Bitcoin value is formally in a bear market as it’s now down over 20% after falling for 3 consecutive days this week. Traders pulled cash out of the crypto market in anticipation of hawkish U.S. Federal Reserve retreat from three rate of interest cuts this 12 months.

Stagflation and sticky inflation considerations proceed to mount amid no indicators of slowing inflation and sluggish financial development. The current PCE information indicated persistent inflationary pressures and Q1 GDP development of 1.6% confirmed stagflation. Immediately’s Fed financial coverage determination and Chair Jerome Powell are essential for the inventory and crypto markets as buyers brace for market crash jitters.

Bitcoin Worth Falls Over 10% to $56K

BTC price fell over 10% in a day amid panic promoting by retail buyers after institutional buyers thought of rising dangers to keep away from danger belongings. Bitcoin presently altering fingers at $57,000. The 24-hour high and low are $56,555 and $62,121, respectively. Moreover, the buying and selling quantity has elevated by 70% within the final 24 hours.

Bitcoin is now down 22% from the all-time excessive of $73,803 in March, technically placing it in a bear market. However it’s nonetheless up 35% year-to-date and double the place it was this time final 12 months resulting from giant cash influx into spot Bitcoin exchange-traded funds (ETF) since January. As demand wanes from spot Bitcoin ETF and buyers didn’t see any elements for a restoration, they began reserving income, which triggered a broader crypto market selloff.

Macro Stress Mounts

The US greenback index (DXY) rose to round 106.4 on Wednesday, marching once more towards six-month highs as buyers brace for key financial coverage selections from the U.S. Federal Reserve. The Fed is anticipated to maintain rates of interest unchanged amid robust US financial information and sizzling inflation. Nonetheless, merchants are focusing extra on Fed Chair Jerome Powell’s steerage on fee cuts this 12 months.

The US 10-year Treasury yield (US10Y) additionally approached a 6-month excessive because it jumped additional to 4.67%. It rose additional after information confirmed US labor prices grew greater than anticipated resonating that the Fed must maintain rates of interest larger for longer.

Bitcoin value strikes in the wrong way to DXY and US 10-Yr Treasury yield.

“The current downtrend could be attributed to elevated profit-taking by buyers who entered the market through the downturns of 2022 and 2023, in addition to ETF buyers who witnessed important value appreciation on their shares after getting into the market within the early weeks of 2024,” mentioned Fineqia analysis analyst Matteo Greco to Reuters.

Additionally Learn: Binance Adds JTO, NFP, MANTA, & Others As Loanable Assets

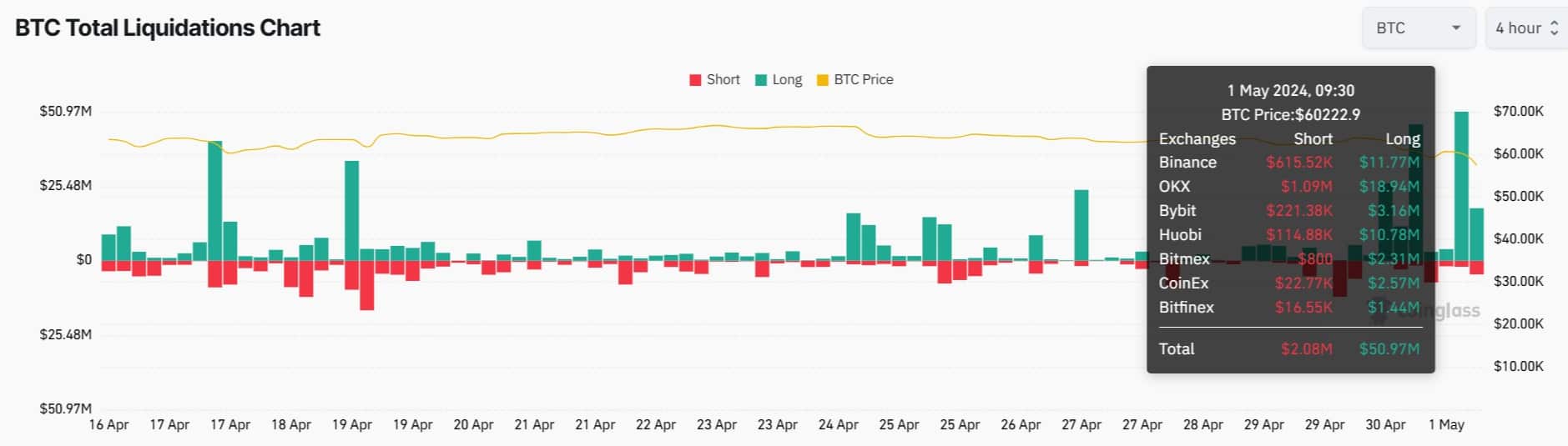

Over $500 Billion Crypto Liquidation

The crypto market cap tumbled from $2.34 trillion to $2.13 trillion, inflicting buyers to lose one other $210 billion after an enormous $250 billion liquidation in the previous few days.

Coinglass information reveals greater than $475 million have been liquidated throughout the crypto market within the selloff. Amongst them, $420 million lengthy positions have been liquidated and over $55 million quick positions have been liquidated.

Over 145K merchants have been liquidated and the most important single liquidation order occurred on crypto alternate OKX as somebody swapped ETH to USD valued at $6.07 million.

Analysts count on a significant rally in Bitcoin value to begin from beneath $50K and however whale accumulation may change the extent for the rally close to $54K, as per analyst Michael van de Poppe. The ultimate restoration available in the market may begin after Could 31 choices expiry.

Additionally Learn:

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: