The latest turmoil within the cryptocurrency market, notably the numerous dip within the Bitcoin value, has stirred a wave of hypothesis and dialogue amongst traders and analysts alike. Nonetheless, amid the chaos, there are indicators of a possible restoration for Bitcoin, hinting at a renewed optimism within the digital asset realm.

So, let’s take a fast tour of the elements influencing Bitcoin’s resurgence and what the long run would possibly maintain for this main cryptocurrency.

Bitcoin Value Recovers After Current Crash

The latest dip in Bitcoin’s value has left many traders apprehensive, however there’s a glimmer of hope on the horizon. Notably, a number of analysts have attributed this newfound optimism to the approaching Bitcoin Halving occasion, scheduled for later this month.

In the meantime, such occasions have catalyzed vital value rallies for Bitcoin prior to now, prompting anticipation of an analogous final result this time round. Nonetheless, the market specialists have additionally cautioned over potential corrections and volatility forward of the Bitcoin Halving occasion.

For example, outstanding crypto market analyst Ali Martinez sees the pre-halving correction as a bullish indicator, suggesting potential for a considerable upward trajectory. He has just lately mentioned that even a 30% Bitcoin price correction could be a bullish indicator.

As well as, the value correction additionally offers a shopping for alternative for the traders, and an analogous scenario was additionally famous just lately. Regardless of the latest market turbulence, there’s proof to recommend that institutional traders stay undeterred.

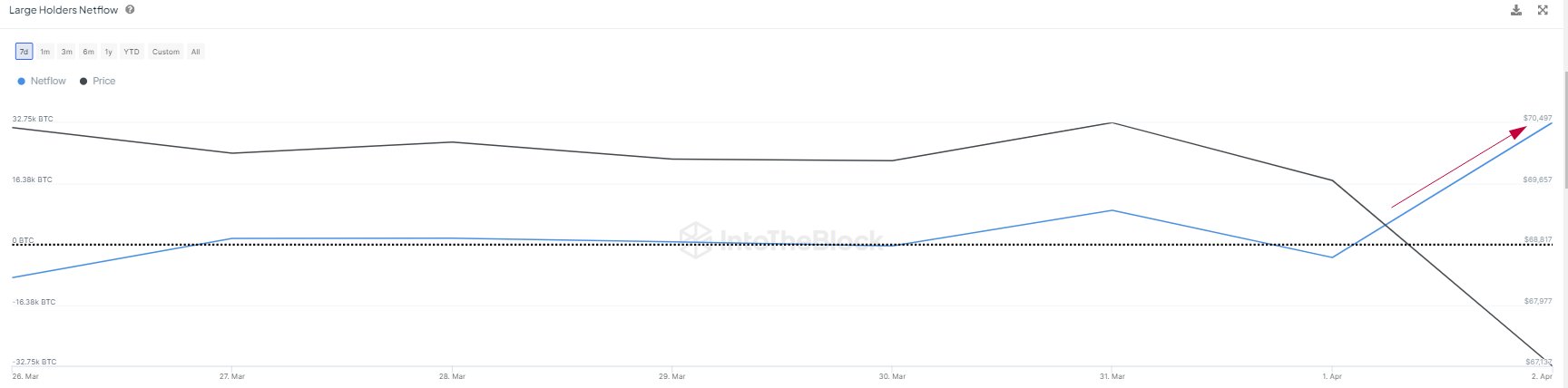

For context, whale exercise has surged in response to the BTC value dip, with vital acquisitions noticed. This development, highlighted by analytics agency IntoTheBlock, underscores rising confidence amongst large-scale traders in Bitcoin’s long-term prospects.

In the meantime, the attract of shopping for alternatives amid market downturns has traditionally attracted savvy traders, reinforcing the narrative of resilience throughout the crypto house. Nonetheless, based on IntoTheBlock, vital Bitcoin holders are capitalizing in the marketplace dip, buying roughly 33,000 BTC, valued at over $2 billion, amid the declining value.

Additionally Learn: Ethena (ENA) Price Surges 53% After Airdrop, More Steam Left?

Anticipated Highs and Wholesome Corrections

Trying forward, market specialists are cautiously optimistic about Bitcoin’s trajectory post-halving. Whereas expectations of latest value highs run excessive, analysts additionally anticipate intermittent corrections alongside the way in which.

In the meantime, these smaller pullbacks, considered as wholesome changes, are thought-about integral to BTC’s total stability and long-term progress prospects. As such, traders are suggested to brace for potential volatility within the brief time period whereas sustaining a give attention to the broader traits shaping Bitcoin’s journey.

It’s value noting that the latest turmoil within the cryptocurrency market, notably the dip within the BTC value, has spurred discussions in regards to the future trajectory of the main digital asset. Nonetheless, regardless of the challenges, optimism persists, pushed by elements akin to the approaching Bitcoin Halving and sustained institutional curiosity. Whereas volatility could persist within the brief time period, the underlying sentiment factors in direction of resilience and potential progress for Bitcoin in the long term.

As of writing, the Bitcoin price was up 0.63% from yesterday and traded at $66,521.32, whereas its buying and selling quantity soared 5.17% to $44.38 billion. During the last 24 hours, the Bitcoin value has famous a excessive of $66,664.09 and a low of $64,559.90.

Additionally Learn: DOGE Whales Move Over 580 Mln Coins, Will Dogecoin Recover?

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: