In latest occasions, the cryptocurrency trade confronted turmoil following false data from Cointelegraph about approving a spot Bitcoin ETF. The wrong information promptly fueled a major, albeit non permanent, enhance in Bitcoin’s price, reaching $30,000. Nevertheless, actuality struck when BlackRock, a world funding administration large, negated the ETF affirmation, inflicting Bitcoin to retract to $28,000.

The aftermath was notably harsh for buyers who acted on Concern of Lacking Out (FOMO). They rushed to buy Bitcoin throughout its temporary surge, solely to come across substantial monetary losses as soon as the reality surfaced. Such speedy fluctuations underscore the crypto market’s volatility and sensitivity to actual and fabricated information.

Whale’s FOMO Transfer Results in Loss

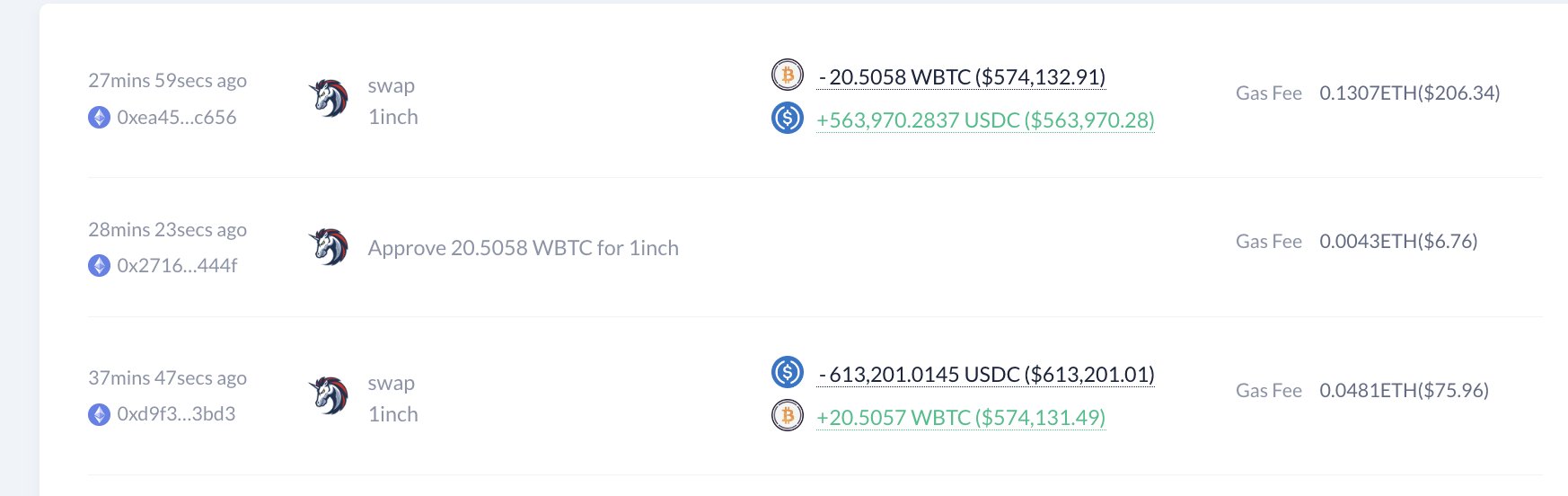

Including to the market’s tumultuous state of affairs, knowledge analytics agency Look On-Chain reported a notable incident involving a whale. This particular person, pushed by the pretend ETF information, bought 20.5 wrapped Bitcoin (WBTC) from sheer FOMO. When the whale realized the misinformation, a hasty sell-off ensued.

This choice resulted in a lack of $49,000 inside a mere 10-minute window. The whale initially expended 613,201 USDC (a stablecoin pegged to the US greenback) for the WBTC and offered the belongings for less than 563,970 USDC.

Grayscale Bitcoin ETF Good points Court docket Help

In the meantime, the SEC has not opposed a latest courtroom choice favoring Grayscale Investments relating to its spot Bitcoin ETF proposal. In August, the District of Columbia Court docket of Appeals ruling in opposition to the SEC’s earlier disapproval of the ETF. The courtroom’s choice marked a major flip in a saga that has captivated trade contributors for over a decade.

This improvement adopted the courtroom’s conclusion that the SEC’s preliminary rejection was unfounded. Consequently, the crypto group’s longstanding aspiration to introduce a Bitcoin ETF may see the sunshine, put up authorized challenges and intensive scrutiny.

Learn Additionally: Upbit Follows Ripple With Major License Approval In Singapore

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: