The Bitcoin worth has famous a surge of round 3%, persevering with its run in direction of the North whereas gaining the buyers’ consideration. The latest momentum signifies that regardless of a short-term pullback, the bulls are nonetheless dominating the market after Donald Trump’s win within the US election. In addition to, it has additionally sparked speculations over the potential causes that may have supported the present BTC rally.

So, let’s check out the potential causes that will have helped positive aspects within the broader digital property area in addition to in Bitcoin.

Why Is Bitcoin Worth Up At the moment?

Donald Trump’s win within the US election has boosted the market sentiment whereas sending Bitcoin worth to its ATH not too long ago. Nevertheless, the present market tendencies trace that the sentiment has pale but, which continues to be supporting the BTC rally.

Listed here are among the high causes that would have contributed to the latest positive aspects in BTC.

Donald Trump’s Election Win Boosts Bitcoin Worth

Donald Trump’s victory has raised bets over potential pro-crypto insurance policies within the US, which seems to have market optimism. In addition to, the market can also be anticipating a transparent regulatory path forward for the crypto market, which might help positive aspects within the broader sector.

The thrill of the Republican victory can also be evidenced by the crypto costs shifting increased and making new data since final week. Moreover, Trump’s earlier guarantees in direction of the crypto market, together with making Bitcoin a strategic reserve for the US, have additionally sparked widespread discussions out there.

This has additionally triggered a FOMO amongst different international leaders. Not too long ago, the UK has planned to unveil crypto-friendly laws to counter the rising US enchantment amongst international buyers. Having mentioned that, these set of occasions have probably influenced the present Bitcoin worth rally.

Bitcoin Choices Approval Sparks Optimism

The latest green light for the US Bitcoin ETF options buying and selling by the Commodities and Futures Buying and selling Fee (CFTC) has additional fueled market curiosity. This marks a significant milestone for the crypto, particularly as institutional curiosity is rising in direction of BTC.

Notably, the CFTC approval can also be probably to offer extra publicity for the funding instrument for the Wall Road gamers. So, wanting on the BTC efficiency after the US Spot Bitcoin ETF approval, this growth is more likely to enhance the Bitcoin worth within the coming days considerably.

BTC Institutional Curiosity Soars

As already mentioned, the Wall Road gamers in addition to the worldwide institutional curiosity have been hovering in latest days. The strong influx into Bitcoin ETF influx after Donald Trump’s election win signifies how buyers are shifting their focus towards the digital property area, particularly Bitcoin. Nevertheless, it’s value noting that the fund stream has been muted over the past two days, as evidenced by the US Spot Bitcoin ETF outflow.

In addition to, massive banks are additionally shifting their focus in direction of BTC. In a latest submitting, Goldman Sachs revealed that it has invested $700 million into Spot Bitcoin ETF, signaling rising market curiosity. In addition to, Bitwise also hit $10 billion in shoppers’ property beneath administration (AUM) not too long ago with a shifting market focus in direction of Bitcoin and crypto.

US SEC Chair Resignation

Donald Trump’s election win additionally sparked discussions over the potential resignation of the present US SEC Chair Gary Gensler. In addition to, Gensler has not too long ago shared a press release saying “proud to serve” the SEC, which has additionally sparked discussions over his potential resignation quickly.

Notably, the anticipation out there retains rising over the US SEC Chair’s potential exit quickly. A flurry of specialists have predicted his exit as quickly as this 12 months, whereas many referred to as for his resignation earlier than Donald Trump takes workplace.

In the meantime, Gensler has confronted immense backlash from the crypto trade over time for his anti-crypto stance. Now, along with his potential resignation, the market anticipates a pro-crypto candidate to interchange him, which could foster innovation and progress within the broader crypto market.

US Fed Price Reduce Boosts Bitcoin Worth

The US Federal Reserve announced a 25 bps rate cut final week on the November FOMC. This has raised the risk-bet urge for food of buyers, whereas many have began specializing in property like crypto. Each Bitcoin worth and different high altcoins have benefited from the choice.

Nevertheless, whereas the market was anticipating one other fee lower in December, the latest financial determine suggests in any other case. The latest US CPI data this week confirmed that the US inflation has superior for the primary time within the final eight months. In addition to, the US PPI figures additionally got here in hotter than anticipated, sparking considerations out there.

Regardless of that, BTC remained sturdy and continued its rally, indicating rising buyers’ confidence. It seems that the merchants have shrugged off the financial considerations as Trump’s victory and anticipation over pro-crypto insurance policies proceed to dominate the market.

Will Bitcoin Worth Hit $100K?

The market specialists are bullish on Bitcoin worth rally to $100K quickly. In addition to, the top altcoins like XRP, Solana, and Dogecoin are additionally noting sturdy positive aspects, with Ripple’s native crypto hovering previous the transient $1 mark. This means the rising market confidence within the digital property area.

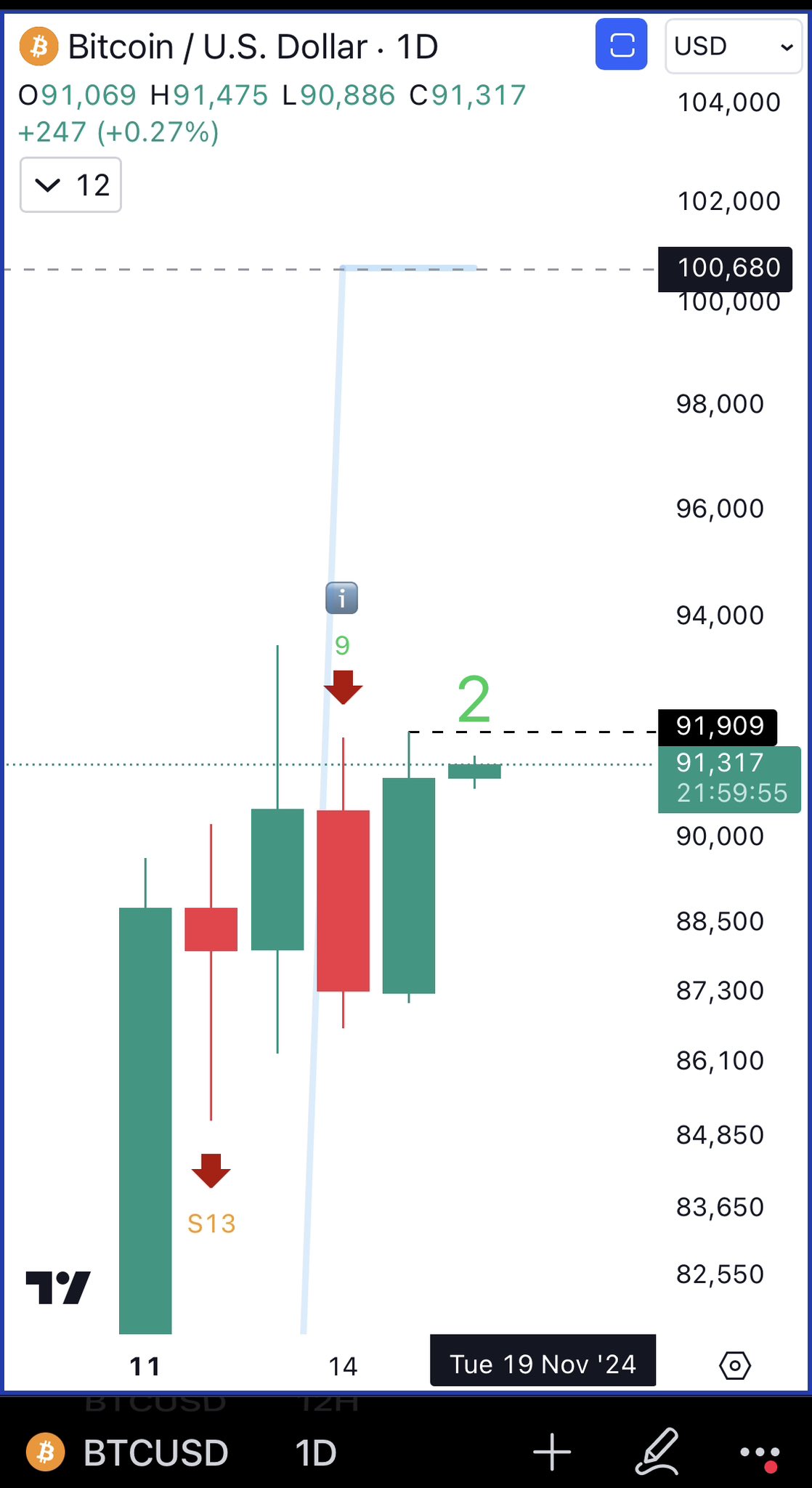

Notably, in a latest X put up, distinguished crypto market professional Ali Martinez remained optimistic regardless of dangers prevailing over a short-term pullback. Martinez famous that BTC is poised to hit $100,680 subsequent if it could witness a day by day shut of over $91,900.

Concurrently, one other market professional Rekt Capital mentioned that if BTC shut above $91,018, it might proceed its run towards the north forward. Notably, BTC worth at this time was 2.85% and exchanged arms at $91,430, whereas its buying and selling quantity fell 19%. The crypto has touched a 24-hour excessive of $91,868.74, and Bitcoin Futures Open Curiosity rose almost 2%, indicating area for additional positive aspects forward.

In addition to, a latest report of Matrixport additionally hints at a possible rally forward. The report famous that regardless of the BTC RSI at 77 now hints at an overbought situation for the crypto, it remained optimistic about Bitcoin’s future trajectory.

Disclaimer: The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: