Bitcoin value noticed a pullback right this moment after reviews of Mt. Gox’s large BTC transfer to an unknown pockets handle triggered a broader market selloff. Mt Gox later denied claims of promoting $10 billion value of Bitcoin and Bitcoin Money reserves for making repayments to collectors. Nevertheless, the crypto market didn’t rebound regardless of denial by a former govt.

Why Bitcoin Worth Is Going Down Immediately

Mark Karpeles, former CEO of Mt. Gox, mentioned “Every little thing is ok with MtGox. The trustee is shifting cash to a special pockets in preparation of the distribution that may seemingly occur this yr, there isn’t any imminent sale of bitcoins taking place.”

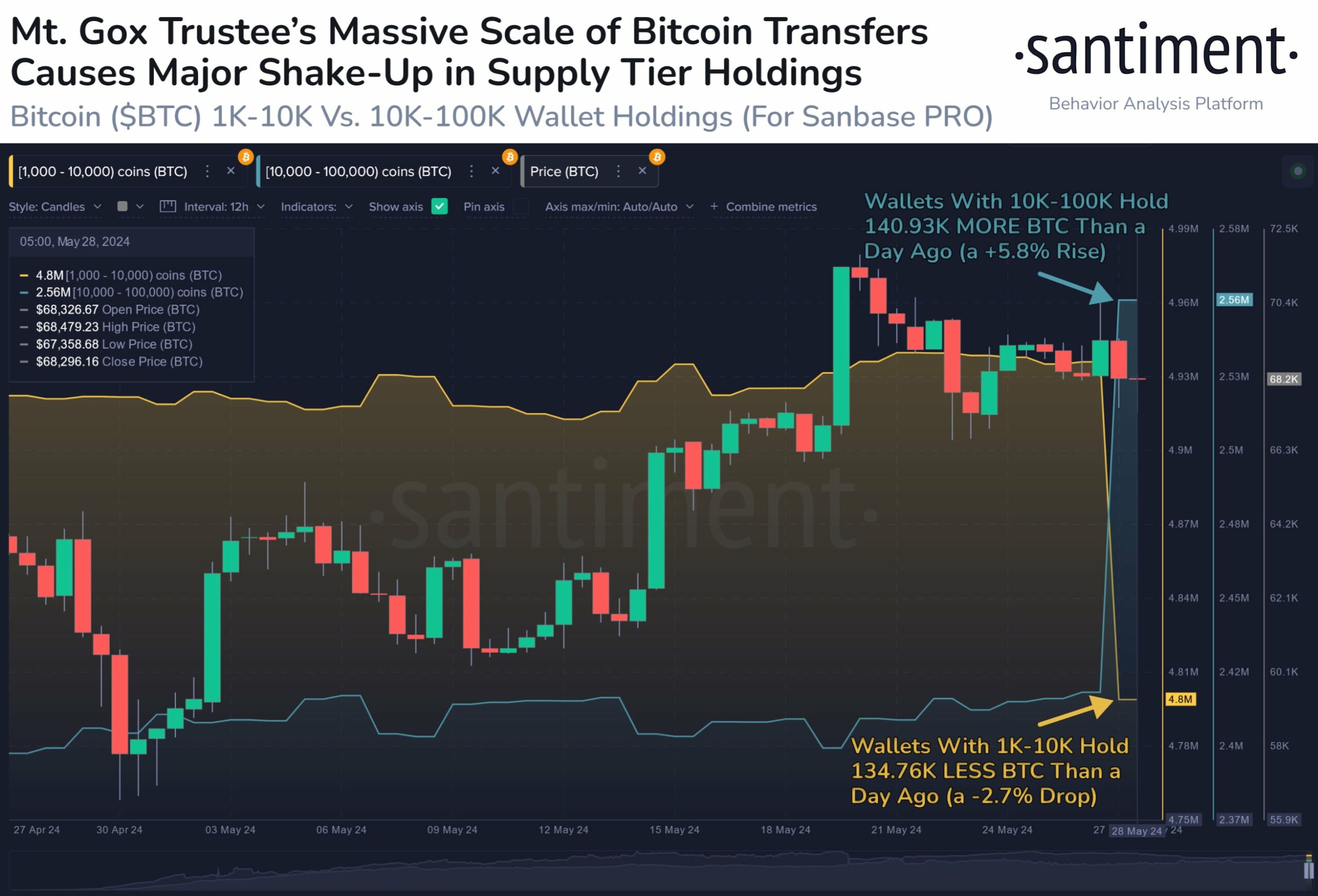

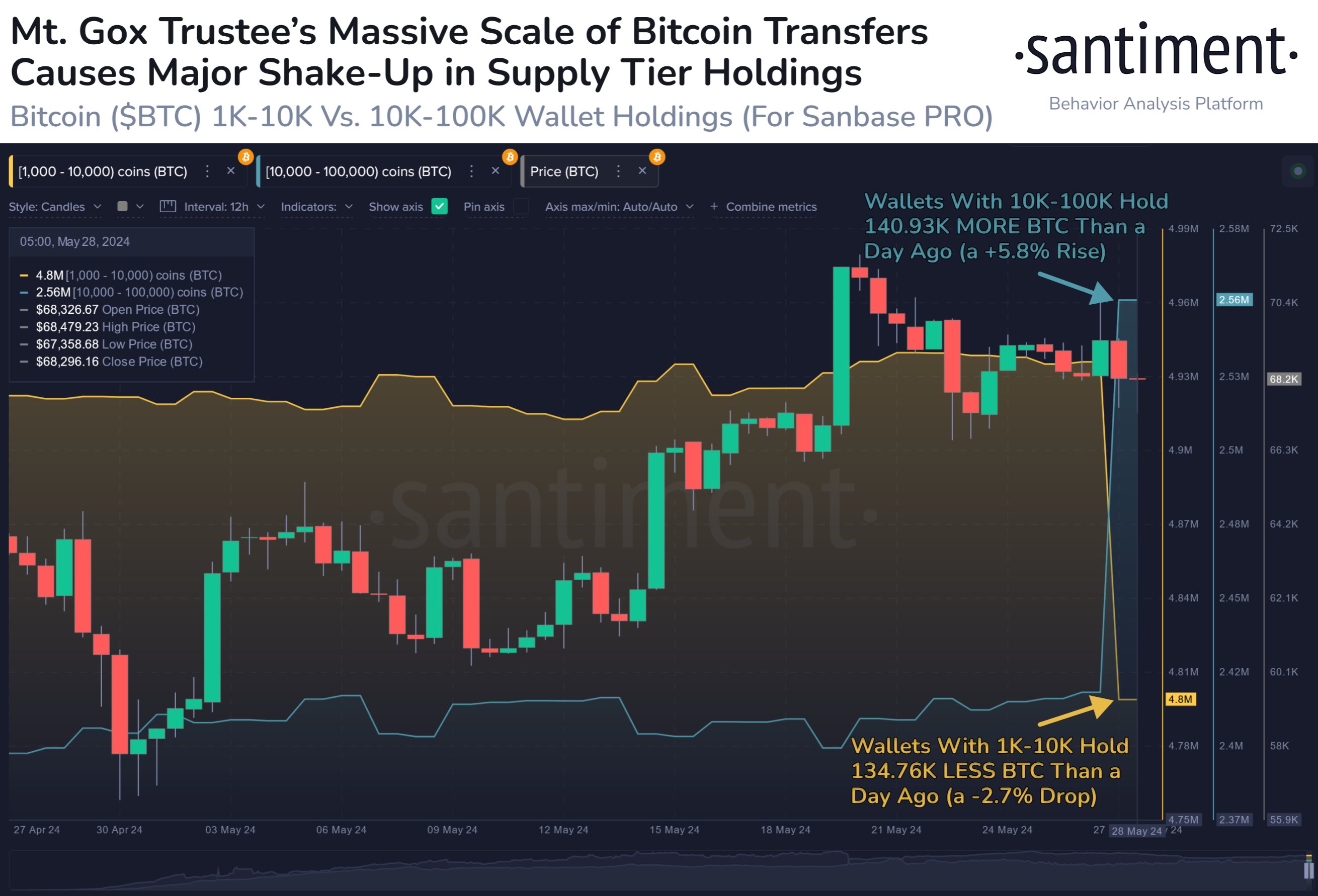

Nevertheless, massive quantities of Bitcoin have been moved inflicting a web drop of BTC held by 1K-10K and 10K-1ooK BTC pockets addresses. This brought on sentiment to stay down as merchants thought of different elements.

Bitcoin nonetheless holds agency above key help stage at $66K, however headwinds resembling US PCE inflation information and crypto market expiry on Might 31 are seemingly elements merchants thought of staying away from the market.

CoinGape reported that over 68,383 BTC choices of a notional worth of $4.66 billion are set to run out, with a put-call ratio of 0.57. The max ache level is $65,000, indicating excessive odds of Bitcoin selloff after days of low buying and selling volumes. Implied volatility (IV) witnessing important declines throughout all main phrases, which suggests unstable value actions can seemingly trigger an additional pullback in BTC value.

Crypto Liquidations

Crypto market noticed $170 million liquidated within the final 24 hours, as per CoinGlass information. Ethereum (ETH) outpaced Bitcoin in liquidation, with BTC recording $25 million in lengthy positions liquidation. The most important single liquidation order occurred on crypto trade Binance as somebody traded ETHUSDT valued at $4.92 million.

BTC price fell over 3% previously 24 hours, with the worth at the moment buying and selling close to $68,243. The 24-hour high and low are $67,227 and $70,479, respectively. Buying and selling volumes rise over 25%, indicating curiosity amongst merchants however with warning.

The US greenback index (DXY) rose above 104.54 after the current drop in greenback index. In the meantime, the US 10-year Treasury yield additionally climbed to 4.54% after poor outcomes of the 5-year and the 2-year auctions triggered a selloff. As well as, Minneapolis Federal Reserve President Neel Kashkari famous that the present coverage stance is restrictive however emphasised that officers haven’t completely dominated out extra fee hikes.

Additionally Learn:

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: