Bitcoin bears have gained management over the previous few weeks, a minimum of within the brief time period, and the battle appears to be on. After Bitcoin failed once more on the $30,000 degree on Sunday as a part of a “weekend pump,” the bears are pushing in the direction of $27,000.

As of press time, Bitcoin was hovering round $28,000, having already examined key help at $27,800 yesterday night (EST). The long-term development continues to be clearly in favor of the Bitcoin bulls, for which a worth above $25,000 speaks. Nevertheless, within the brief time period, the bottom line is to defend the $27,800 degree to keep away from a deeper correction to $25,000, as additionally indicated by analyst XO.

$BTC pic.twitter.com/OKS791fYEi

— XO (@Trader_XO) May 1, 2023

Bitcoin Stays In Buying and selling Vary

For technical analyst Michaël van de Poppe, founding father of Eight International, breaking by way of $28,400 on the shorter time-frame is the trend-setting worth degree. “Breaking by way of $28.4K and we might be again to $30K in a number of days. Not breaking and folding coming days, $25K subsequent. Massive volatility on the horizon,” the analyst warns.

Nevertheless, the present weak point that Bitcoin is displaying with hovering round $28,000 might be a sign that one other sweep of the lows is required to generate new upside momentum. “Nonetheless eyeing $27.8K for a possible lengthy right here, or a break and flip of $28.4 for Bitcoin,” van de Poppe notes.

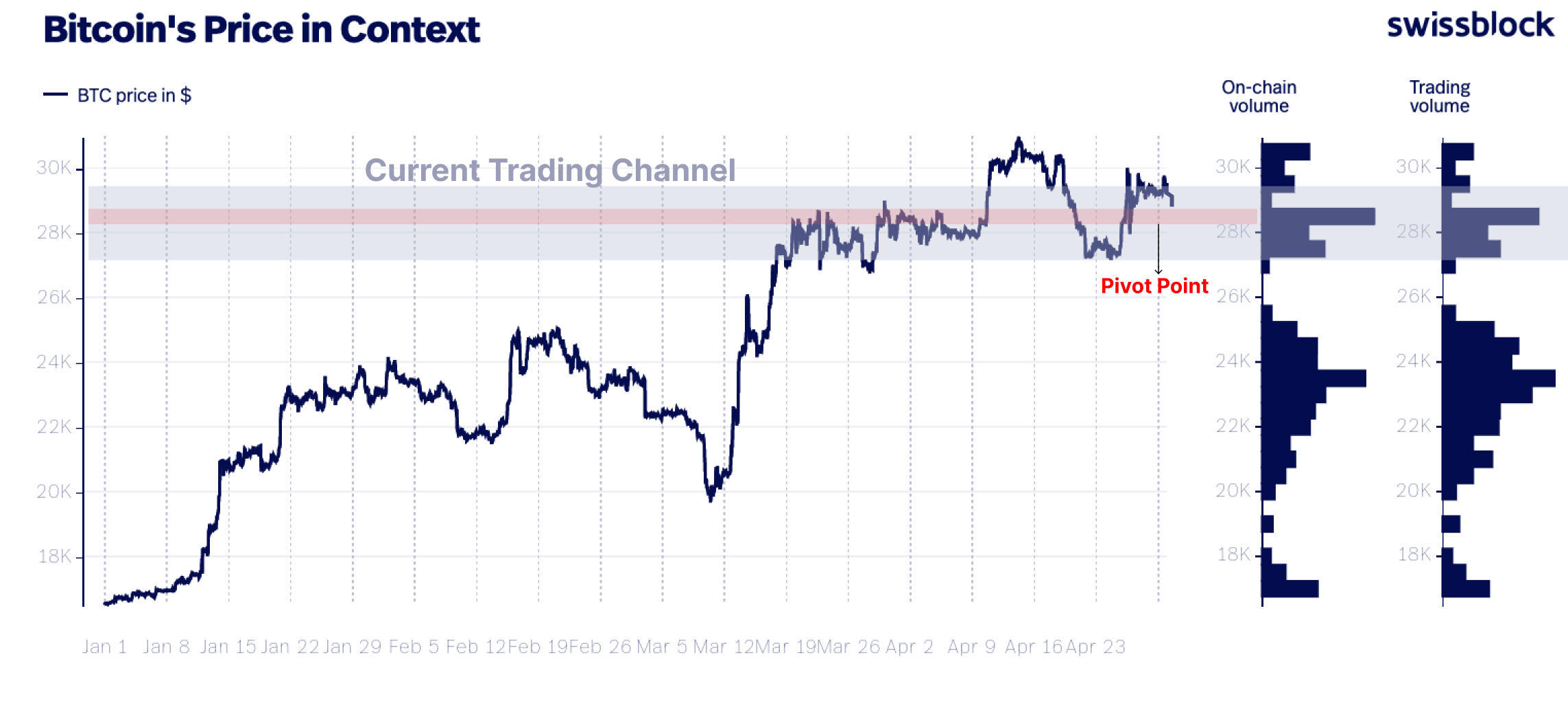

Glassnode co-founders Yann Allemann and Jan Happel write of their newest evaluation that Bitcoin’s April month-to-month shut was a significant signal for the bulls. BTC closed in inexperienced for the fourth consecutive month. In accordance with the analysts, the short-term buying and selling channel is between $27,000 – $29,200.

[B]ut we’re assured that we’ll be over $30k very quickly. Our thesis solidifies the longer we’re above the extremely energetic $28 – $28.2k degree. Discover the massive horizontal bar.

All Eyes On The Fed

Key to the worth motion within the coming weeks would be the FOMC assembly tomorrow, Wednesday, and the next press convention by Fed Chairman Jerome Powell. The market expects a closing hike of 25 foundation factors. This may put the U.S. benchmark rate of interest on the identical degree as earlier than the monetary disaster in 2007.

Nevertheless, the choice is prone to be priced in already. Extra essential would be the FOMC press convention at 2:30 pm EST, when Powell will give his remarks for the approaching months.

The market might be hoping for a remark from Powell that this was the final fee hike and that the primary fee cuts will come later this yr (not possible). The main target will even be on Powell’s feedback on the banking disaster and the way the credit score crunch is intensifying.

Probably, Powell will play either side, as he did on the March FOMC assembly. Feedback equivalent to “inflation just isn’t fairly the place we wish it to be,” “monitoring developments within the banking sector,” and “information dependence” are just about assured. On the bullish facet, Powell might sign a pause in June and go away a door open for fee hikes if information grants it.

Lol … unstable day coming tomorrow, and maybe a decisive development setter for the approaching weeks. The beginning of a brand new #Bitcoin rally? https://t.co/Dd8FWOjsDa

— Jake Simmons (@realJakeSimmons) May 2, 2023

On the time of writing, Bitcoin was buying and selling at $28,100, under the mid-range after rejecting on the vary excessive once more. Till the FOMC determination, it appears somewhat unlikely that BTC will make a significant transfer until there’s one other brief or lengthy squeeze as a result of insanity within the futures market. A recapture of the higher vary could be a bullish signal going into the FOMC.

Featured picture from iStock, chart from TradingView,com