Key Notes

- The platform will tokenize main shares for round the clock buying and selling in fractional shares, democratizing fairness entry globally.

- Blue Ocean’s transfer follows ICE’s $2B Polymarket acquisition and Nasdaq’s SEC submitting to allow tokenized inventory buying and selling.

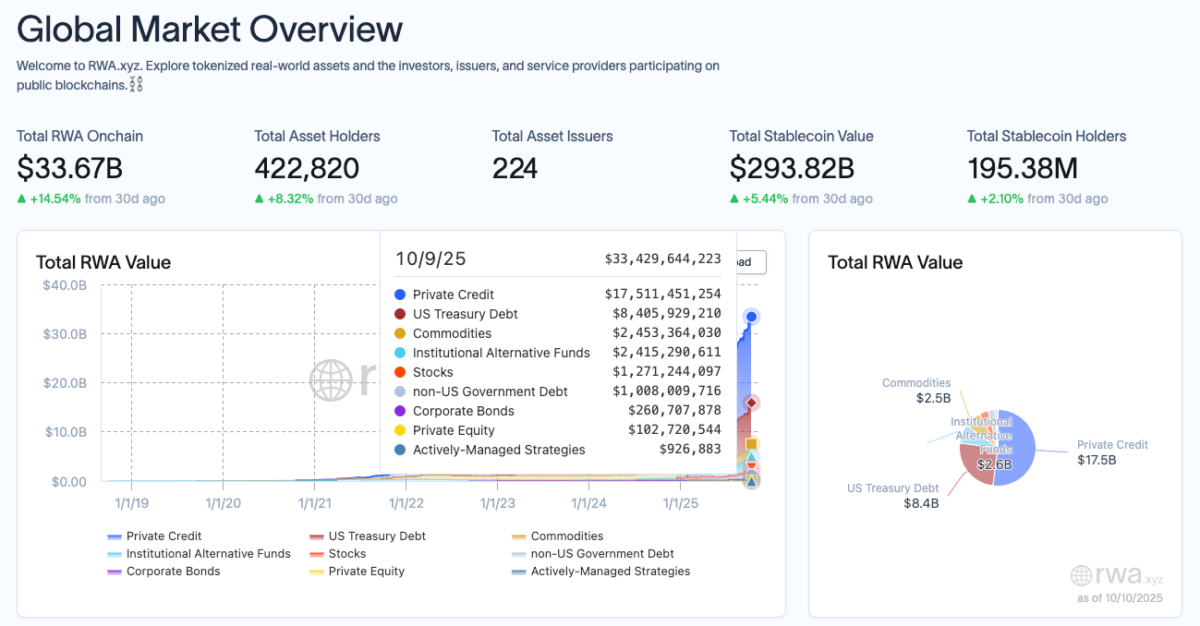

- World tokenized property reached $33B, led by non-public credit score at $17.5B and US Treasuries at $8.4B market share.

On Oct. 10, Blue Ocean, an off-exchange platform for in a single day US inventory buying and selling, introduced its official entry into blockchain-based fairness choices.

Blue Ocean permits traders to purchase and promote blue-chip shares like Apple and Tesla after Wall Road closes, bridging the hole between international time zones.

According to Reuters, the corporate’s newest blockchain push follows a system overload incident in August, which prompted an improve on infrastructure, counting on main retail brokers like Robinhood, Schwab, and Interactive Brokers to increase capability.

As a part of our innovation technique, we introduced we might be pursuing integration with forthcoming tokenized NMS equities options, positioning us as the primary ATS to help tokenized U.S. equities buying and selling, paving the best way for twenty-four/7/365 market entry. https://t.co/6FhIXeFvBZ

— Blue Ocean ATS (@BlueOceanATS) October 10, 2025

With its newest transfer, Blue Ocean is about to checklist shares straight on the blockchain, making them tradable 24/7, in smaller, extra accessible fractions. This mannequin might democratize fairness possession, making international round the clock markets a actuality for retail merchants and establishments.

Blue Ocean’s Crypto Transfer Aligns With Different Outstanding US Buying and selling Platforms

Blue Ocean’s enterprise into asset tokenization mirrors a broader institutional pattern as main US buying and selling platforms more and more lean towards cryptocurrencies amid enhancing regulatory readability.

Earlier this month, Intercontinental Exchange (ICE), mother or father firm of the New York Inventory Change, acquired Polymarket in a landmark $2 billion deal.

World Actual-World Asset (RWA) sector rises 14.7% in 30 days to hit $33 billion on October 10, 2025 | Supply: RWA.XYZ

According to Rwa.xyz, the worldwide asset tokenization sector has surpassed $33 billion in complete on-chain property, with non-public credit score main at $17.5 billion, representing 53% of the entire tokenized market. US Treasuries rank second with $8.4 billion, or 24% market share, emphasizing the rising demand for yield-bearing property standard amongst institutional traders.

In the meantime, Nasdaq just lately filed a proposal with the US Securities and Change Fee (SEC), tweaking its rules to enable trading of listed stocks and exchange-traded products in both conventional or tokenized type.

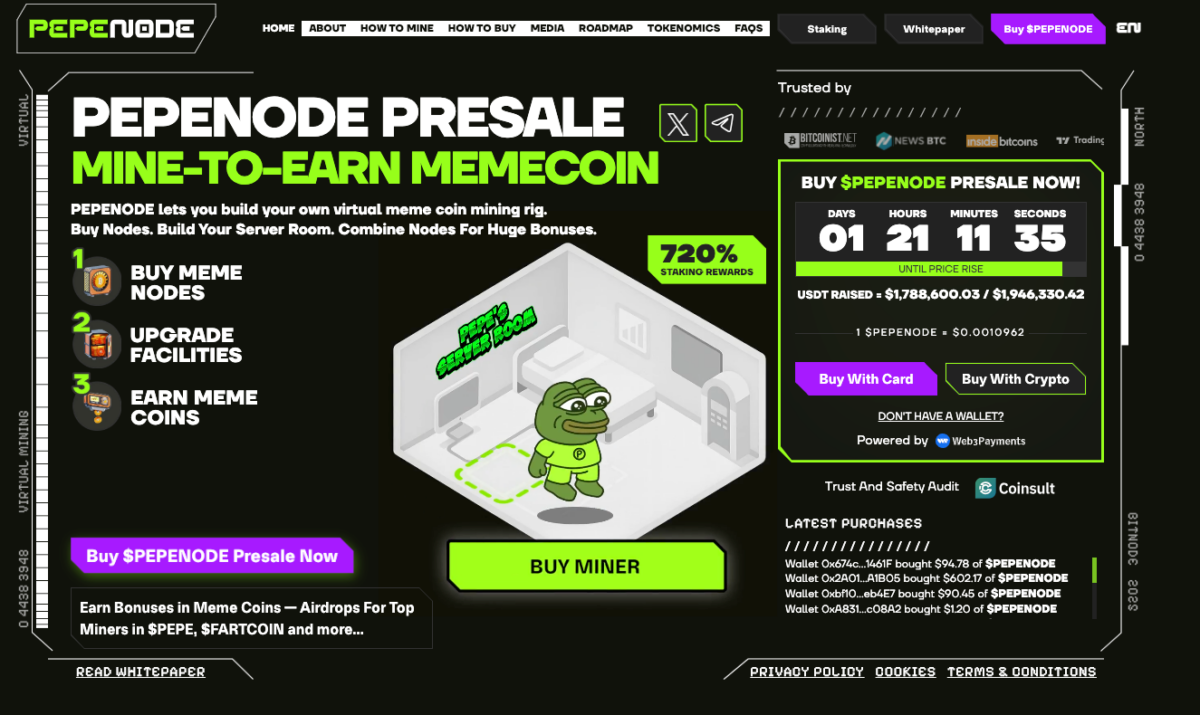

Pepe Node Presale Beneficial properties Momentum as Tokenized Markets Develop

As Blue Ocean’s newest transfer deepens Wall Road’s rising involvement in crypto, community-driven crypto tasks like Pepe Node are additionally drawing investor curiosity.

Pepe Node permits customers to personal digital meme coin mining rigs, mix nodes for greater yields, and earn bonus rewards from community participation.

Pepe Node Presale

Presently priced at $0.0010, the Pepe Node presale has already raised over $1.16 million of its $1.3 million goal. Buyers can nonetheless be a part of by the official Pepe Node website earlier than the subsequent value tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.