A current research by Swan, a Bitcoin monetary companies firm, has revealed that almost all different cryptocurrencies (altcoins) expertise fast and systemic depreciation when measured in opposition to Bitcoin (BTC).

The findings spotlight Bitcoin’s function as a extra steady asset for capital preservation within the fluctuating cryptocurrency market.

Bitcoin vs. Altcoins: Which is Higher?

Swan shared its insights in an in depth thread on X (previously Twitter).

“Altcoins don’t simply underperform Bitcoin. They collapse in opposition to it,” the put up learn.

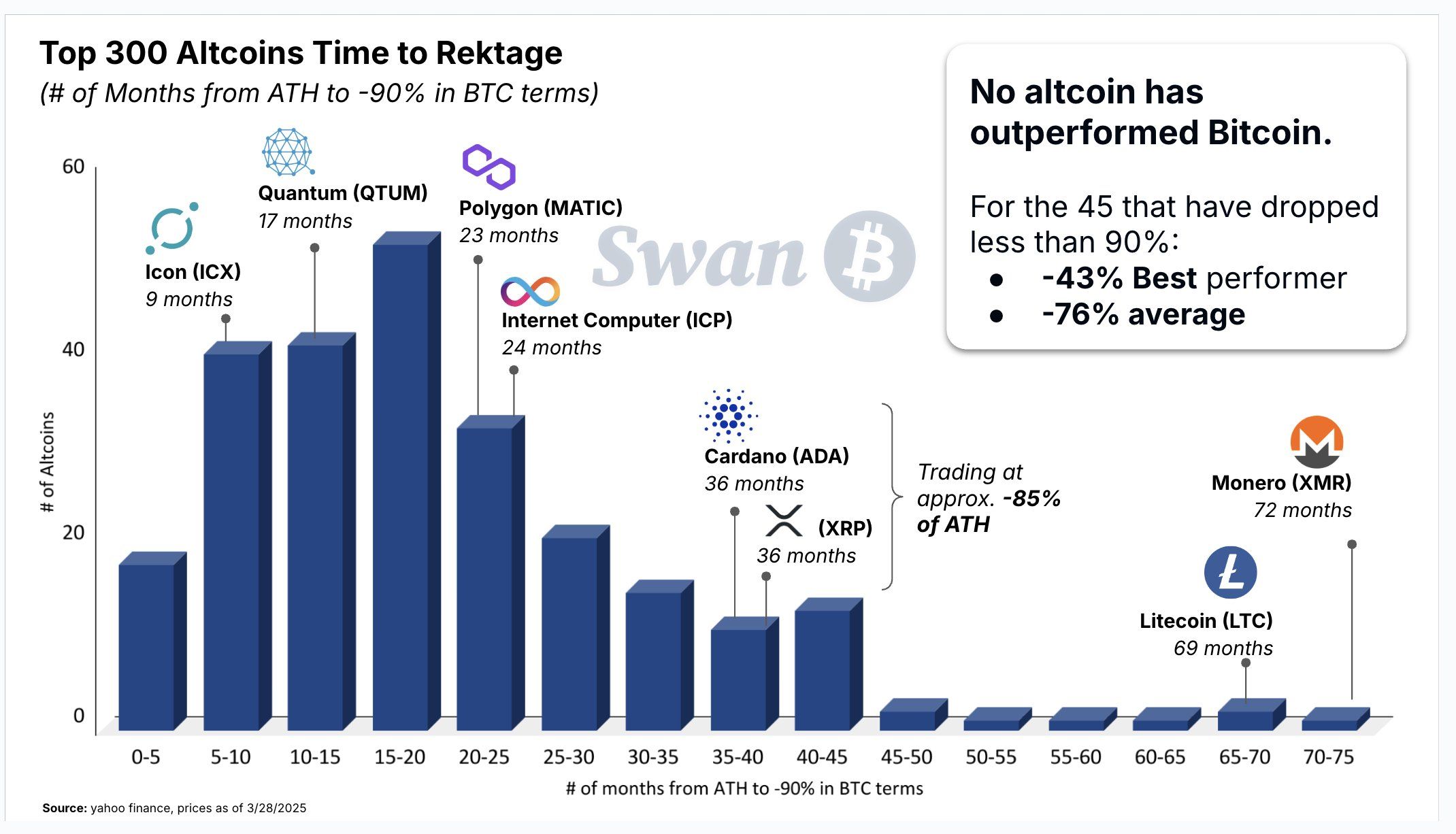

The evaluation examined the efficiency of the highest 300 altcoins over 5 years. It centered on the time it takes for these property to lose 90% of their value relative to Bitcoin after reaching their all-time highs (ATH).

“The median altcoin reached a -90% drawdown in simply 10–20 months,” Swan revealed.

Furthermore, in response to Swan’s knowledge, Terra (LUNA1), Ontology Gas (ONG), and Bitgert (BRISE) collapsed the quickest, hitting the 90% drawdown mark in underneath two months. Bigger, extra established altcoins weren’t proof against this development.

As an example, Cardano (ADA) and XRP (XRP) took 36 months to depreciate 90% from their report peak. In the meantime, Litecoin (LTC) skilled a gradual decline, taking 69 months. Monero (XMR) noticed the slowest drop, taking six years to achieve a -90% drop.

Swan’s evaluation extends to 45 altcoins that haven’t but skilled the 90% decline. Whereas they haven’t but “collapsed,” the info suggests they are merely delaying their inevitable losses.

The typical drawdown for these altcoins is 76% from their peak worth. Even the best-performing altcoin amongst them remains to be down by 43% in comparison with BTC.

“Bitcoin stays the benchmark for capital preservation. These property don’t hedge Bitcoin — they bleed in opposition to it,” Swan added.

The findings level to a systemic situation inside the altcoin area. The information means that altcoins, often marketed as alternatives to Bitcoin, fail to ship sustained worth over time in comparison with the main cryptocurrency.

Swan additionally burdened that long-term outperformance by altcoins is exceptionally uncommon. Moreover, the agency believes survivorship bias — the tendency to concentrate on profitable tasks — has hidden the widespread decay throughout the broader market.

“With efficiency like this, it’s astonishing that altcoins live on. Then once more, people love playing,” Swan government John Haar remarked.

Why Altcoin Season Would possibly By no means Return?

The growing saturation in the altcoin market adds to the issues. In response to CoinMarketCap (CMC) data, over 1.8 million tokens have been created in simply the previous month.

Nonetheless, the overwhelming majority of those tokens fail to ship. BeInCrypto recently reported that 89% of tokens listed on Binance in 2025 are within the purple. Thus, newer altcoins’ worth is pushed extra by short-term buying and selling and hype relatively than any lasting fundamentals.

As well as, this surge within the variety of tokens has fragmented market liquidity. These elements have even delayed the long-anticipated “altcoin season.” But, some analysts even argue that the normal altcoin season may never return.

This shift is basically as a consequence of Bitcoin’s rising dominance out there, bolstered by institutional adoption and rising regulatory consideration. Whereas Bitcoin solidifies its place because the dominant digital asset, the identical can’t be stated for altcoins, which battle to keep up relevance and investor curiosity in the face of Bitcoin’s continued rise.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.