Ethereum is as soon as once more approaching important ranges after a stretch of unstable but bullish value motion. Following a pointy rebound from yesterday’s low of round $3,675, ETH is now buying and selling above the $3,800 mark, regaining momentum as merchants eye a decisive transfer. Whereas short-term volatility stays, the general construction favors continuation—offered ETH can break cleanly above the $4,000 resistance degree.

Associated Studying

This threshold now stands as the important thing barrier between consolidation and a possible rally towards new highs. A confirmed breakout would probably ignite contemporary bullish momentum throughout the broader altcoin market. Till then, value stays trapped in a narrowing vary, testing each dealer persistence and liquidity depth.

In the meantime, on-chain information helps the bullish case. Based on blockchain analytics platform Arkham, whales have ramped up their accumulation, with giant addresses steadily including to their ETH holdings in latest days. This ongoing accumulation development displays rising conviction amongst high-cap gamers and provides weight to the potential of additional upside within the months forward.

Whale Receives Ethereum From Galaxy OTC As Establishments Double Down

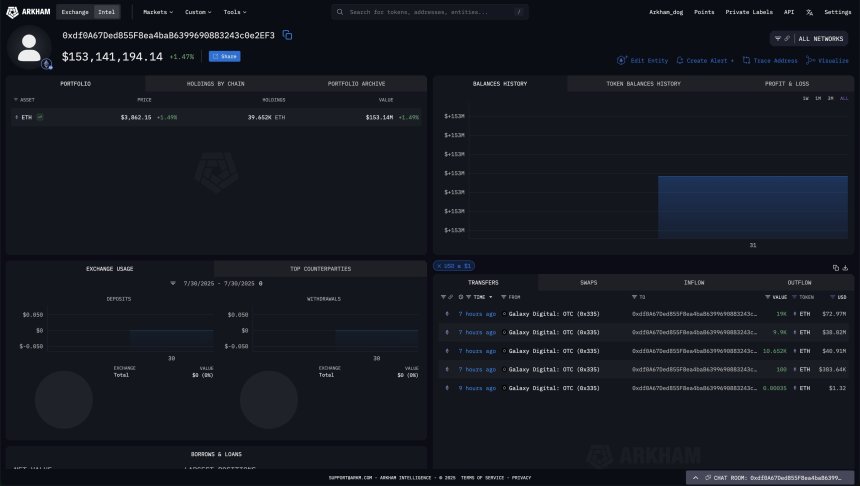

Ethereum’s bullish narrative gained additional momentum this week after Arkham disclosed an enormous on-chain transaction involving a significant institutional participant. A contemporary pockets deal with—0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3—simply acquired $153 million value of ETH, bought instantly via Galaxy Digital’s over-the-counter (OTC) desk. The size and nature of this transaction recommend rising institutional conviction in Ethereum’s long-term potential.

This isn’t simply one other whale transfer. The truth that the ETH was funneled into a brand new pockets from a regulated OTC supplier underscores the strategic accumulation happening behind the scenes. As conventional finance more and more integrates with crypto, Ethereum’s utility, programmability, and future position in tokenized finance are making it a high-conviction play amongst institutional allocators.

This heavy purchase comes after a chronic interval of weak spot. Earlier this yr, ETH suffered persistent promoting strain, with value motion sliding decrease for months. Retail curiosity light, and sentiment turned bearish. However whereas the general public panicked, subtle gamers seem to have taken the opposite aspect of the commerce—accumulating quietly through the downturn.

Associated Studying

ETH Consolidates Under Resistance

Ethereum (ETH) continues to commerce in a good vary slightly below the important thing resistance degree of $3,860.80, as proven within the 4-hour chart. Regardless of latest value volatility, ETH has remained above its 50- and 100-period shifting averages, at the moment close to $3,756 and $3,629, respectively. This implies that bullish momentum continues to be intact within the quick time period.

Quantity has picked up barely, indicating rising curiosity from merchants as ETH checks this important horizontal resistance. The worth has failed to shut decisively above this degree a number of instances since July 25, highlighting its significance. Nonetheless, the constant larger lows forming over the previous week level to constructing shopping for strain beneath the floor.

Associated Studying

A confirmed breakout above $3,860.80 might open the door for a push towards the psychological $4,000 degree and past. Conversely, failure to interrupt resistance might result in one other retest of the 100-period shifting common and even the $3,700 assist zone.

Featured picture from Dall-E, chart from TradingView