The crypto market witnessed over $1 billion in liquidation. Merchants and whales cite weak market construction and liquidations as causes for the selloff, not SpaceX’s bitcoin gross sales or China’s actual property large Evergrande’s chapter submitting.

CoinGape Media first reported a probability of a large selloff after the FOMC Minutes launch. US inventory market indices continued to fall this week amid banking issues and weakening China’s financial system. US Federal Reserve in search of additional charge hikes and crypto longs liquidations amid weak market construction on Wednesday already triggered a correction.

Merchants now await the probably choice within the Grayscale vs SEC lawsuit on Friday, which is able to give a transparent course to the market. Approval of a Bitcoin ETF this yr majorly relies upon upon Grayscale’s win in opposition to the SEC. In truth, GBTC is wanting sturdy regardless of a fall in BTC value, as per knowledge by Coinglass. Grayscale Investments has additionally put out an advert to make use of a Senior ETF Associate because it nears the tail finish of its lawsuit with the SEC.

Additionally Learn: XRP Price Plunges 20% to Pre-Court Ruling Levels, More Correction Likely?

Indicators That Signaled A Crypto Market Selloff

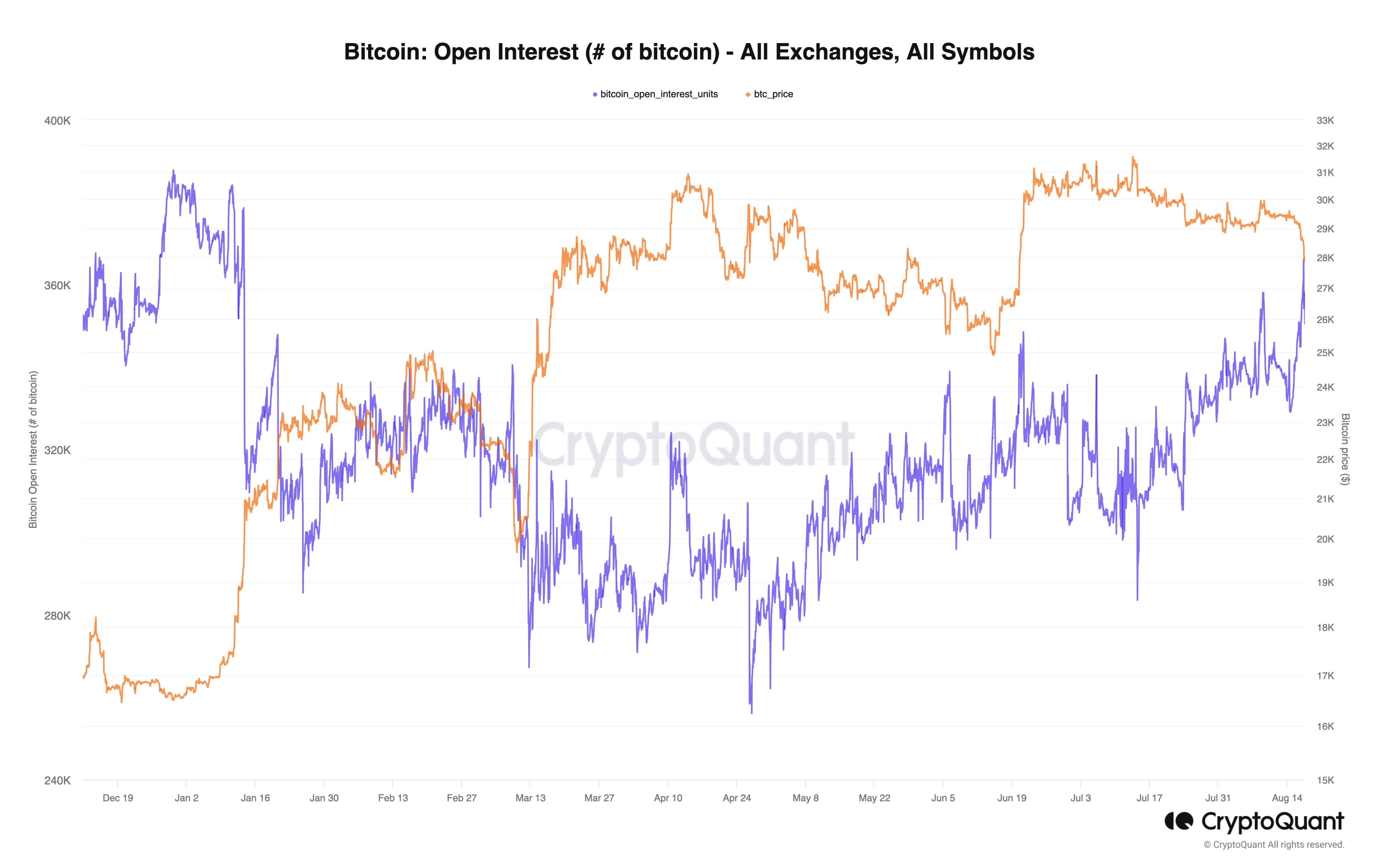

CryptoQuant revealed that the market construction was weakening since mid-July after Bitcoin failed to carry the $30k psychological stage. Bitcoin open curiosity (OI) of quick positions was growing since mid-July amid value declines.

As well as, the selloff was preceded by a interval of low demand for Bitcoin, leading to a unfavorable Coinbase premium. The BTC value remained caught in a spread close to $29300. Additionally, a rise in whale spending exercise earlier than and through the selloff was recorded.

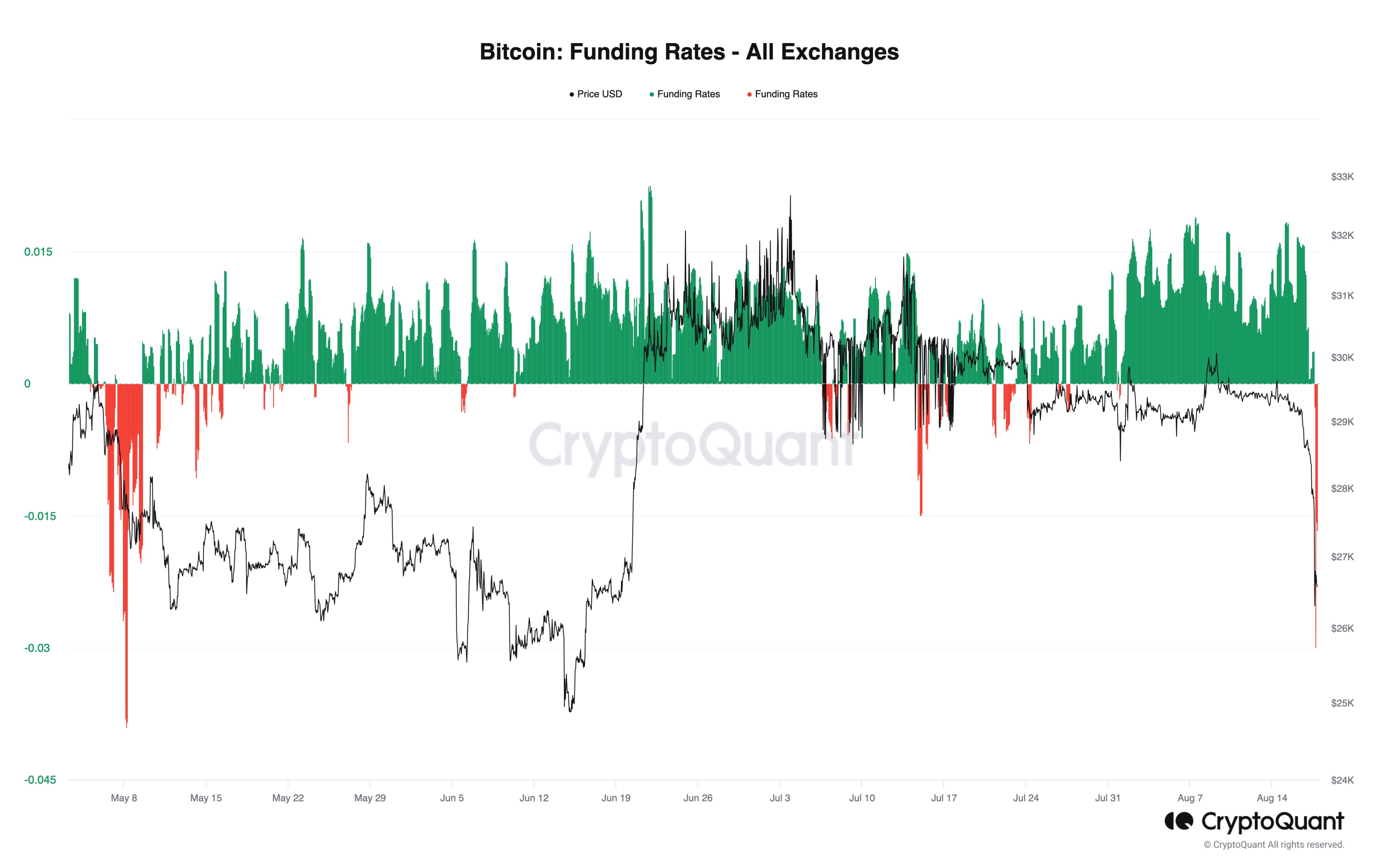

At the moment, the sentiment stays unfavorable, with unfavorable funding charges indicating that merchants are keen to go quick. Merchants are skeptical about restoration after longs liquidation. Thus, the value motion to probably stay weak till the top of the month.

BTC price trades at $26,577, down 7% previously 24 hours. In the meantime, ETH price is buying and selling at $1694, recovering from a 24-hour low after experiences of SEC to approve Ether futures ETF.

Evergrande submitting for chapter?

Area X supposedly promoting its #BTC holdings?

Largest $BTC liquidation occasion since FTX crash in November 2022?

Regardless of the narrative

Regardless of the catalyst

It doesn’t matter the right way to clarify the transfer now that it has occurred

Those that have… pic.twitter.com/p3zjqzi38U

— Rekt Capital (@rektcapital) August 18, 2023

Additionally Learn: Shibarium Restarts Block Production, SHIB And BONE Rebounds

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.