The US Federal agencies have demanded extra energy to crack down on the stablecoin market as they imagine it may doubtlessly destabilize the present monetary system. The President’s Working Group together with main monetary regulators revealed a brand new report on Stablecoins urged Congress to manage stablecoin issuers much like banks. The official report learn,

“The fast development of stablecoins will increase the urgency of this work,” the regulators stated. “Failure to behave dangers development of cost stablecoins with out enough safety for customers, the monetary system, and the broader financial system.”

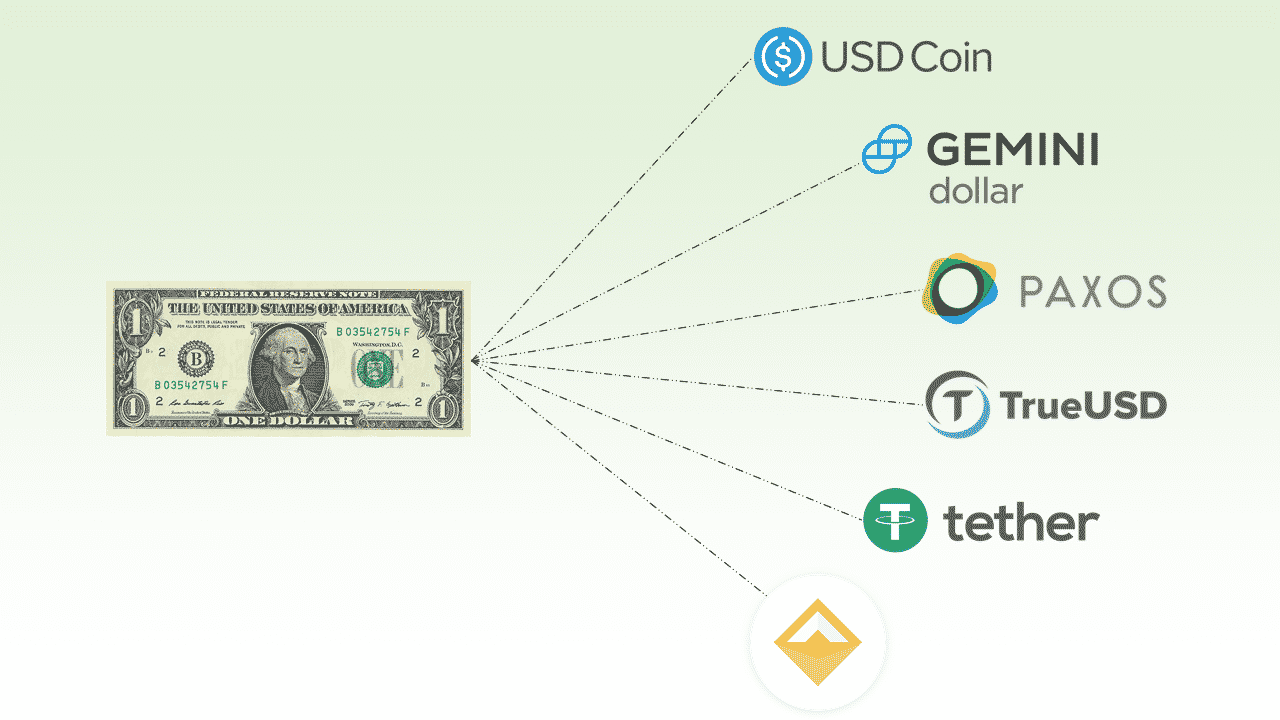

Regulators shared particular concern for stablecoin issuers and the reserves they declare that again the circulating provide of those steady currencies. The stablecoin market has turn into a $130 billion business with Tether’s USDT main the market with over $72 billion in circulation adopted by Circle’s USDC with $37 billion in circulation. Federal companies imagine there is no such thing as a method to confirm whether or not the circulating provide is equally backed with out clear laws in place.

Tether appears to be the largest explanation for fear for the companies at this level, because the stablecoin issuer has been fined and warned on quite a few events for its opaque reserves. The agency nevertheless claims in any other case and in addition promised to completely cooperate with federal companies with the brand new proposed laws across the stablecoin business.

We respect the curiosity from lawmakers on the perform, function, and safety of all stablecoins throughout the cryptocurrency ecosystem. We have now been and are happy to work with coverage makers all over the world on these essential points. 1/3

— Tether (@Tether_to) November 25, 2021

Will Stablecoin Market Undergo Subsequent After Privateness Cash

The just lately handed Infrastructure Bill has already created a number of panic and worry amongst crypto companies as a result of excessive and close to unimaginable crypto reporting that it calls for. US authorities’s concentrate on the stablecoin market was mirrored when the StableAct was launched final 12 months and confronted a number of criticism from the crypto group. Equally, a Stablecoin threat report was additionally revealed initially of November demanding congress to formulate new laws across the market.

Privateness cash have been a giant explanation for fear amongst European nations which has led to a number of crypto exchanges delisting them. Now the US authorities is trying to deliver the stablecoin market beneath the banking legal guidelines.

Disclaimer

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.