A brand new report from Glassnode has revealed a traditionally vital Ethereum degree that might mark the beginning of an overheated section if breached.

Ethereum Is Shifting In direction of Lively Realized Value

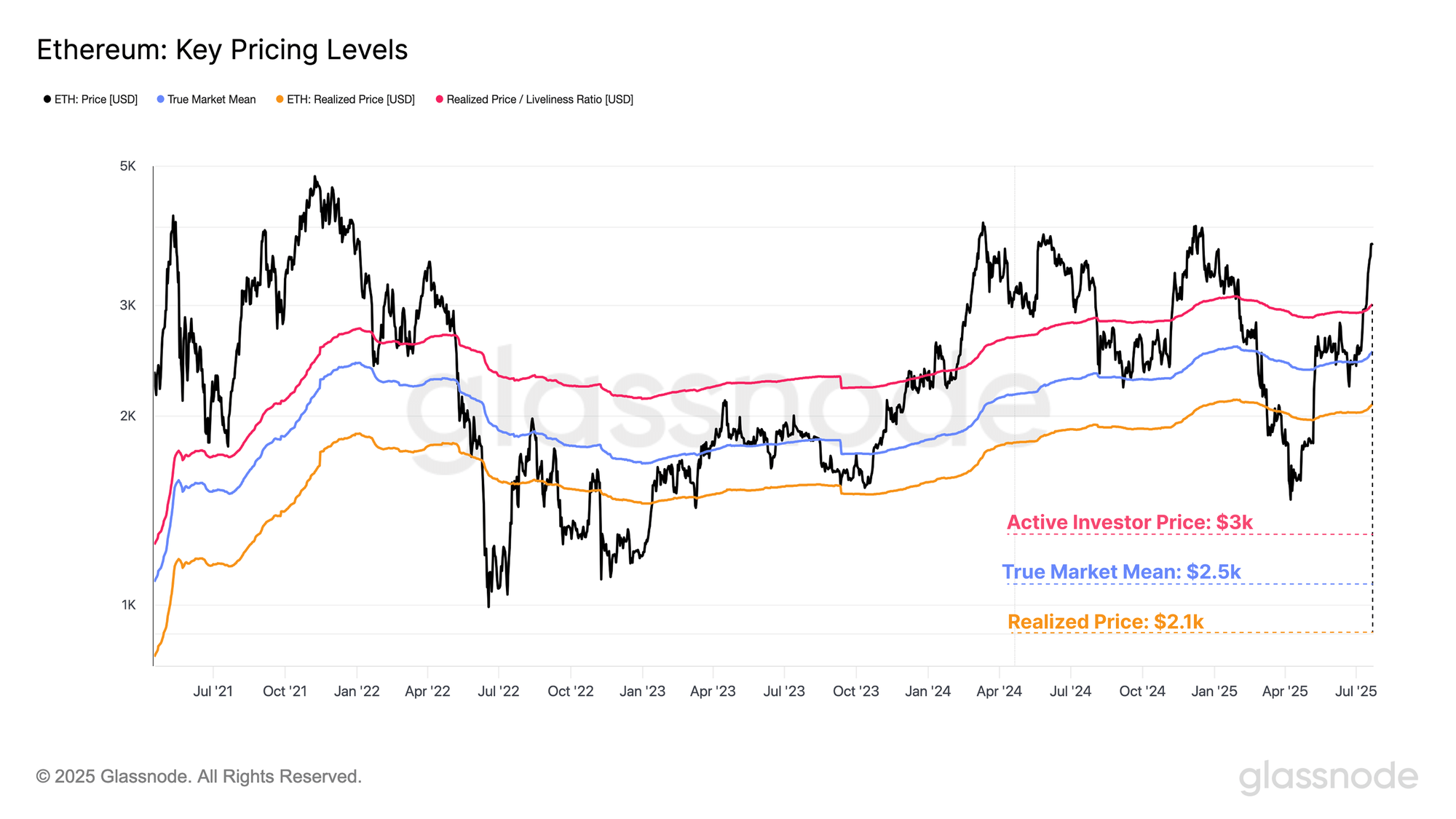

In its newest weekly report, the on-chain analytics agency Glassnode has talked about some valuation fashions for Ethereum. The fashions in query are the Realized Value, True Market Imply, and Lively Realized Value.

Associated Studying

The primary of those, the Realized Price, refers back to the common value foundation or acquisition worth of all tokens of the cryptocurrency which can be at present a part of the circulating provide.

The opposite two fashions, the True Market Imply and Lively Realized Value, additionally goal to seek out the community value foundation, however each of those exclude for the long-dormant cash. Such tokens are more likely to be misplaced on account of lacking wallets keys, in order that they aren’t a part of the financial provide. Thus, these fashions might present for a extra correct measure of the market state of affairs than the Realized Value.

Now, here’s a chart that reveals the pattern within the three on-chain pricing fashions for Ethereum over the previous few years:

As displayed within the above graph, the Ethereum Realized Value, True Market Imply, and Lively Investor Value are located round $2,100, $2,500, and $3,000, respectively. Which means at ETH’s present spot worth, all fashions agree that the holders as an entire are within the inexperienced.

However now that the asset has escaped above these strains, what could possibly be subsequent? “As a way to gauge upside targets for this ETH rally, we are able to flip to the +1 customary deviation band of Ethereum’s Lively Realized Value,” notes Glassnode.

The +1 customary deviation (SD) band of the indicator occurs to be the place promoting stress has intensified up to now. The rationale behind the pattern might lie in the truth that investor earnings change into vital past this boundary, so mass selloffs with the aim of profit-taking can change into extra more likely to happen.

Under is a chart that reveals the place this degree at present lies for ETH.

From the graph, it’s seen that the Ethereum Lively Realized Value +1 SD is positioned at $4,500 in the present day. ETH is at present nonetheless at a distance from the extent, but when its current bullish push continues, it’d find yourself retesting it.

Within the present cycle thus far, ETH has examined the boundary as soon as, in March 2024. Again then, the cryptocurrency discovered rejection at it. Within the 2021 bull run, the coin was in a position to surge previous it, however in doing so, it kicked off the unsustainable euphoria market section.

Associated Studying

“As such, $4,500 could be recognized as a crucial degree to look at on the upside, particularly if Ethereum’s uptrend continues and speculative froth builds additional,” explains the analytics agency.

ETH Value

On the time of writing, Ethereum is floating round $3,600, up virtually 7% within the final seven days.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com