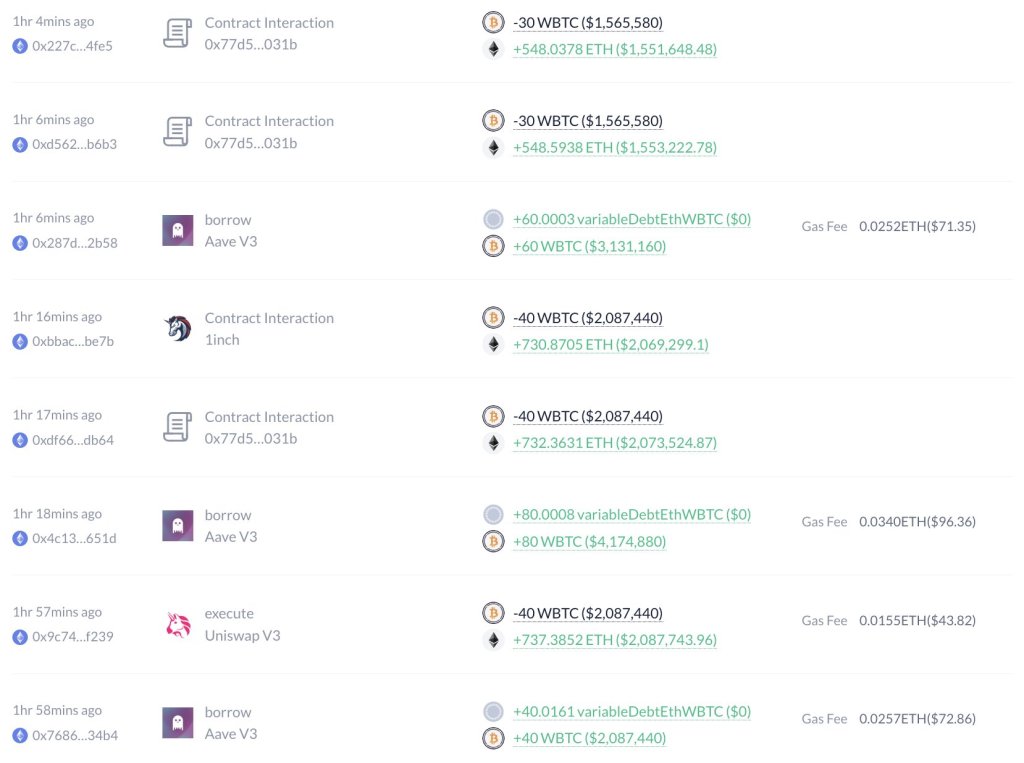

On-chain information exhibits that one whale is quickly accumulating Ethereum (ETH), promoting massive quantities of Wrapped Bitcoin (WBTC) by way of Aave, a preferred non-custodial protocol.

Whale Borrows WBTC From Aave, Buys ETH

As of February 16, Lookonchain data confirmed that the whale borrowed 280 Wrapped Bitcoin (WBTC), equal to roughly $14.6 million, Aave, one of many main DeFi protocols.

Associated Studying: How Much To Hack Bitcoin And Ethereum? New Study Reveals Price

Afterward, the whale bought 5,150 ETH. The whale is actively shopping for ETH, not from centralized exchanges however by way of decentralized protocols. This transfer exhibits the dealer expects ETH to outperform the digital gold within the session forward.

What may have triggered the whale to build up ETH and dump the resurgent Bitcoin shouldn’t be instantly clear. Nonetheless, what’s recognized is that since mid-January, Ethereum has been outperforming Bitcoin in worth and varied different metrics.

As an instance, ETH is up roughly 13% versus BTC within the final buying and selling month. Though ETH costs cooled off from January’s peaks, the uptrend stays. Trying on the improvement within the each day chart, BTC bulls clawed again losses versus ETH.

Nonetheless, they didn’t reverse losses posted in January fully. To this point, the rapid help is at 0.052 BTC, marking the present February lows. Even so, a pointy loss under this vital help would possibly strengthen BTC within the brief to medium time period.

Associated Studying: Bitcoin Contract Explosion: Frenetic Activity As $23 Billion Floods Major Exchanges

The broader crypto neighborhood stays bullish on Bitcoin, even with the crypto whale choosing ETH. From the each day chart, BTC is at round 2024 highs, the best in barely over two years. Specialists and analysts anticipate extra good points within the days forward. Supplied BTC stays above the psychological help at $50,000, the percentages of the world’s most dear coin floating to $70,000, or higher, stays excessive.

Billions Of {Dollars} Flowing To Bitcoin

Wall Road and retail traders are plowing billions of {dollars} into BTC following the approval of spot Bitcoin exchange-traded funds (ETFs) by the US Securities and Trade Fee (SEC). On the identical time, the overall investor and dealer sentiment is that Bitcoin will roar, contemplating the anticipated provide shock as soon as the community halves miner rewards in early April. Then, if the present demand stays, the ensuing imbalance may see BTC rally to 6 figures.

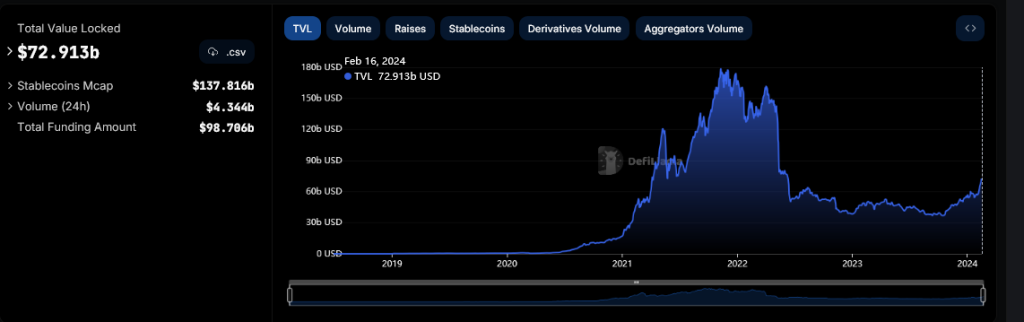

In the meantime, rising Bitcoin costs have propped up altcoins, with Ethereum rallying in greenback worth over the previous few weeks. Although the coin is capped under $3,000, supporters anticipate extra good points within the medium time period, citing enhancing defi, studying from the increasing complete worth locked (TVL) based on DeFiLlama data.

Characteristic picture from Canva, chart from TradingView