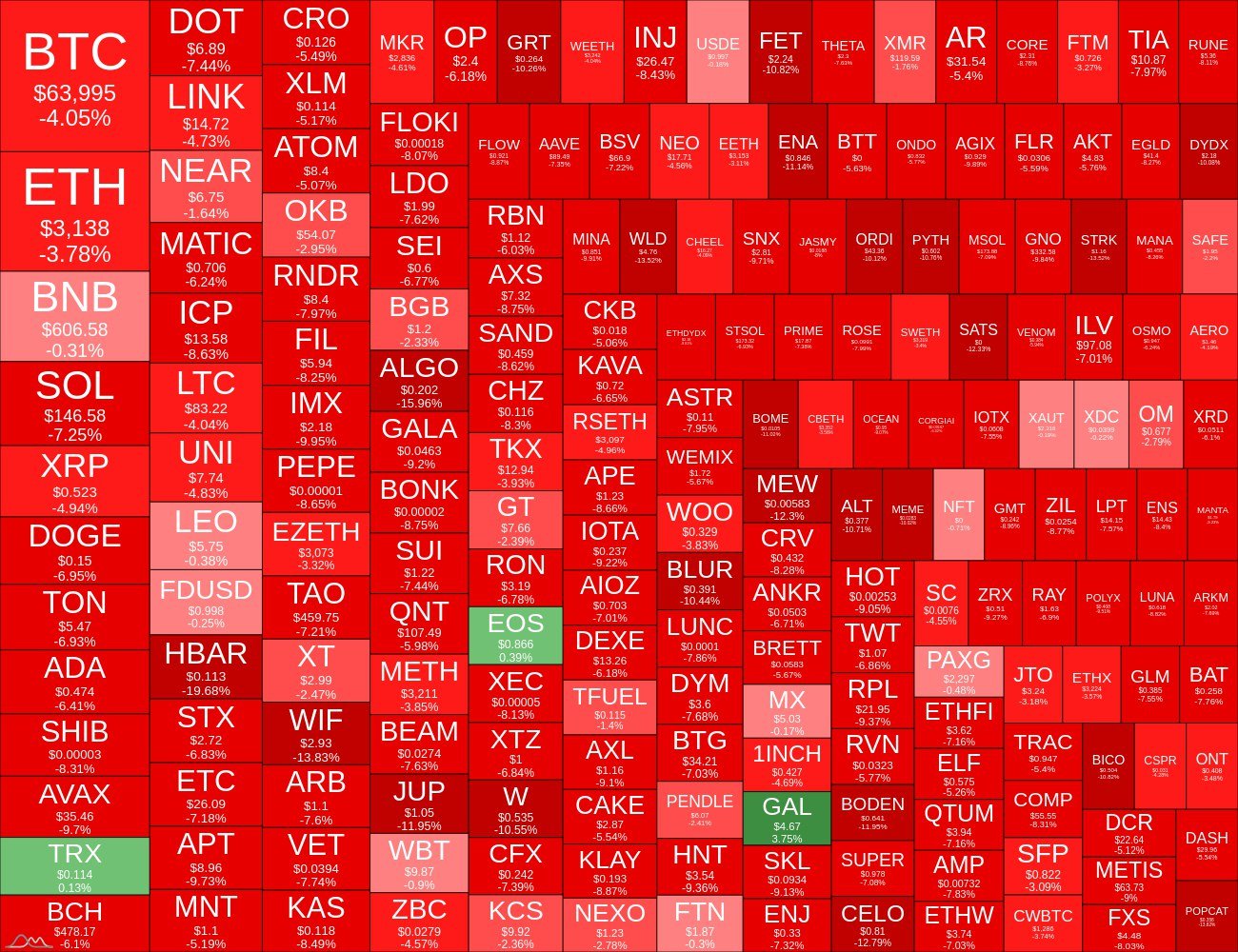

The crypto market has taken a dip within the final 24 hours after failing to keep up the upside momentum post-Bitcoin halving. The worldwide crypto market cap tumbled over 4% to $2.36 trillion from $2.47 trillion, which suggests over $110 billion in market worth was misplaced within the final 24 hours.

Bitcoin price plunges beneath $64,000 attributable to lack of buying and selling volumes and rising uncertainty, with BTC hitting a low of $63,589. Merchants are bullish on the crypto market this cycle amid bull market and anticipated post-Bitcoin halving rally. Nonetheless, sure elements are inflicting them to change into cautious within the short-term.

Second-largest crypto Ethereum price additionally fell over 3% to $3,100, with different altcoins together with Solana, XRP, Cardano, Dogecoin, Toncoin, and Shiba Inu tumbling 5-10% within the final 24 hours.

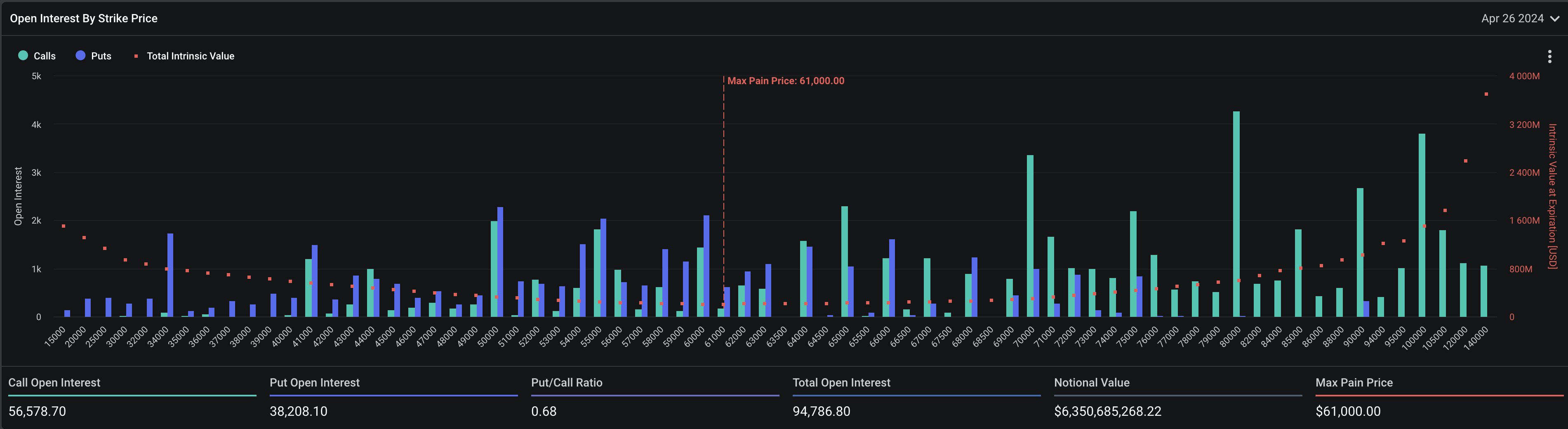

$9.4 Billion In Crypto Market Expiry

The Concern & Greed Index signifies an uptick in sentiment, with a rise in worth from 57 to 72 inside this week. The market contributors are ready for some headwinds to vanish earlier than taking new positions and $9.4 billion month-to-month crypto options expiry is the important thing headwind.

Over 96k Bitcoin choices of $6.3 billion in notional worth are set to run out on Deribit on Friday. The put-call ratio is 0.68, indicating an increase in put choices lately as month-to-month expiry approaches. The max ache level is $61,000, beneath the present value. The market can count on large volatility with a pullback in value anticipated on the expiry day, however derivatives merchants stay cautious of sustaining the place as funding charges are unfavorable.

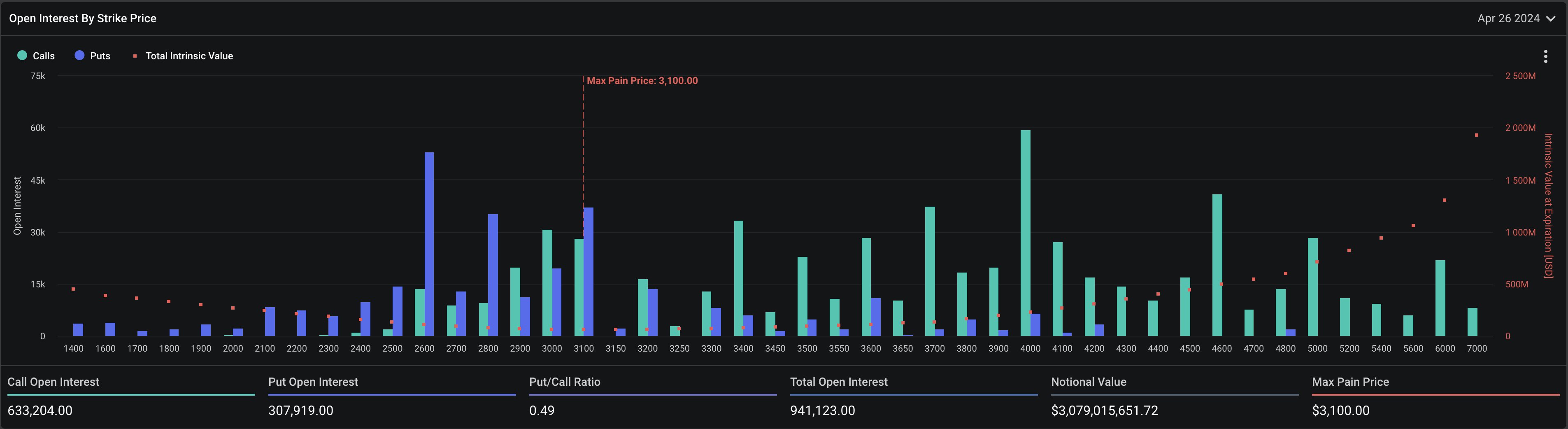

Furthermore, 977k Ethereum choices of notional worth $3.1 billion are set to run out, with a put-call ratio of 0.49. The max ache level is $3,100, with the ETH price at the moment buying and selling above the max ache level at additionally increased than the present value of $3,252.

The trades within the final 24 hours point out a rise in put open curiosity with a put/name ratio of 0.94. The value may witness a decline to max paint level and begins a rally after the expiry.

US PCE Inflation Knowledge

The week is seen as macro heavy due to a number of financial occasions together with GDP, PCE inflation, preliminary jobless claims, and others. The Bureau of Financial Evaluation estimates sturdy GDP progress within the U.S. regardless of a slowdown for the second consecutive quarter from 3.4% to 2.5%.

Nonetheless, the important thing figures on watch is PCE inflation on Friday as international buyers await the U.S. Federal Reserve most popular gauge to indicate some indicators of falling inflation after CPI and PPI inflation knowledge got here in hotter. As per the economists, annual PCE inflation to return in hotter at 2.6%, 0.1% increased than 2.5% beforehand. Additionally, Core PCE inflation is anticipated to return in at 2.6%, down from 2.8% final month.

The Fed charge cuts are a key issue this yr to substantiate the underside in inventory and crypto markets, with different central banks prone to comply with the U.S. central financial institution pivot.

Additionally Learn: Binance Founder Changpeng “CZ” Zhao Requests Probation, Gets Unprecedented Support

Leveraged Crypto Liquidations

Excessive-leverage positions in crypto are inflicting large liquidations, with potential liquidation anticipated within the short-term. Bitcoin value dangers liquidation and fall to $60,000 within the occasion of a number of selloffs.

Coinglass knowledge exhibits greater than $220 million have been liquidated throughout the crypto market amid the pullback. Amongst them, $180 million lengthy positions have been liquidated and practically $40 million quick positions have been liquidated.

Over 92K merchants have been liquidated and the biggest single liquidation order occurred on crypto trade OKX as somebody swapped ETH to USD valued at $5.66 million.

Two promote indicators have been introduced on the #Bitcoin 12-hour chart: A dying cross between the 50 and 100 SMA and a purple 9 candlestick from the TD Sequential.

If $BTC falls beneath $63,300, brace for doable dives to $61,000 and even $59,000. pic.twitter.com/24A3YtbgTb

— Ali (@ali_charts) April 25, 2024

Additionally Learn: Bitcoin ETF Volume At Four Week High, But Net Inflows Turn Negative Again

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: