The U.S. Federal Reserve’s most popular gauge to measure inflation private consumption expenditures (PCE) is predicted to come back in barely scorching, as per US economists. This may probably trigger the US FOMC to deliberate once more on beginning Fed fee cuts in September. Bitcoin and Ethereum costs can even witness additional promoting strain if the PCE inflation is available in greater.

Economists Estimate PCE Inflation at 2.6%, Core PCE at 2.7%

The U.S. Bureau of Economic Analysis will release US PCE inflation knowledge for July on Friday, August 30. In response to economists, the annual PCE to come back in at 2.6%, greater than 2.5% final month. Additionally, the PCE on a month-to-month foundation is predicted to rise 0.2%, in opposition to 0.1% earlier month.

They anticipate the annual core PCE, which excludes meals and vitality costs, to rise 0.18% on a month-to-month foundation and a pair of.7% on an annual foundation. The estimates are barely hotter than June’s PCE numbers, however markets contemplating inflation to proceed decrease.

“We’re going to see continued progress on inflation,” says José Torres, senior economist at Interactive Brokers, reported Morningstar. He attributed this to falling costs for items, together with crude oil and gasoline. Nonetheless, crude oil, pure fuel, and gold costs are hovering in the present day, making merchants cautious.

Bitcoin and Ethereum costs are more likely to fall if PCE inflation is available in greater. This may set off a broader liquidation in crypto market.

Will Fed Begin Charge Cuts in September?

The European Central Financial institution (ECB) is contemplating one other fee reduce on September 12, which can present merchants with additional cues earlier than the Fed plans fee cuts on September 18. ECB policymakers have indicated the speed reduce is probably going, whereas eyes are on inflation figures for France, Italy, and the broader Eurozone launch this Friday.

The Fed expects three fee cuts this yr, with a possible begin in September as per the most recent signal by Fed Chair Jerome Powell. Nonetheless, the Fed may delay fee cuts to November if PCE inflation and jobs knowledge are available in greater.

In the meantime, the inventory and crypto market has turned unstable as merchants monitor Nvidia earnings and PCE inflation. Nvidia shares tumbled about 7% in prolonged buying and selling even after beating income and earnings expectations, because the agency’s gross sales outlook for the present quarter didn’t impress traders.

CME FedWatch data exhibits a 65.5% likelihood of 25 bps fee cuts in September. Additionally, it nonetheless exhibits a complete of 100 bps fee cuts this yr.

The Buffett Indicator (Complete US Market Worth/GDP) is a ballpark measure of how costly shares are at anyone level in historical past…

It’s now sitting at ~200%.

“If the ratio approaches 200%, because it did in 1999, you might be enjoying with fireplace.” – W. Buffett pic.twitter.com/WD18O7SoMb

— Geiger Capital (@Geiger_Capital) August 28, 2024

Bitcoin and Ethereum Worth Beneath Strain

BTC price jumped 2% from the 24-hour low of 58,637, with the worth at the moment buying and selling at $60,142. This occurred after a breakout within the decrease timeframe. The buying and selling quantity has decreased by 23% within the final 24 hours, indicating a decline in curiosity amongst merchants.

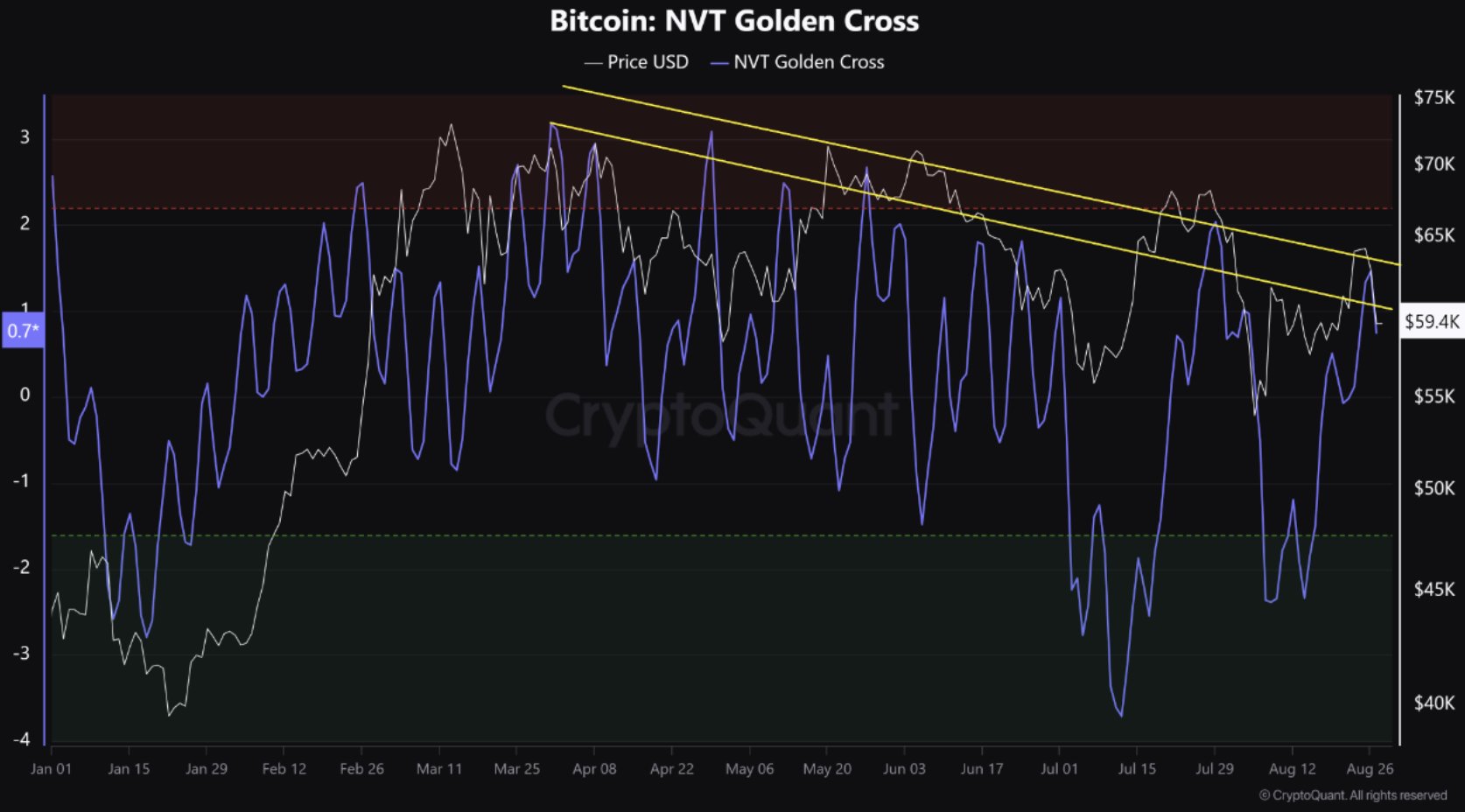

CryptoQuant metric NVT Golden Cross for Bitcoin is struggling to surpass its earlier peak. This means that the present uptrend is shedding momentum. The NVT Golden Cross must surpass the earlier peak with help from bulls to regain the upside momentum.

Furthermore, Bitcoin choices value $3.65 billion and Ethereum choices value $1.35 billion are set to run out on the biggest derivatives change Deribit. This might additional convey lengthy liquidations in BTC and ETH, triggering a market correction amid the US PCE inflation knowledge.

In the meantime, ETH price additionally jumped 2% from the 24-hour up to now 24 hours, with the worth at the moment buying and selling at $2,570. Ethereum additionally noticed a breakout in 1-hr timeframe. The buying and selling quantity has decreased by 25% within the final 24 hours.

Within the day by day timeframe, Ethereum worth is dealing with robust resistance at the moment. RSI is close to the impartial space at 41. The fib substitute signifies the worth is bouncing off the 0.236 degree at $2,450. The value might drop once more to the extent throughout the ETH choices expiry as max ache level is greater at $2,800, as per Deribit data.

Disclaimer: The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: