The crypto market was a narrative of two distinct halves, one in every of which noticed the Bitcoin worth soar to a number of all-time highs. After reaching its all-time excessive of round $122,800, the premier cryptocurrency has succumbed to a sobering wave of bearish strain prior to now few days.

This current wave of downward strain was precipitated by the movement of a Satoshi-era whale on Thursday, July 17. Nonetheless, the Bitcoin worth by no means appeared more likely to cross the $123,000 stage, and a distinguished on-chain professional on X has defined why.

Is The Transfer To $143,000 Nonetheless Potential?

In a current submit on the social media platform X, Alphractal CEO & founder Joao Wedson explained why the value of BTC failed to interrupt the $123,000 stage throughout its rally to a brand new all-time excessive prior to now week. In response to the crypto professional, this seeming lack of momentum may spell hazard for the market chief within the brief time period.

Associated Studying

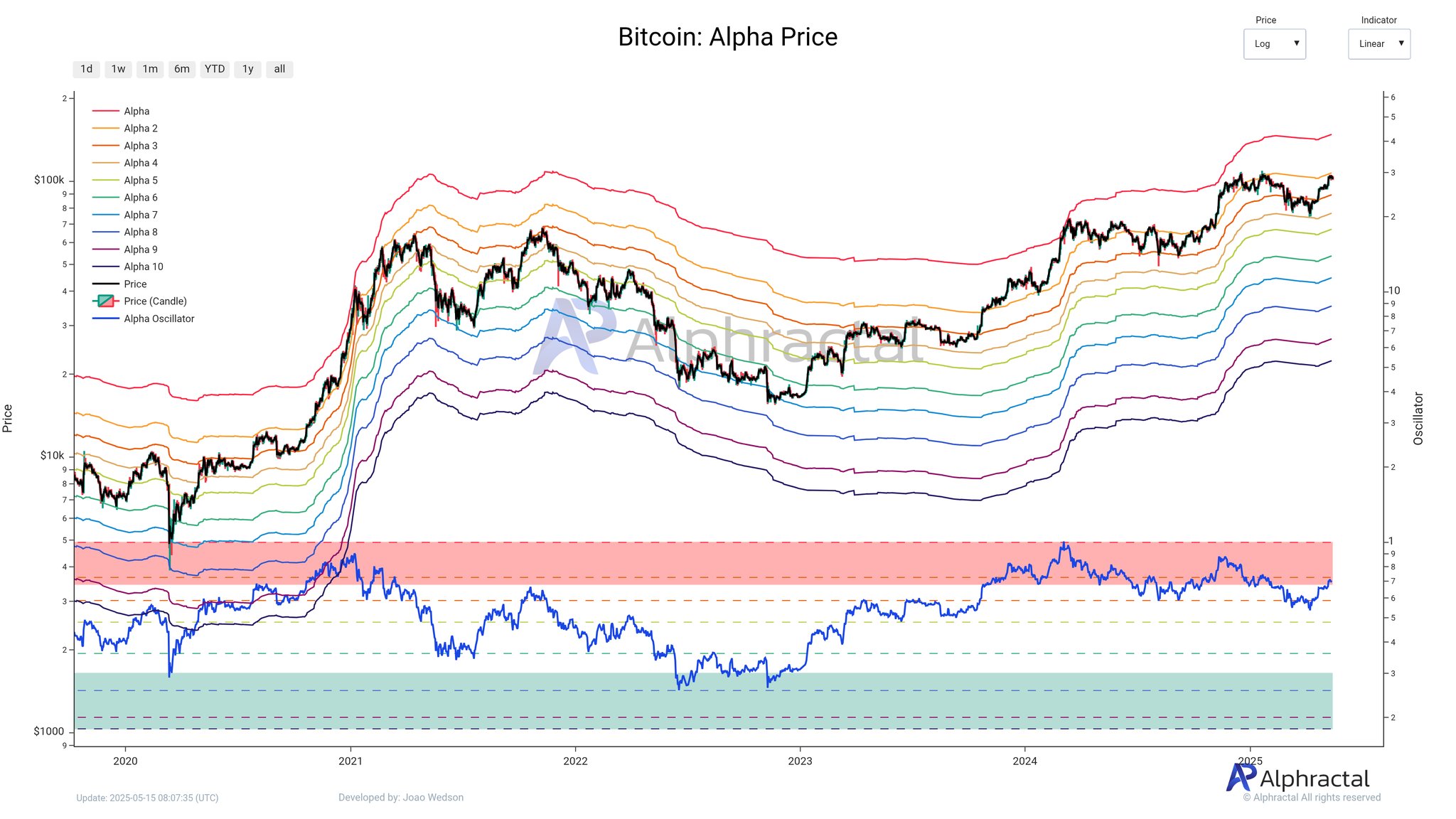

The rationale behind this prediction is that the $123,000 area (or extra exactly, $123,370) is the second Alpha Worth stage for the Bitcoin worth. For context, the Alpha Worth is a robust on-chain indicator that makes use of a number of key metrics to estimate the place the BTC worth is more likely to discover assist or resistance.

In essence, the Alpha Worth is a stage that the value of Bitcoin must breach and keep above to enter the following important phase of the bull cycle. “It begins by calculating the market’s age in days and makes use of that to derive the common market cap—primarily the historic valuation baseline,” Wedson added concerning the indicator.

As proven within the chart above, the Alpha Worth indicator has a number of threshold ranges, which behave like strain areas. These thresholds mirror zones the place investor sentiment is more likely to shift; decrease ranges act as helps as a result of traders usually purchase to defend their positions, whereas higher ranges sign elevated promoting strain because of revenue taking.

Wedson famous that the Bitcoin worth failing to breach the second Alpha Worth stage doesn’t indicate that the market prime is in. Nonetheless, the $123,370 area is a transparent resistance zone, and the BTC worth may have to face some pullback earlier than climbing to new highs.

Wedson additionally talked about that the Alpha Worth stage will replace on Saturday, July 19, because it’s dynamically adjusted primarily based on real-time on-chain transaction flows. Nonetheless, if the Bitcoin worth does break this stage, a transfer to above $143,000 could still be on the cards.

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $117,610, reflecting an over 2% decline prior to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView