Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) enters the third quarter (Q3) of 2025, bullish sentiment is rising, fueled by historic post-halving patterns which have repeatedly marked the start of explosive market moves. A crypto analyst now factors to recurring developments noticed in previous cycles, the place Q3 has typically acted as a launchpad for vital value rallies in BTC following every halving yr.

Bitcoin Publish-Halving Years Level To Explosive Q3

Luca, a crypto market knowledgeable on X (previously Twitter), has doubled down on expectations for a significant Bitcoin value rally within the coming quarter. He argues that expectations of an prolonged consolidation in Bitcoin, based mostly on the fractals and market conduct seen in 2023 and early 2024, fail to account for a vital issue: 2025 is a post-halving year.

Associated Studying

The analyst points to a constant sample noticed in each post-halving yr all through Bitcoin’s history. In his chart evaluation printed on June 26, Luca notes that Q3 in these years have constantly demonstrated energy, with no historic precedent for weak spot, reinforcing the case for a bullish breakout.

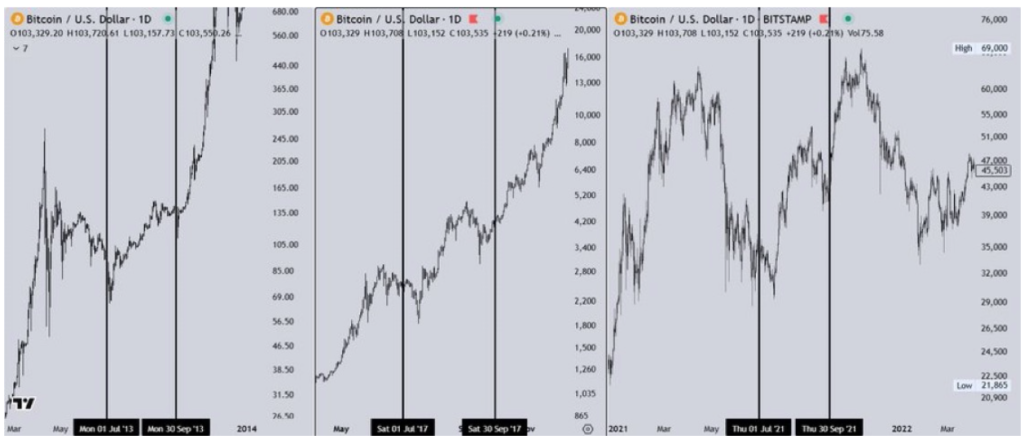

The chart compares Q3 efficiency through the post-halving years of 2013, 2017, and 2021. In every case, Bitcoin entered the third quarter with average or corrective value motion, solely to rally considerably within the weeks that adopted.

The left panel of the chart reveals the 2013 post-halving yr, the place Bitcoin went from below $100 in July to over $680 in November. In 2017, the center panel highlighted the same trajectory, the place BTC broke out from below $2,800 in early Q3 to over $16,000 by year-end.

The latest cycle in 2021, proven in the fitting panel of the chart, noticed a Q3 restoration rally that took Bitcoin from below $39,000 in July to a former all-time high above $69,000 in November.

Notably, Luca maintains that this constant historic conduct is just not coincidental, predicting {that a} related rally may unfold within the present cycle, inside the subsequent few months. Whereas he acknowledges the possibility of a short-term pullback, he emphasizes that Bitcoin’s broader market construction stays firmly bullish, with momentum nonetheless favoring additional upside.

Analyst Predicts $140,000 – $160,000 Bitcoin Cycle High

Shifting ahead, Luca’s chart reveals technical components that align along with his bullish thesis. Based mostly on key Fibonacci Extension ranges, the analyst projects that BTC’s next cycle top falls between $140,000 and $160,000, a goal he believes could possibly be attained towards the tip of Q3.

Associated Studying

Whereas acknowledging that the precise goal may shift relying on how technical confluences evolve, the expectation stays {that a} Bitcoin rally is imminent. With BTC now buying and selling round $107,423 after rebounding from a earlier dip below $100,000, a possible transfer to $140,000 and even $160,000 would mark a considerable acquire of roughly 30.35% and 48.97%, respectively.

Featured picture from Unsplash, chart from TradingView