The U.S. Bureau of Labor Statistics launched the much-awaited Consumer Price Index (CPI) inflation information for February, which confirmed that US inflation is available in hotter at 3.2%. The crypto and inventory market traders anxious as they seemed for additional cues on Fed charge cuts.

After a surprising hotter CPI inflation final month of three.1%, the likelihood of Fed charge cuts was pushed to June, with consultants even predicting charge cuts beginning in September. The CME FedWatch data signifies over 60% odds of 25 bps charge cuts in June and an extra 25 bps charge reduce in July.

US CPI Is available in Scorching in February

The US annual inflation charge within the US got here in at 3.2%, towards the anticipated 3.1%, increased than January’s figures and sustaining ranges not seen since 2021. Nevertheless, client costs elevated by 0.4% from the earlier month, a slight uptick from 0.3%, primarily pushed by a surge in gasoline costs.

In the meantime, annual core CPI inflation additional slowed to three.8%, down from 3.9% final month, however increased than anticipated 3.7%. The month-to-month charge comes increased than market expectation at 0.4%, in step with 0.4% in January. The February report displays a continued gradual disinflation course of within the US, though the inflation charge stays excessive.

US fairness futures and European shares are regular after the important thing CPI information, with merchants anticipating market volatility. US greenback index (DXY) shifting close to 102.85 however volatility is predicted. Furthermore, the US 10-year Treasury yield that fell to 4.087% has elevated to 4.110% after CPI.

https://www.marketwatch.com/story/jamie-dimon-says-fed-should-hold-off-on-cutting-interest-rates-5eb2df6a

Additionally Learn: Binance Waives Fees For DOGE, SHIB, PEPE, BONK, WIF, FLOKI Meme Coins

BTC Worth to $75K?

BTC price stays risky after the CPI launch, with with the value at the moment buying and selling underneath $72K. The 24-hour high and low are $71,339 and $72,850, respectively. Moreover, the buying and selling quantity has elevated barely in the previous couple of hours.

In the meantime, JPMorgan CEO Jamie Dimon says the Fed ought to maintain off on slicing rates of interest amid lack of readability on the state of the financial system. “I feel the possibility of a smooth touchdown within the subsequent yr or two is half,” Dimon mentioned. “The more severe case can be stagflation.”

Whereas the fairness market stays underneath stress, merchants can eye for Bitcoin as an inflation hedge and BTC value can maintain with an extra rally.

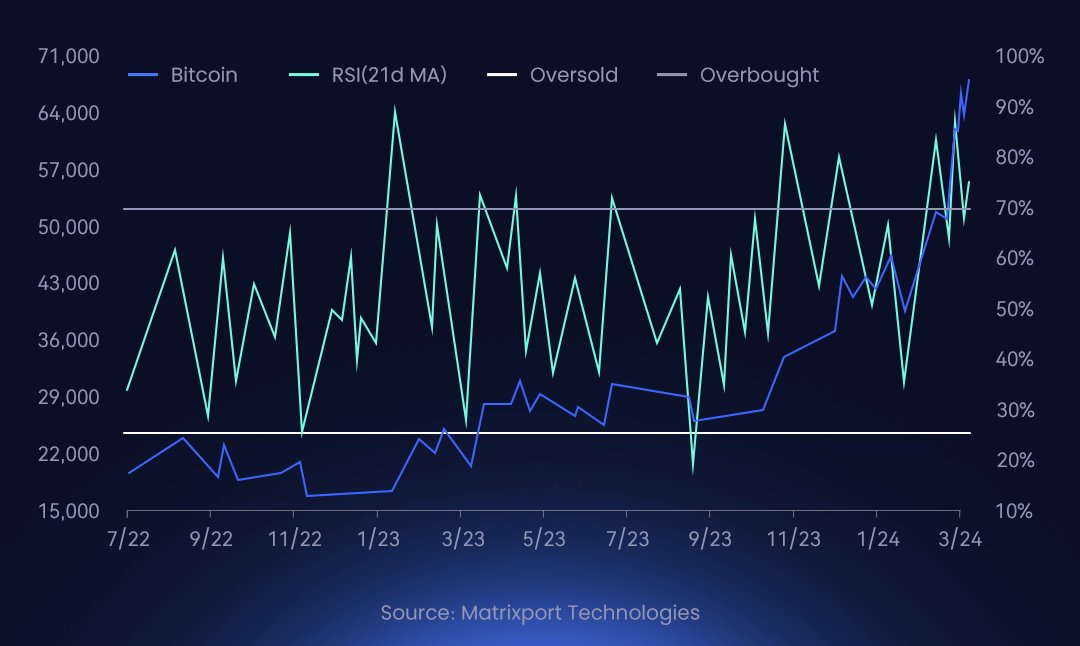

Nevertheless, Matrixport predicts consolidation within the subsequent few weeks, as per the risk-reward evaluation. They added that bull market will proceed however divergence between a declining RSI and better Bitcoin value indicators want for a consolidation earlier than a rally.

Additionally Learn: CoinShares Acquires Valkyrie Bitcoin ETF To Strengthen US Presence

- Breaking: US CPI Comes Hotter at 3.2%, Bitcoin Price to Fall?

- Binance Unveils Key Update For XRP, WIF, FLOKI, NEAR, GRT

- Binance Waives Fees For DOGE, SHIB, PEPE, BONK, WIF, FLOKI Meme Coins

- Shiba Inu Community Burns 383 Mln SHIB, Price To Reach $0.000045?

- XRP, MATIC, SOL Options Goes Live on Deribit, Here Are Pre-Bitcoin Halving Target Price

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: