One other nation has entered the cryptocurrency celebration, and it’s a giant one. The UK’s Financial and Finance Ministry introduced this afternoon that the nation will probably be amending its regulatory framework to permit the introduction of stablecoins as a method of cost.

Certain, it’s not like Boris Johnson has gone full-El Salvador and launched Bitcoin as authorized tender, however it’s nonetheless an essential step and one that will trigger a domino impact, particularly given it’s coming from Britain.

Essentially the most criticised side of El Salvador’s Bitcoin initiative, in fact, is the infamous volatility that Bitcoin suffers from. With stablecoins, that’s not a problem, with their worth pegged to fiat counterparts.

That is a part of the explanation that this announcement is such notable information – that is very a lot a focused initiative introducing crypto particularly as a technique of cost, slightly than merely loosening the general regulation on the business.

Her Majesty’s Treasury (in any other case known as the Exchequer – I’m nonetheless studying my British acronyms as I intend to maneuver to London later this yr), have been fairly bullish of their evaluation of stablecoins of their assertion Monday: “The rationale for doing that is that sure stablecoins have the capability to doubtlessly turn into a widespread technique of cost together with by retail prospects, driving client selection and efficiencies”.

Her Majesty’s Treasury (in any other case known as the Exchequer – I’m nonetheless studying my British acronyms as I intend to maneuver to London later this yr), have been fairly bullish of their evaluation of stablecoins of their assertion Monday: “The rationale for doing that is that sure stablecoins have the capability to doubtlessly turn into a widespread technique of cost together with by retail prospects, driving client selection and efficiencies”.

The assertion continued that the modification of regulation to facilitate these stablecoins was only one side of a “package deal of measures” geared toward incorporating blockchain know-how into the UK and making a “international hub” – so whereas cost is the primary merchandise on the listing, as we simply talked about, the UK are additionally signalling their intent to finally transcend this area of interest and embrace the broader crypto business, too.

With the volatility of “regular” cryptocurrencies rendering them impractical proper now for commerce, stablecoins are primed to take the step up…if regulators get on board. This transfer by the UK, subsequently, is an enormous sign of intent – as a result of it’s so achievable. “If crypto applied sciences are going to be a giant a part of the longer term, then we – the UK – wish to be in, and in on the bottom flooring” the Financial Secretary, John Glen, mentioned on the Innovate Finance Global Summit. “In reality, if we commit now…if we act now…we are able to cleared the path”, he continued.

We received ideas from Katie Evans, DeFi Skilled at Swarm Markets, on what this may increasingly imply, as an insider within the business. “London is an enormous international monetary hub, and it has to maintain up with the constantly-changing face of monetary know-how”, she mentioned. “The UK Authorities does appear to be being attentive to the truth that the race is on to construct the crypto centres of the following 50 years, and that is in essence its approach of setting out its stall”. Evans was additionally enthused that stablecoins particularly have been some extent of focus, declaring that they function “a helpful on-ramp for potential crypto asset customers” and are “one of many easiest to evaluate and approve in crypto phrases, bringing them according to present monetary markets regulation”.

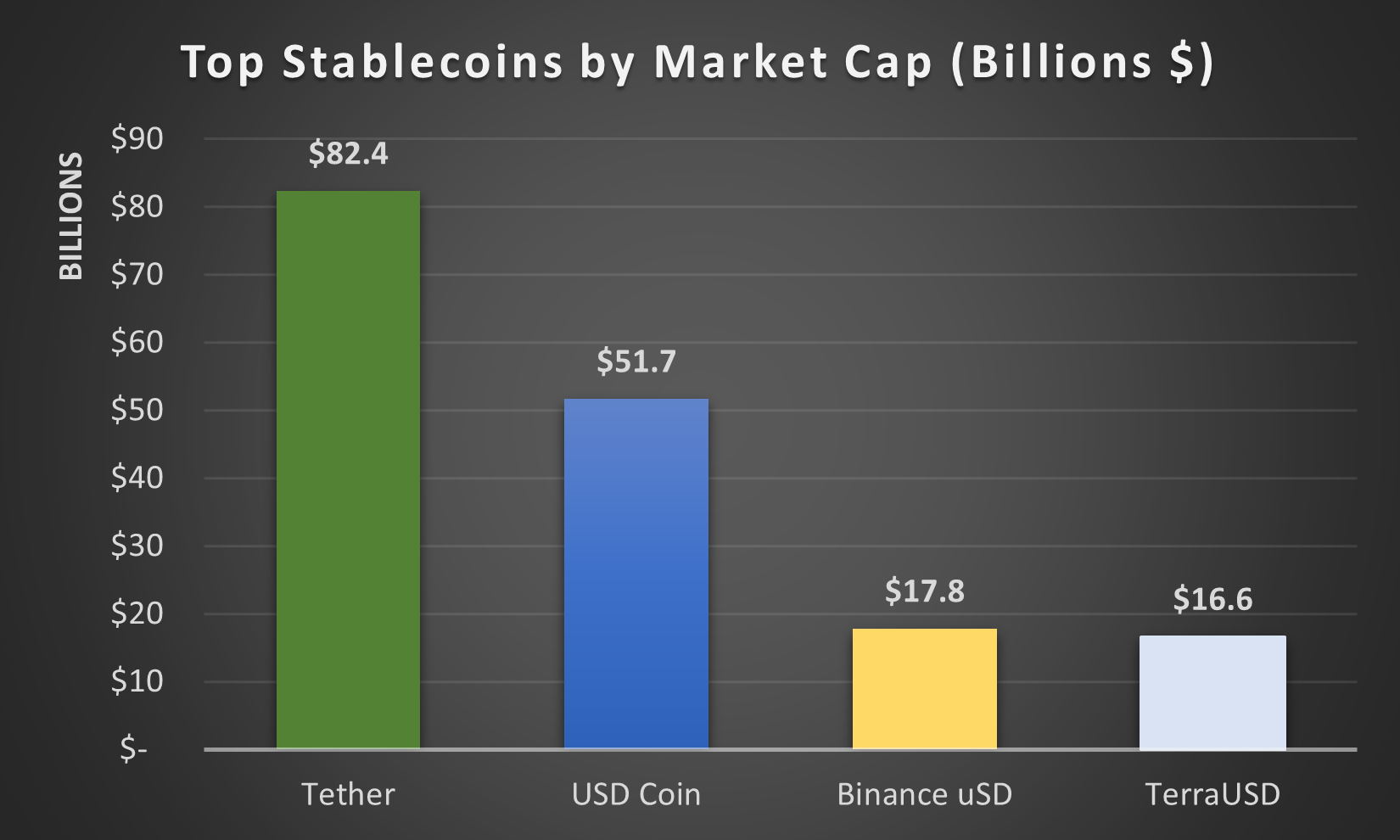

One other fascinating tidbit? The non-appearance of Central Financial institution Digital Currencies (CBDCs) within the announcement. That is very a lot stablecoins reminiscent of Tether, Circle and so forth for use as a medium of alternate, when many would have anticipated a CBDC announcement as extra seemingly.

It’s a giant marker to put down, because the UK are actually set to turn into one of many first nations to offer clear steering to the crypto business as to how stablecoins might be carried out. This story will develop and is much from over, however in the present day is a vital first step.