Ethereum confirmed contemporary shopping for strain this week after stories {that a} main Bitcoin whale dramatically elevated its Ether holdings, a transfer market watchers say might reshape short-term flows.

Associated Studying

Main Whale Strikes Into Ether

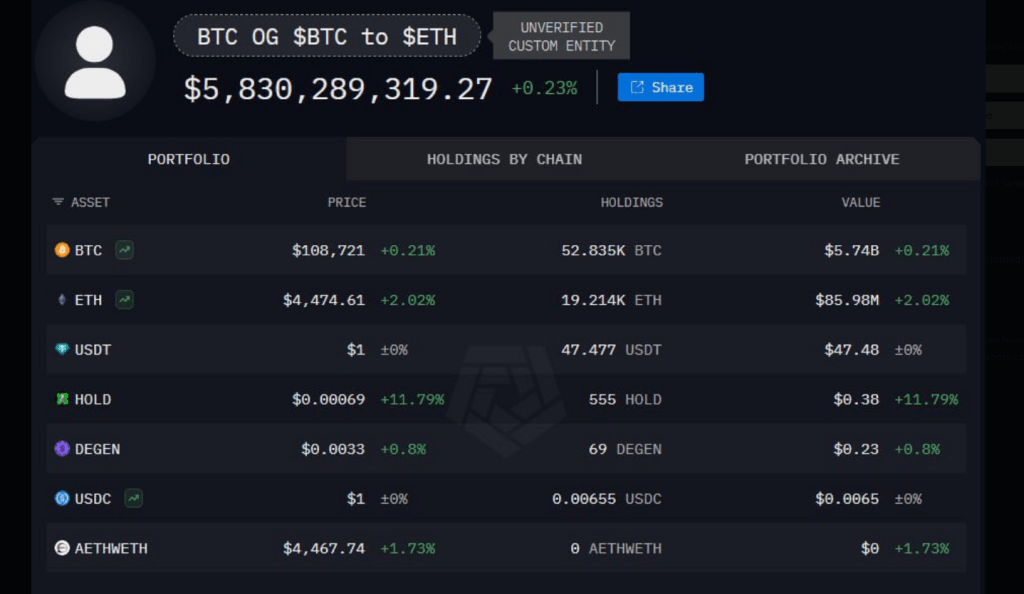

In response to stories, one of many earliest and most influential Bitcoin whales purchased roughly 820,220 ETH over the course of two weeks, a haul valued at about $3.6 billion at present costs.

The purchases had been logged throughout a number of addresses and have drawn consideration as a result of they characterize a big switch of capital into Ether somewhat than Bitcoin.

Merchants say such concentrated accumulation can carry sentiment and draw different massive holders into the market.

Ethereum’s newest buying and selling efficiency has mirrored the massive transfer. On the time of reporting, ETH traded round $4,390, with a 24-hour buying and selling quantity of $39 billion and a market cap close to $538 billion.

🐳 THIS OG BITCOIN WHALE HAS BOUGHT 820,224 ETH WORTH $3.6 BILLION IN JUST 2 WEEKS.

HE DEFINITELY KNOWS SOMETHING 👀 pic.twitter.com/iG9Su2BGZE

— Ash Crypto (@Ashcryptoreal) August 31, 2025

The token was up 2% over the day prior to this. These uncooked numbers underline that demand for Ether stays excessive whilst some elements of the market pull again.

Derivatives exercise tells a extra combined story. Reported information exhibits derivatives quantity fell 14% to $61 billion, whereas open curiosity climbed 2.90% to $60 billion.

The OI Weighted metric declined -0.0007%, a small drop that signifies a minimal discount in positioning energy. In response to these actions, sellers remark that the market could also be consolidating: much less new trades however extra positions held.

Ether Worth Forecast And Sentiment

Mixing technicals with on-chain information, present forecasts level to average upside. Based mostly on the most recent prediction, Ether is expected to rise 11% and attain $4,870 by October 1, 2025.

Market sentiment is listed as Bullish whereas the Concern & Greed Index reads 46 (Concern). Over the past 30 days, ETH logged 47% inexperienced days and an 9% worth volatility studying. These indicators recommend a market that has room to run, however which nonetheless carries significant uncertainty.

$ETH has been holding up very well in comparison with BTC.

However there’s nonetheless an opportunity of $4K retest.

Simply check out big liquidity clusters and also you’ll perceive.

Simply preserve one factor in thoughts: I’m simply short-term bearish. pic.twitter.com/D9XIrxr5zq

— Ted (@TedPillows) August 31, 2025

Analysts have supplied a cautionary notice. In response to analyst Ted, ETH’s current outperformance versus Bitcoin might pause for a quick retest round $4,000 as liquidity clusters are swept and merchants reassess publicity.

He factors to order-book dynamics that always set off a pullback earlier than new upward strikes — a sample that has performed out in prior rallies.

Associated Studying

What Merchants Are Watching

Buyers and desks say they’re watching three issues: the circulation of enormous on-chain buys, whether or not derivatives open curiosity continues to rise, and whether or not worth holds above key assist close to $4,000.

Studies of whale accumulation have sparked discuss of rising institutional curiosity, however the drop in spot derivatives quantity exhibits some short-term individuals stepping again to attend.

Featured picture from Meta, chart from TradingView