After a tough couple of months, this week began with a powerful upward motion from Bitcoin because the coin broke out above the $45,000 stage on Monday to $48,215 earlier than fluctuation, thus erasing yearly losses and anticipating a $50,000 goal.

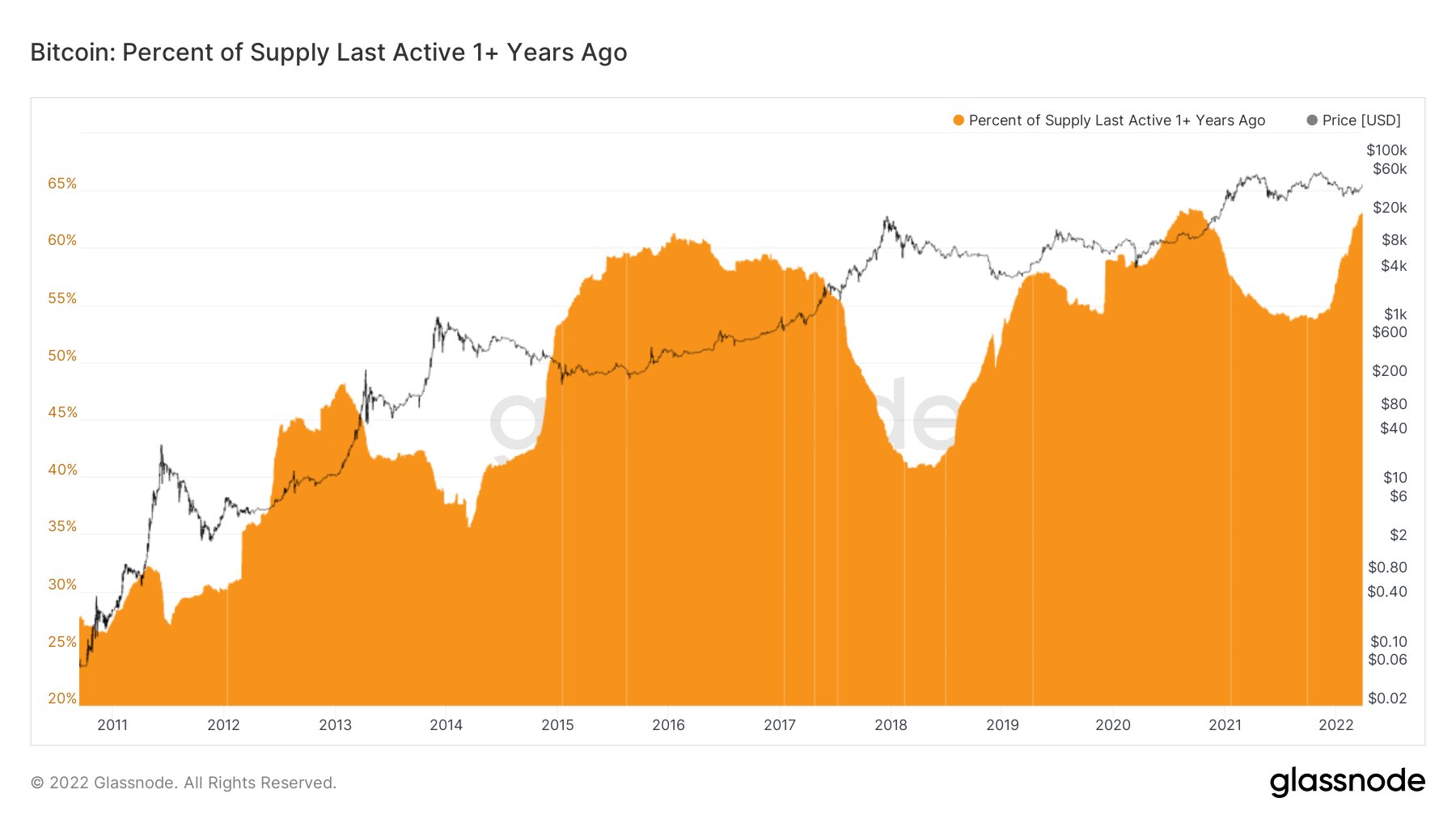

Regardless of the decline over the yr, a considerable amount of the coin was by no means offered. A state of affairs that reveals how holders strongly consider within the long-term recreation and stay surprisingly calm over a interval of turmoil.

Constructing Up To A Rally

Senior Analyst Dylan LeClair noted that, as Bitcoin is buying and selling at round $48,000, “there has solely been one different time that the proportion of provide that hadn’t moved in over a yr was at this stage,” which was throughout September 2020.

On the talked about date Bitcoin recovered from the dramatic crash of march 2020. The robust bounceback noticed a 185% hike within the costs, taking to coin to over $10,000. A excessive variety of dedicated ‘hodlers’ had additionally stored their BTC dormant regardless of the intense swings in costs in the course of the yr.

This was adopted by a efficiency that catapulted Bitcoin’s popularity amongst buyers as “digital gold”. It closed the yr buying and selling at document highs of near $30,000, outperforming gold with a rise of 416% over the yr.

Brett Munster at Blockforce Capital had additionally noted final week a near-record highs proportion of the whole Bitcoin provide that hasn’t moved in over a yr, additional mentioning that it’s rising at a a lot quicker tempo than the final time Bitcoin was at these ranges.

“I anticipate this quantity to set new all-time highs in coming weeks and months as a result of it’s precisely this cohort that stepped in and aggressively purchased in April and Could of final yr when Bitcoin’s value fell.”

Associated Studying | Bitcoin Likely To Continue Upward Trajectory, Is $50K Its Next Target?

Bitcoin Derivatives Paint A New Image

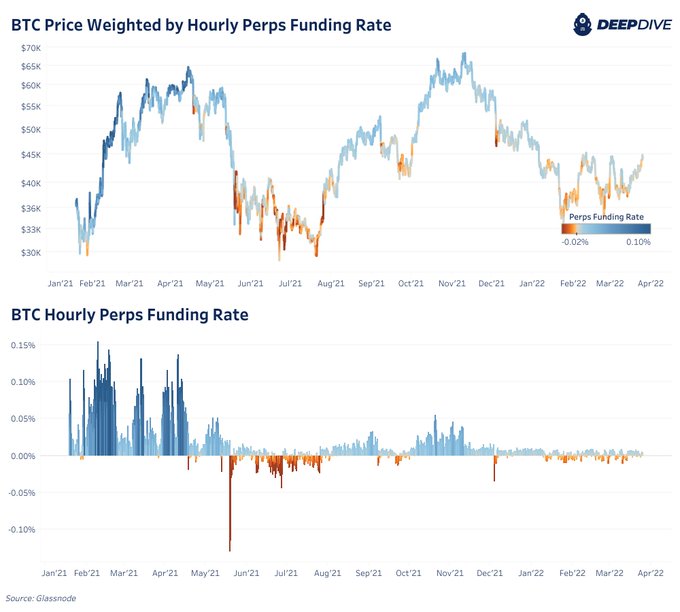

Moreover, Dylan LeClair additionally famous that BTC derivatives “are nonetheless considerably defensive & nowhere close to as risk-on as 2021 regardless of similar value ranges.”

Illustrated by the next chart, the analyst confirmed the motion of BTC derivatives all through 2021 “when the value was buying and selling at this present stage.”

Word that funding charges “signify merchants’ sentiments within the perpetual swaps market,” with optimistic funding charges (over 0) indicating that lengthy place merchants are dominant and destructive funding charges (below 0) indicating the other, CryptoQuant explains.

In comparison with earlier years, the BTC hourly perpetual funding charges are considerably nearer to zero. “Extreme long-biased by-product market hypothesis is close to non-existent presently,” says LeClair.

What the analyst is mentioning signifies that extreme hypothesis and leverage drove the market to those value ranges in 2021, and “now its mainly nowhere to be seen and bitcoin is rallying.” This might suggest that the value is now rising due to demand, not market hypothesis.

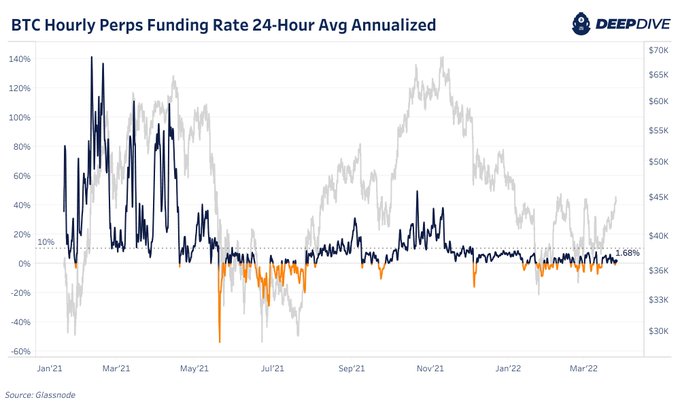

Equally, within the following chart, LeClair shows annualized perpetual future funding charges on a 24-hour Shifting Common, whereas including that “Merchants have been paying ~100% annualized to go lengthy BTC early in 2021. An identical however much less extreme speculative market arose within the fall. As we speak? Funding has been flat/destructive for many all of 2022.”

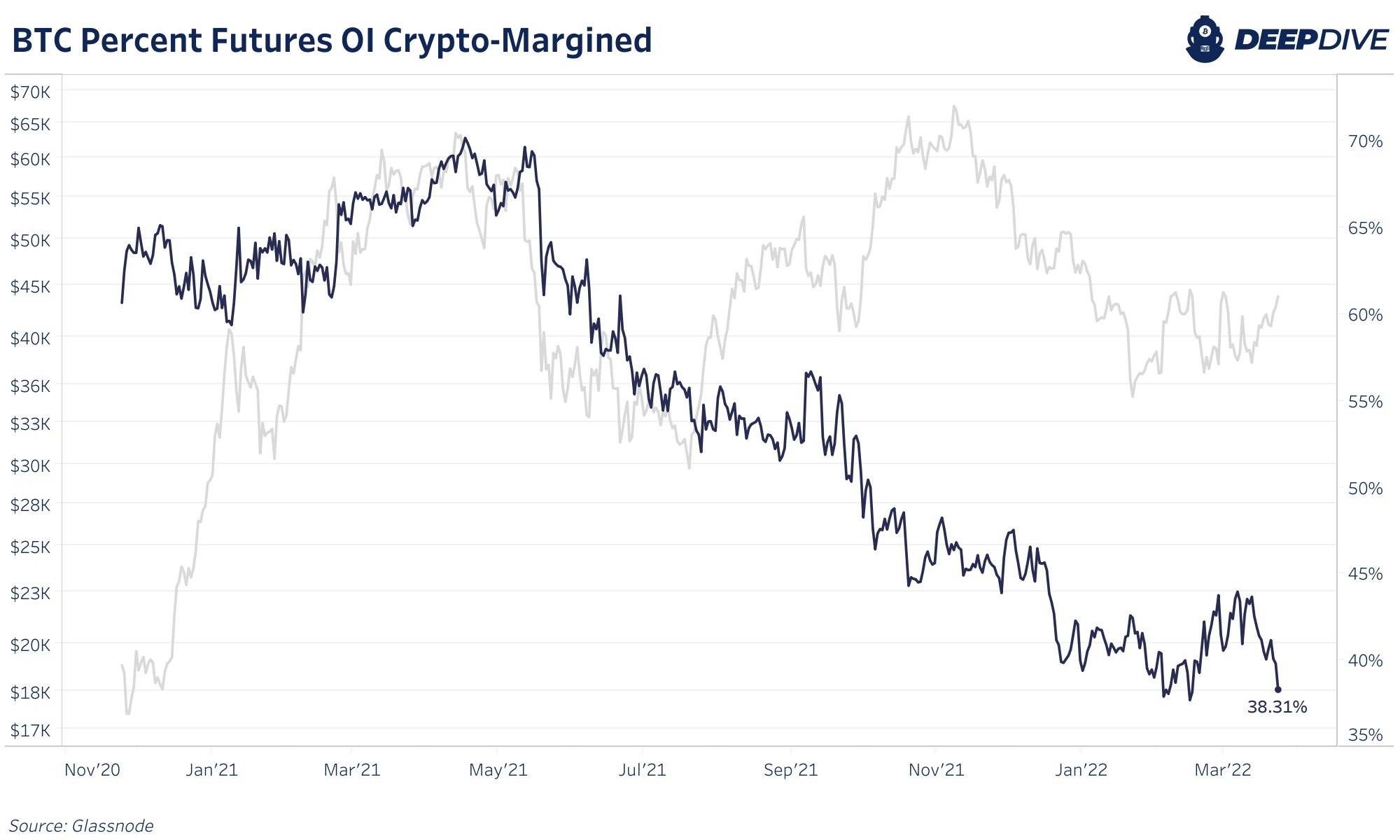

“Lastly, have a look at the collateral make-up of BTC by-product open curiosity,” LeClaire provides.

“In 2021 as much as 70% of OI was collateralized with BTC. Merchants have been paying outrageous charges to lengthy with BTC collateral, resulting in huge liquidations. Now a majority of OI is collateralized with stables.”

Associated Studying | TA: Bitcoin Saw Key Technical Breakout: Big Reaction From Bulls Imminent