On-chain knowledge exhibits the Bitcoin change whale ratio has continued to say no lately, an indication that will show to be bullish for the crypto’s value.

Bitcoin Alternate Whale Ratio 72-Hour MA Has Been Going Down Just lately

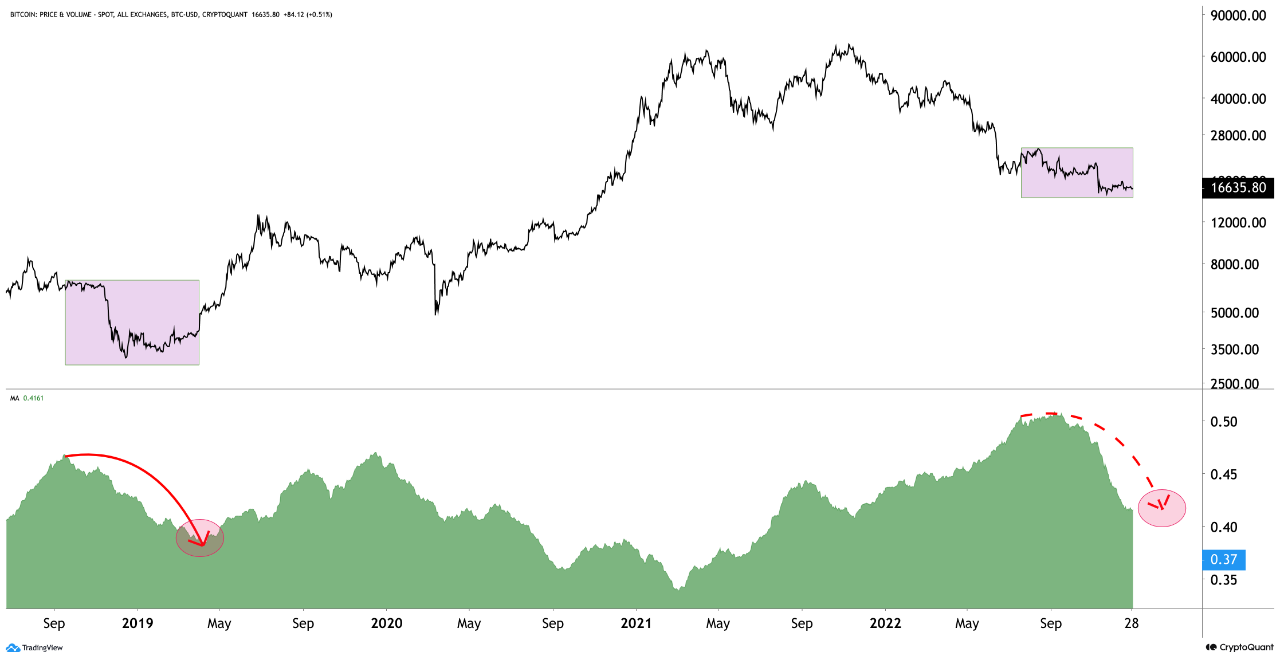

As identified by an analyst in a CryptoQuant post, the bitcoin change ratio on a 72-hour transferring common has been on a decline. The “change whale ratio” is an indicator that measures the ratio between the sum of the highest 10 Bitcoin transactions to exchanges and the whole exchange inflow.

For the reason that ten largest deposits to exchanges are often from the whales, this metric tells us what a part of the whole change inflows is being contributed by these humongous holders. Thus, when the worth of the indicator is excessive, it means whales are making up a excessive a part of the inflows proper now.

As one of many primary causes traders deposit to exchanges is for promoting functions, this type of development could be a signal of heavy dumping from this cohort, and will due to this fact be bearish for the worth of the crypto. Alternatively, low values of the ratio suggest whales aren’t making a disproportionate contribution to the inflows presently, which may very well be bullish for the worth of BTC.

Now, here’s a chart that exhibits the development within the 72-hour transferring common (MA) Bitcoin change whale ratio over the previous couple of years:

The 72-hour MA worth of the metric appears to have noticed some downtrend in current months | Supply: CryptoQuant

Because the above graph shows, the 72-hour MA Bitcoin change whale ratio was rising within the first half of the 12 months, exhibiting that whales had been more and more dumping the coin as the worth plummeted. By Q3 2022, nonetheless, the metric noticed a slowdown, and in the previous couple of months of the 12 months, the development had reversed and the indicator began a downtrend.

This suggests that whales have been dropping their promoting stress lately. Apparently, an identical sample was additionally seen within the interval between late 2018 and early 2019, as could be seen from the chart. In that cycle’s bear market, this development within the whale ratio coincided with the worth bottoming out.

As soon as the whale ratio had completed its decline in that bear market, Bitcoin lastly started to see some upwards momentum. If the identical development follows this time as properly, then the present downtrend of the whale ratio may additionally result in some bullish reduction for BTC traders.

BTC Value

On the time of writing, Bitcoin’s value floats round $16,700, down 1% within the final week.

Appears like the worth of the crypto has gone up throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from Dylan Leagh on Unsplash.com, charts from TradingView.com, CryptoQuant.com