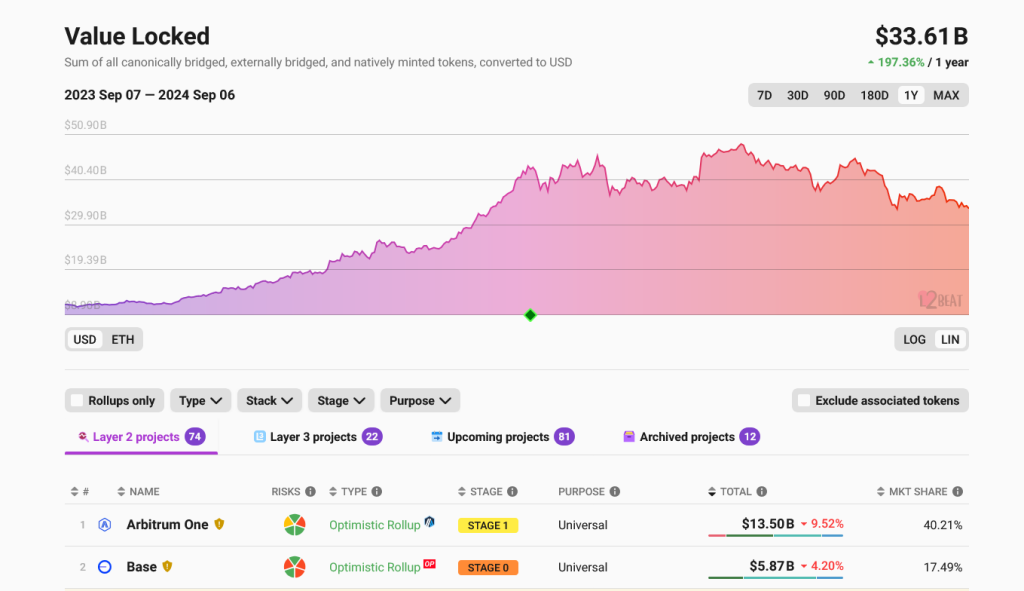

Whereas Ethereum builders are working arduous to develop on-chain scaling options, together with Sharding, layer-2s is selecting up steam. In keeping with L2Beat, as of September 6, all these layer-2 scaling options managed almost $34 billion.

Widespread as they’re, most should not solely rising to be centralized but in addition have safety issues. Not too long ago, the OP Mainnet needed to revert to a centralized fault-proof system after discovering flaws within the decentralized model.

Ethereum And Its Layer-2s Are Flawed

In gentle of those weaknesses, Justin Boons, the founder and CIO of Cyber Capital, a enterprise capital agency, is ripping more durable into Ethereum and, particularly, its layer-2 platforms. In a put up on X, the founder argues that layer-2s like Arbitrum and Base are essentially flawed and centralized providers.

Boons took to X, highlighting the shortcomings of Ethereum builders. The founder accuses them of not scaling proper after launching and the way “parasitic” layer-2 options are turning out to be. Regardless of their benefits, Boons claims these off-chain options create an unhealthy dependency.

Apparently, the founder continued that Ethereum is changing into extremely reliable on these options, although they don’t adhere to the guiding ideas governing the blockchain: decentralization.

The enterprise capital is satisfied that Ethereum layer-2s are benefiting from the recognition of the mainnet to not advance its adoption however to revenue.

Their choice to sacrifice decentralization (and thus safety) will, on the fullness of time, solely serve to undermine your complete ecosystem. In his view, platforms like Base, Arbitrum, and the OP Mainnet shouldn’t be thought of “extensions” of the bottom layer attributable to their inherent weaknesses.

Sprint Will Profit For Decentralizing From The Begin

As Boons criticized Ethereum and its dominant scaling choices, the founder backed Sprint, one of many earliest blockchain platforms. In contrast to the off-chain options, Sprint, the enterprise capitalist said, prioritized scaling from the start.

Particularly, Boons additionally selected the blockchain’s choice to pick out a decentralized governance method. Their transfer, the founder added, will “profit” them within the coming days.

Nonetheless, although there are challenges with layer-2s, Ethereum builders are working to refine the mainnet. Ethereum 2.0 will ship on-chain scaling with out sacrificing safety and decentralization in a collection of upgrades, from the Verge to Splurge.

On the similar time, the approval of spot Ethereum ETFs is a big endorsement of the community. Although america Securities and Change Fee (SEC) is but to publicly endorse ETH to be a commodity, like Bitcoin, the Commodity Futures Buying and selling Fee (CFTC) considers it a commodity.

Although one of many earliest platforms, Sprint has light into obscurity lately. It’s exterior the highest 100 most precious networks and faces liquidity challenges after delisting from some centralized exchanges like HTX.

Characteristic picture from Canva, chart from TradingView