Wallstreet’s main monetary regulator, the Securities and Exchange Commission (SEC) has advisable stricter guidelines for companies that safe belongings for fund managers. This transfer may additional constrain crypto platforms similar to Coinbase and Kraken because the trade faces persevering with strain from regulators.

SEC’s Newest Crypto Crackdown

On Wednesday, the SEC voted 4-1 to suggest a rule that may increase the kinds of belongings that funding advisers, similar to hedge funds and pension funds, are required to carry utilizing certified custodians. The brand new rule, if it have been to be handed, would increase the scope of the safeguarding mandate to cowl any belongings, together with cryptocurrency, that monetary advisers are entrusted with.

Learn Extra: Check Out The Top 10 DeFi Lending Platforms Of 2023

Banks, belief firms, and broker-dealers are the basic kinds of companies that qualify as certified custodians. Regardless of this, over the previous a number of years, buying and selling platforms like Coinbase have begun to supply the service due to the peculiarities concerned in defending belongings like bitcoin from being stolen or hacked.

Coinbase & Different Exchanges In Hassle?

The motion presents a brand new hazard to the custody insurance policies of cryptocurrency exchanges as a result of different federal regulators actively stop custodians like banks from protecting shopper cryptocurrency holdings. The modifications additionally come at a time when the SEC is aggressively stepping up its enforcement efforts.

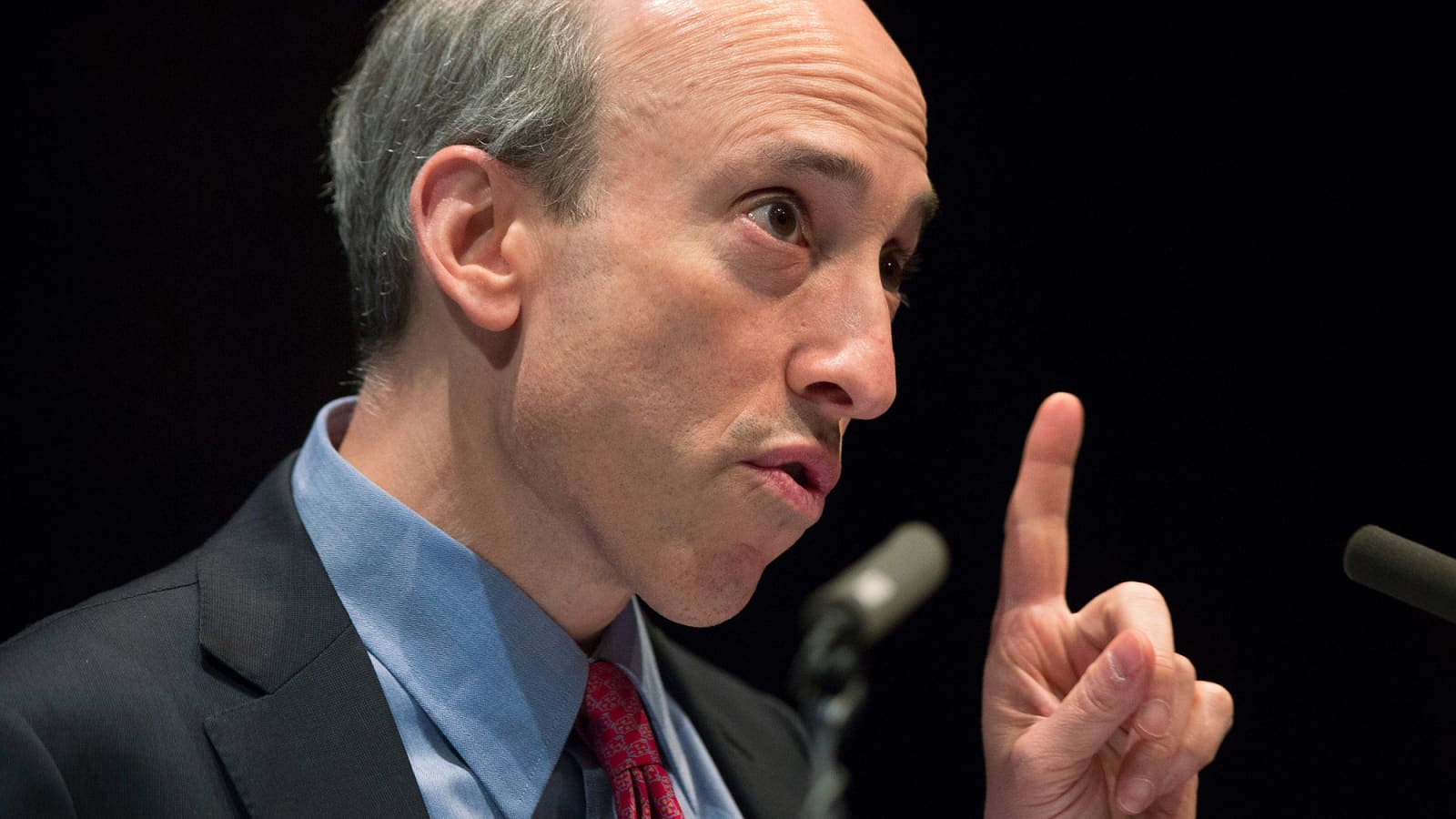

Even if the proposal doesn’t single out cryptocurrency firms, SEC Chair Gary Gensler was quoted as saying:

Make no mistake: Primarily based upon how crypto platforms typically function, funding advisers can not depend on them as certified custodians. Although some crypto buying and selling and lending platforms might declare to custody traders’ crypto, that doesn’t imply they’re certified custodians.

In line with the web site of cryptocurrency alternate Coinbase, the agency claims to be a professional crypto custodian, with hundreds of institutional purchasers utilizing its Prime platform to safe their funds. The corporate’s custodial providers introduced in income of $68.4 million in the course of the first 9 months of 2022, which was 21% lower than the identical interval within the earlier 12 months.

Crypto’s Rising Regulatory Considerations

In response to Gensler’s alleged anti-crypto stance, SEC commissioner Hester Peirce famous that the Fee doesn’t have the authority to manage custodians straight. Furthermore, given their lack of regulatory authority, Peirce doubted on “who can be on the hook if a professional custodian didn’t fulfill these necessities?”

My assertion on at this time’s custody proposal. Trying ahead to feedback from the general public. This one impacts crypto, amongst many different points: https://t.co/1eWT6P45Ya

— Hester Peirce (@HesterPeirce) February 15, 2023

The Dodd-Frank Act of 2010, which was handed after the earlier vital monetary catastrophe, offers Gensler’s company the authority to train these new guidelines on the broader crypto market. Though the SEC is rumored to have recently been investigating crypto custodial points, SEC officers claimed that the company has been engaged on this plan for a very long time and never in response to any latest theatrics round cryptocurrency.

Additionally Learn: U.S. Voters Can Now Donate In Crypto To Politicians; However Conditions Apply

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.