social media submit, Martinez emphasised the latest dip in Bitcoin’s worth as a shopping for alternative, echoing sentiments of optimism from different market pundits anticipating a possible rally.

Market Sentiment Amid Uncertainty & Halving Anticipation

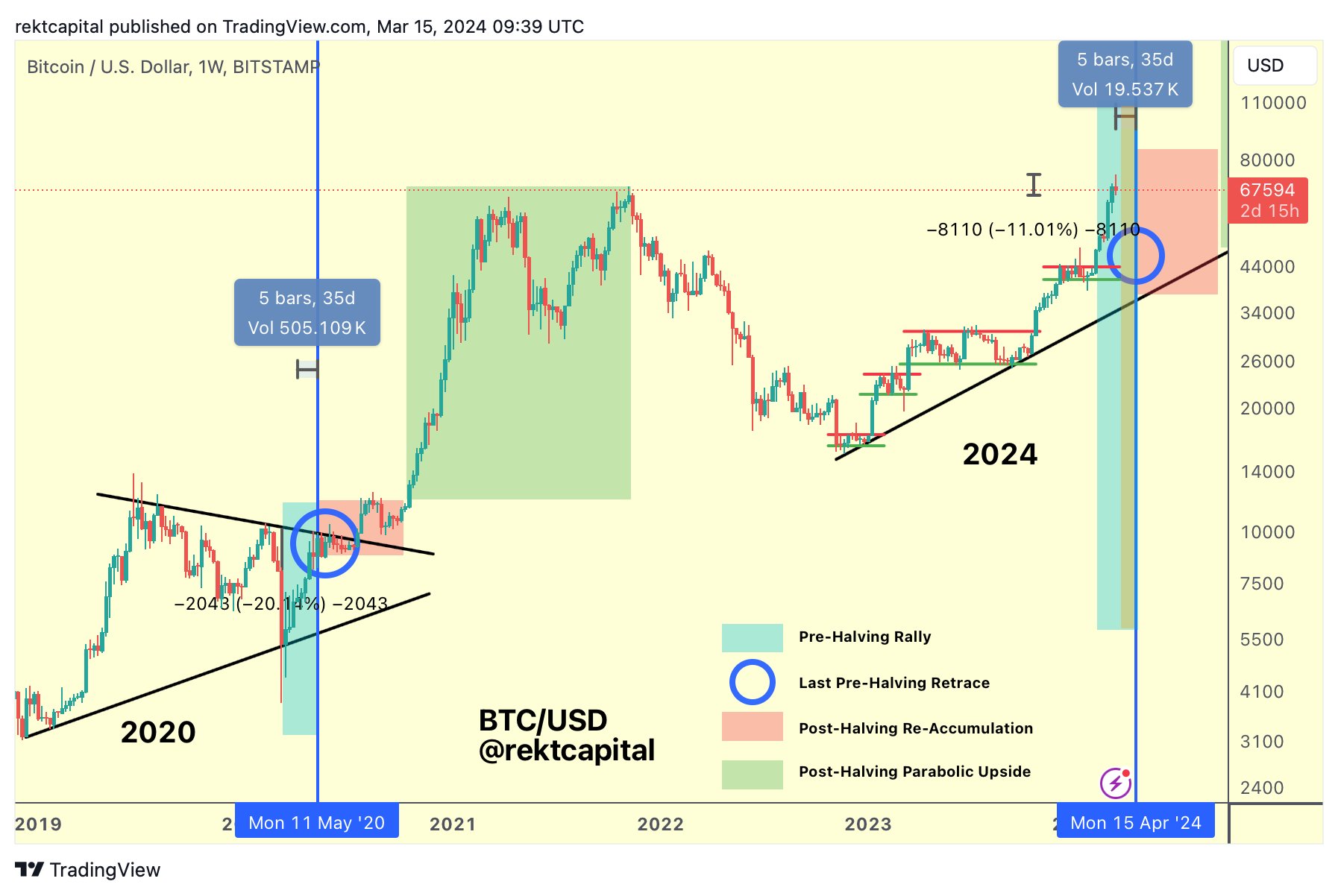

One other notable analyst, Rekt Capital, presents a cautionary perspective, suggesting that Bitcoin is nearing the “Hazard Zone” traditionally related to pre-halving retraces. In a latest X submit, Rekt Capital shared an evaluation, which confirmed that Bitcoin is poised to enter the “Hazard Zone” in 4 days.

In the meantime, he notes that the earlier information signifies retraces of 20% in 2020 and 40% in 2016, occurring 14-28 days earlier than the Bitcoin Halving. With Bitcoin at the moment round 32 days away from the occasion and experiencing an 11% pullback this week, buyers await developments eagerly.

Nevertheless, regardless of short-term fluctuations, a number of market pundits stay optimistic, fueled by anticipation over the upcoming halving occasion. Nevertheless, analysts warning in opposition to overlooking the potential affect of market dynamics and exterior components on Bitcoin’s worth trajectory.

In the meantime, as BTC approaches crucial assist and resistance ranges, market members stay vigilant, carefully monitoring developments for insights into potential worth actions. Whether or not Bitcoin dips under $61,000 or surges to new highs, the market continues to navigate with a mix of warning and anticipation, searching for readability amid the evolving panorama of digital property.

Notably, the Bitcoin price was down 7.11% and traded at $67,684.23 throughout writing, with its buying and selling quantity hovering 91.21% to $85.58 billion. The crypto has touched a low of $65,630.69 and a excessive of $73,063.22 within the final 24 hours, reflecting the risky situation out there.

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: