Bitcoin bulls misplaced bullish momentum within the crypto market once more as BTC worth fell under $97.5K, from an intraday excessive of $102,712. Merchants anticipate an total bullish outlook at first of 2025 because the crypto-friendly Donald Trump administration takes management on January 20. Nevertheless, the markets braced for short-term liquidity considerations and volatility dangers amid jobs knowledge and FOMC minutes launch.

Bitcoin Loses Earlier Beneficial properties After Jobs Information

The JOLTS jobs openings elevated by 259,000 to eight,098 million for November 2024, in response to the U.S. Bureau of Labor Statistics. This means the labor market stays robust and the Fed charge cuts could also be restricted in 2025. JOLTS jobs knowledge has elevated for 2 consecutive months now. The job openings have elevated in skilled and enterprise companies, finance and insurance coverage, and personal instructional companies.

In the meantime, ISM Providers Costs PMI exhibits the US economic system stays robust. The resilience of the US forward of Trump’s inauguration day fueled considerations about risky market circumstances. In actual fact, US shares declined on Tuesday, ending a two-day rally, as contemporary financial knowledge fueled hypothesis that the Federal Reserve could hold charges regular this month regardless of rising inflation.

This prompted the US greenback index (DXY) to rebound sharply over 108.50, after a two-day low transfer that prompted a restoration in Bitcoin worth. Additionally, the 10-year Treasury yield elevated to a 35-week excessive of 4.68%.

BTC Worth Falls 5% Inside An Hour

BTC worth fell 5% previously 24 hours, with the worth at the moment buying and selling at $97,566. The 24-hour high and low are $$97,153 and $$102,712, respectively. Moreover, the buying and selling quantity has elevated by 27% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Bitcoin worth has skyrocketed over 10% in per week and should break above the earlier ATH on bullish macroeconomic and technical components. The upside transfer is supported by inflows into the spot Bitcoin ETFs, indicating institutional curiosity returning.

In keeping with K33 Research, Bitcoin and crypto costs jumped after the strongest 2-day circulation to ETFs since mid-November. Furthermore, BTC open pursuits inches greater, recording a strong 7-day streak of constructive each day returns.

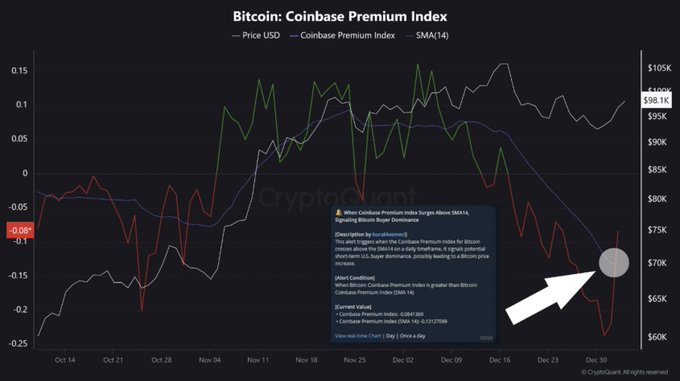

The value of Bitcoin has jumped again to the $100,000 mark, an indication that exhibits the Coinbase Premium Index is again to constructive.

Bitcoin Worth Hits Over $102K On Donald Trump’s Inauguration

Bitcoin’s current drop displays a seasonal lull throughout the Christmas vacation interval. These traits at the moment are reversing to create a bullish momentum within the world markets, in response to Matrixport.

Furthermore, traders anticipate the upside momentum to maintain as Donald Trump enters the White Home on January 20. His pro-crypto administration to work on offering crypto regulatory readability within the nation, making a framework that different international locations could undertake. Trump’s strategic Bitcoin reserve plans noticed huge adoption from different international locations and states.

In the meantime, BitMEX co-founder Arthur Hayes has predicted a severe correction in Bitcoin and the crypto market in mid-March. His prediction got here primarily based on declining US greenback liquidity. Whereas the Reverse Repo Facility (RRP) and the US Treasury’s Normal Account (TGA) will keep bullish momentum, it might not proceed additional after March.

Disclaimer: The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: