One other crypto market crash is happening, with the Bitcoin worth dropping under the essential $95,000 assist stage, dragging altcoins like Ethereum, Solana, and the XRP worth together with it. This worth crash has occurred primarily as a result of bearish sentiment available in the market, due to a number of elements.

Crypto Market Crash: Why BTC, ETH, SOL & XRP Are Down

CoinMarketCap data reveals {that a} crypto market crash is happening once more, with the Bitcoin worth dropping under the psychological $95,000 stage. Altcoins like Ethereum, Solana, Dogecoin, and the XRP worth have additionally considerably declined.

This worth crash has occurred as a consequence of a number of elements, together with international financial uncertainty. For one, US President Donald Trump continues to threaten to impose tariffs on different international locations. Yesterday, the president introduced that he has determined that for the needs of equity, he’ll cost reciprocal tariffs on international locations that cost the US.

This continues to lift issues about commerce wars, which is bearish for the crypto market. In the meantime, the bearish sentiment available in the market can also be as a result of US Federal Reserve’s quantitative tightening coverage, with no hopes of financial easing insurance policies anytime quickly. Merchants predict that there can be just one Fed fee reduce this yr, which is unlikely to come back till the second half of the yr.

These developments sparked a bearish sentiment amongst traders, finally resulting in this crypto market crash. The Bitcoin price has struggled to reclaim $100,000 for some time now and now even appears to be like extra more likely to contact $90,000.

Bearish Elements In The Market

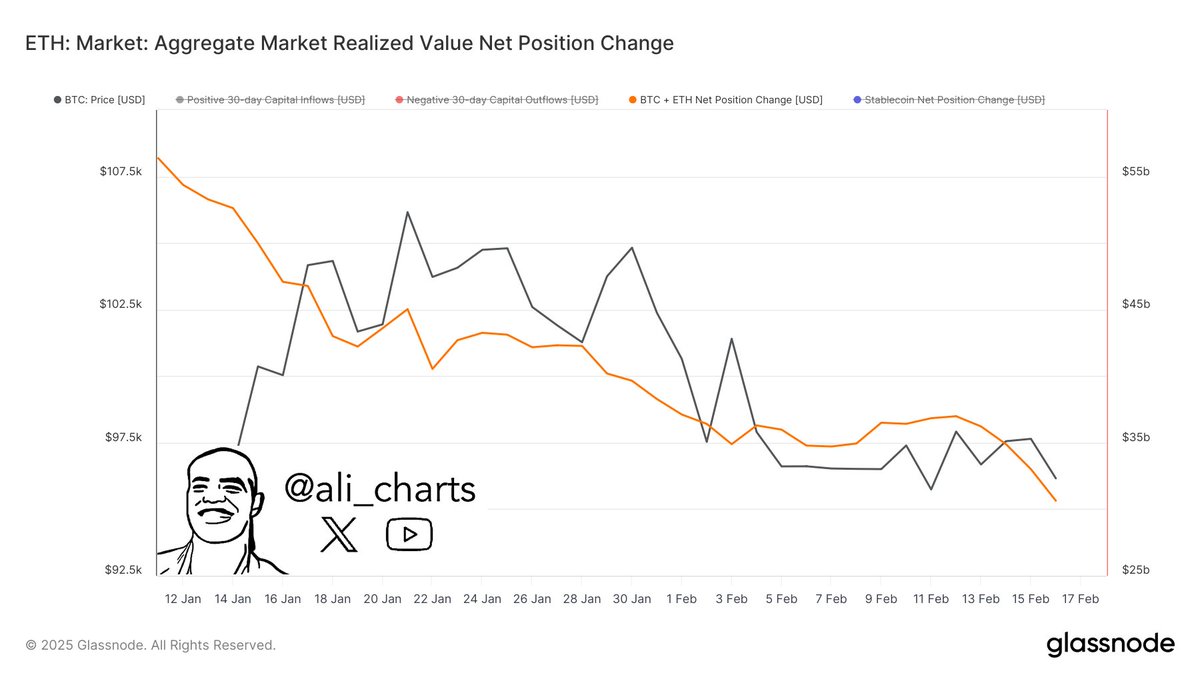

Apart from the uncertainty on the macro facet, different developments have led to the crypto market crash. Crypto analyst Ali Martinez not too long ago revealed that the capital inflows into Bitcoin and Ethereum have declined by over 30% up to now month, dropping from $45 billion to $30 billion.

This means that there’s a lack of liquidity available in the market to maintain greater costs. Traders look to be holding off on allocating extra capital to the market as a result of bearish sentiment. As a substitute, extra traders look to offloading their cash because the market seemingly priced in to Donald Trump’s administration even earlier than he took workplace.

Furthermore, some neighborhood members consider that Trump’s administration has fallen in need of its guarantees to the crypto business, contemplating that the Strategic Bitcoin Reserve initiative hasn’t but occurred.

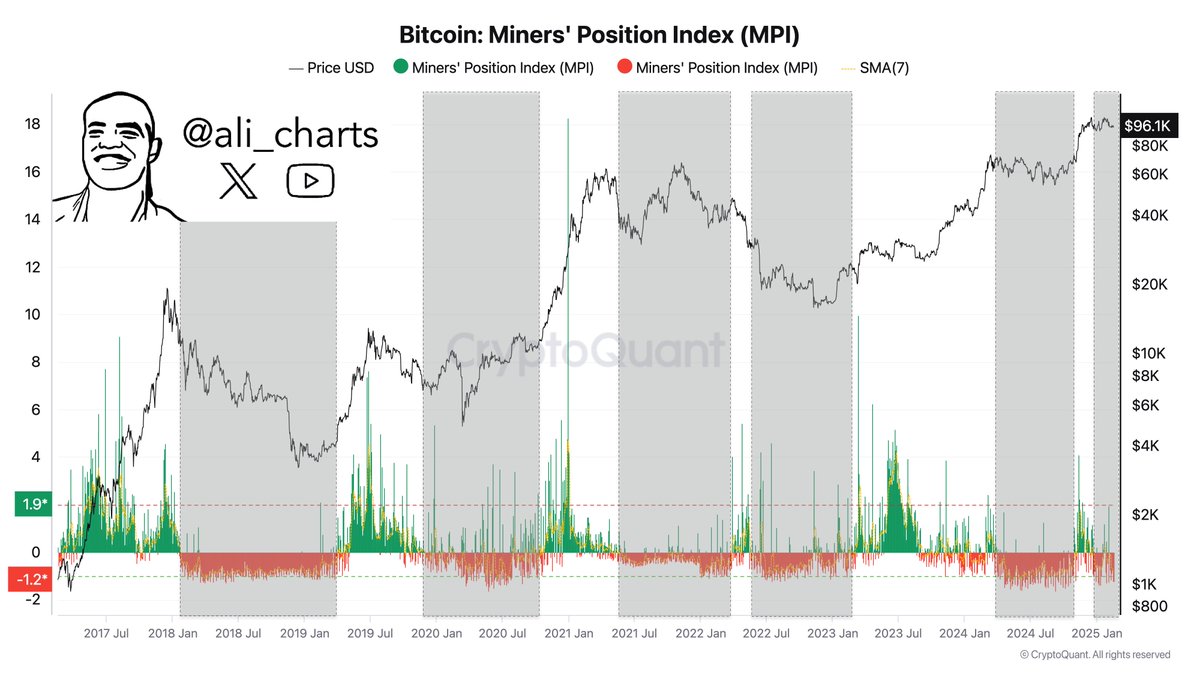

Amid this crypto market crash, Martinez has additionally advised that the market may witness decrease costs, as he revealed that extended worth corrections have traditionally adopted a decline in Bitcoin mining exercise.

Away from the Bitcoin ecosystem, the bearish sentiment within the Solana sentiment additionally appears to be like to be at an all-time excessive (ATH) following the LIBRA meme coin rug pull. Merchants allegedly misplaced over $286 million to the rug pull, which has additional sucked liquidity out of the crypto market.

This growth has additional dampened traders’ confidence, particularly contemplating Argentina’s President Javier Milei promoted this meme coin on his X account. This saga has raised the ghosts of the TRUMP and Melania meme cash, which sucked liquidity from the market simply earlier than Donald Trump took workplace.

Disclaimer: The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: