The Bitcoin value has surged greater than 3% in the present day, hovering to the $63,000 mark, after a risky buying and selling just lately. Notably, the latest BTC rally, after risky buying and selling in latest days has sparked discussions within the cryptocurrency market over the potential causes behind the rally in its value. In the meantime, a flurry of analysts has supplied key insights on the latest BTC value actions and a few key ranges to look at.

Why Is BTC Worth Rising As we speak?

The crypto market, together with the BTC value, has witnessed heightened volatility over the previous few days. Nonetheless, the flagship crypto has surged in the present day, indicating the rising confidence of the buyers in the direction of the crypto. So, right here we take a have a look at the potential causes and a few key evaluation for cues on the potential causes behind the rally.

Elevated Bitcoin Accumulation Alerts Bullish Sentiment

A latest publish by IntoTheBlock on the X platform has stirred optimism inside the investor group, doubtlessly fueling the latest rally within the Bitcoin value. In accordance with the analytics agency, roughly 5.1 million Bitcoin addresses, equal to round 10% of the overall BTC holding addresses, have collected BTC between the present value and the all-time excessive (ATH) of $72,500.

In the meantime, this revelation suggests a major inflow of recent patrons into the market, indicating rising confidence and bullish sentiment towards Bitcoin. Notably, the substantial improve in Bitcoin accumulation underscores buyers’ perception within the long-term potential and worth proposition of the cryptocurrency.

A number of analysts see this report as a possible motive that’s driving the BTC value larger as demand outpaces provide. With a large portion of addresses buying Bitcoin at present ranges, the market sentiment seems buoyant, contributing to the latest upward momentum within the Bitcoin value.

Additionally Learn: Cardano’s Charles Hoskinson Explains Why Trump Is Better Than Biden For Crypto

Analysts’ Remarks Fuels Optimism

A flurry of analysts have shared key insights on the present BTC value actions. As well as, some have additionally make clear the important thing ranges to look at for the flagship crypto’s value.

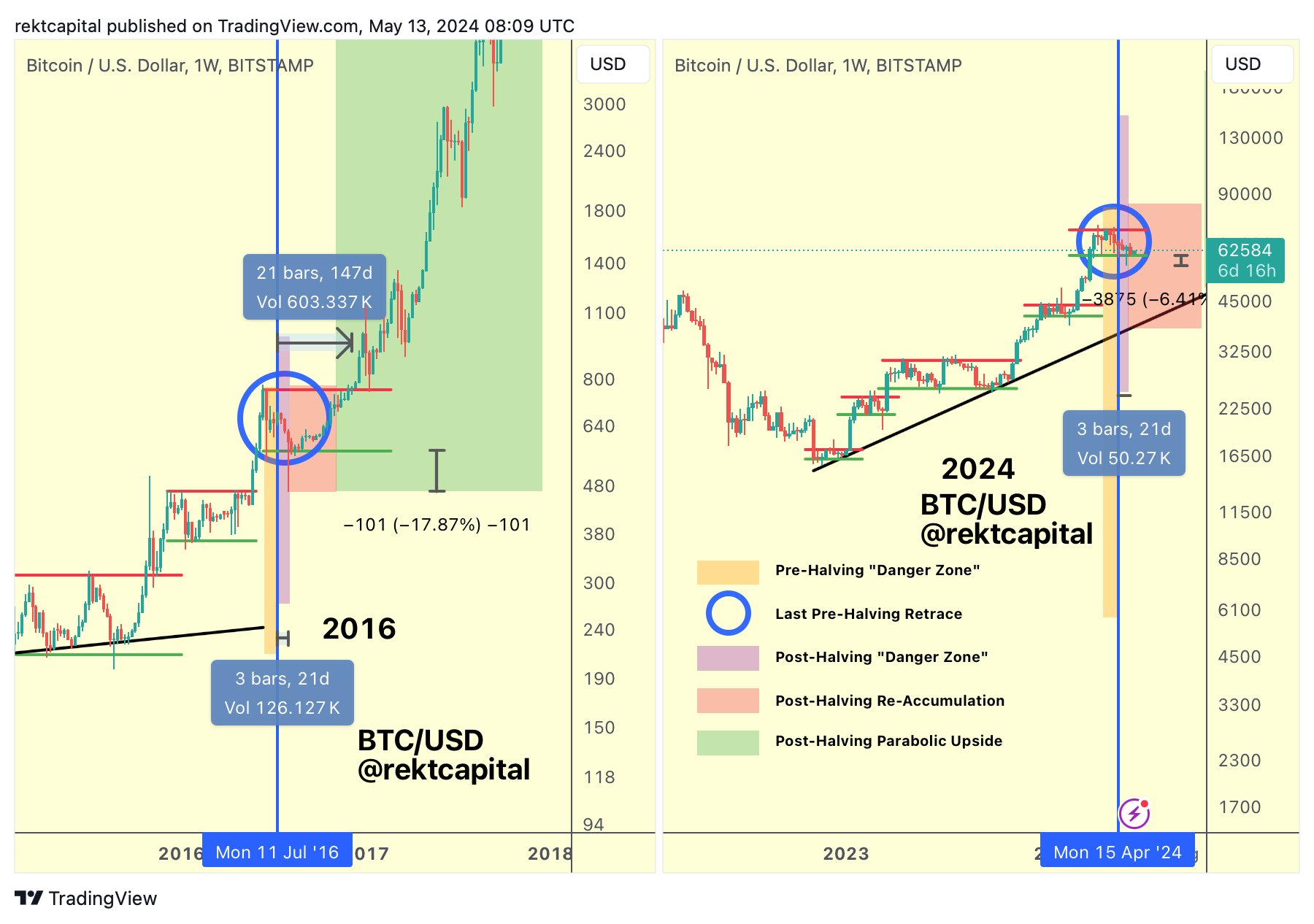

For context, famend crypto market analyst Rekt Capital supplied perception into Bitcoin’s latest value surge. Rekt Capital declared the tip of the Post-Halving Bitcoin “Hazard Zone,” signaling a optimistic flip for the cryptocurrency.

In the meantime, in accordance with the analyst, Bitcoin’s bounce from the Re-Accumulation Vary Low help marks a celebratory second, indicating renewed investor confidence. Notably, this announcement comes amid a backdrop of rising optimism within the crypto market, with Bitcoin rallying from latest lows.

As well as, Rekt Capital’s evaluation means that the halving-induced uncertainties surrounding Bitcoin’s value trajectory have dissipated, paving the best way for extra bullish sentiment.

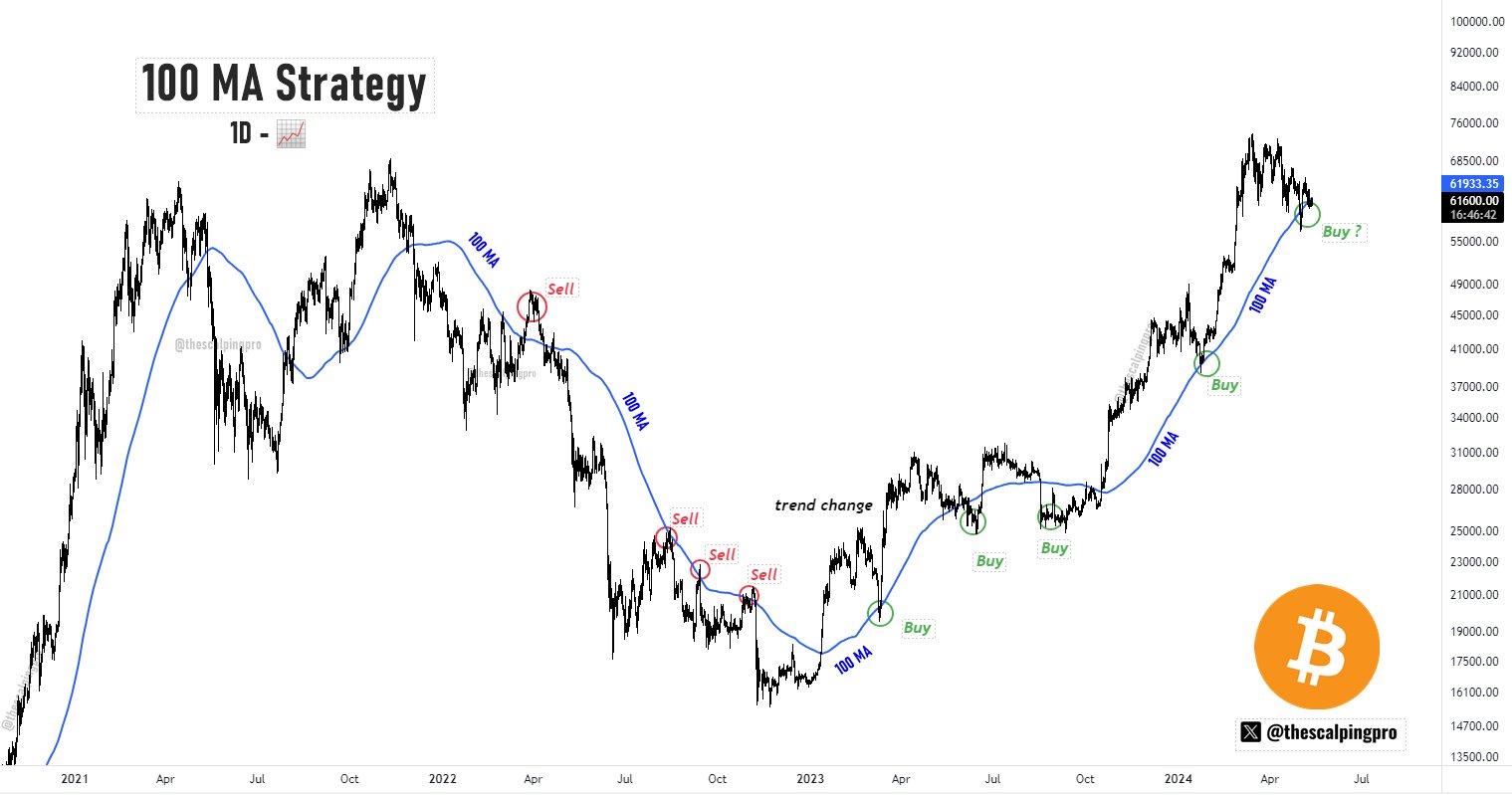

Alternatively, Mags, one other fashionable analyst, has supplied helpful insights that might be attributed to the latest BTC rally. In accordance with Mags, Bitcoin’s present rally might be attributed to technical evaluation indicators, notably the 100-day moving average (MA) on the each day chart.

Notably, Mags highlights a historic sample the place Bitcoin tends to backside out or expertise a neighborhood backside when it reaches or barely dips beneath the 100-day MA. The analyst mentioned that in January, the final time Bitcoin examined this MA, it marked a major turning level, resulting in a powerful 90% surge in value.

This sample means that the latest rally in Bitcoin could possibly be pushed by related technical elements, with merchants deciphering the check of the 100-day MA as a bullish sign.

Key Ranges To Watch

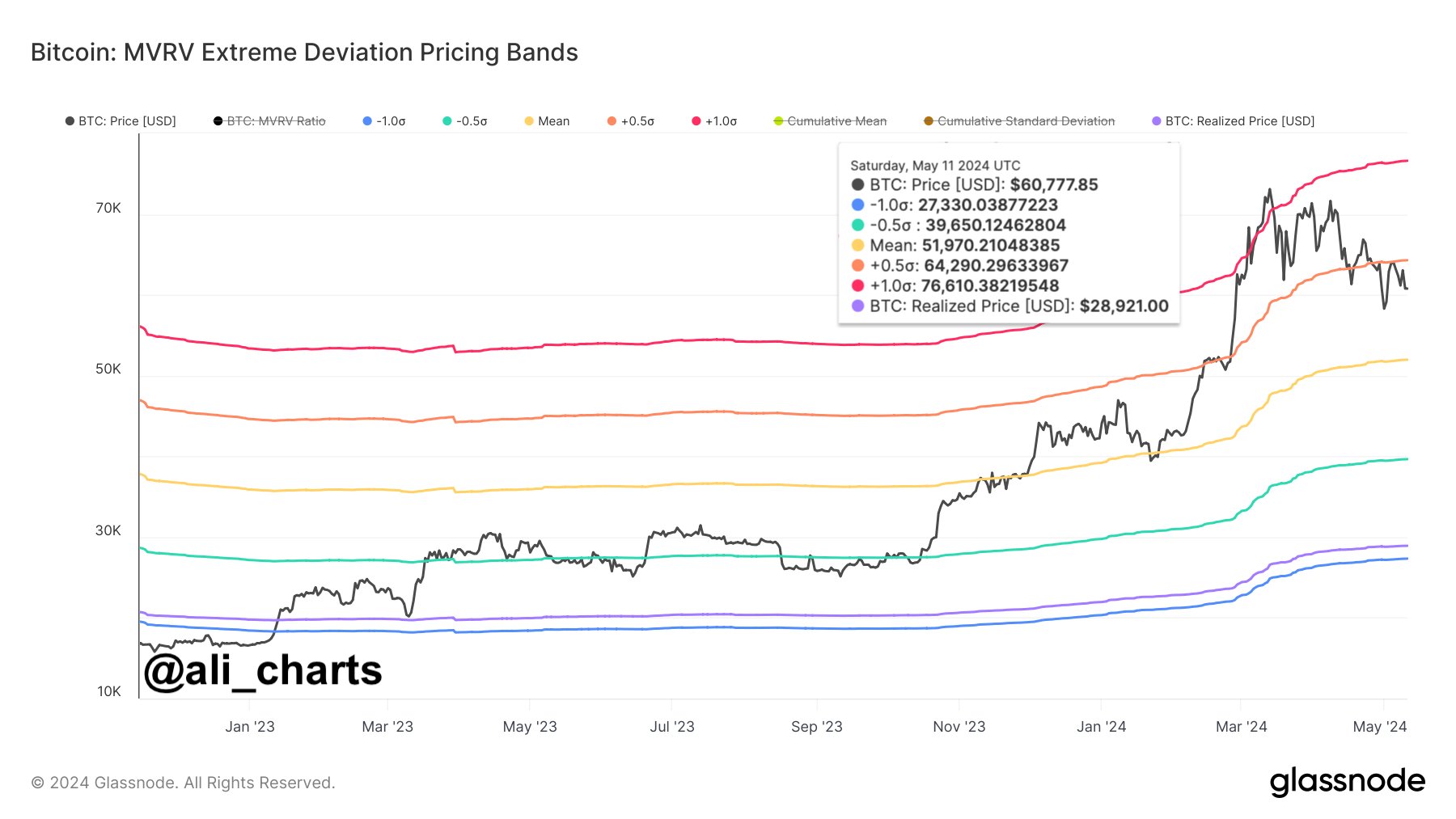

Prime crypto analysts, together with Ali Martinez and Michael van de Poppe, have emphasised essential BTC value ranges amidst market volatility. Notably, Martinez underscores the importance of Bitcoin reclaiming $64,290 for a possible surge in the direction of $76,610. Nonetheless, he additionally warned of a BTC retest in the direction of $51,970 if this degree isn’t surpassed.

Alternatively, Michael van de Poppe advocates for holding onto the present help degree, suggesting {that a} breach of $60,000 might result in an extra dip in the direction of $52,000-$55,000. As well as, he urged the market individuals to stay affected person and accumulate amid the uncertainty, because the crypto market navigates by means of numerous news-driven fluctuations.

BTC Worth Rallies Amid Hovering OI

The Bitcoin value rally comes amid a hovering open curiosity, suggesting a bullish sentiment available in the market in the direction of the flagship crypto. In accordance with CoinGlass knowledge, the Bitcoin Futures Open Interest (OI) has surged 3.74% within the final 24 hours to 479.88K BTC or $30.25 billion.

The CME and Binance exchanges have topped the record within the OI chart, hovering about 3.20% and three.57%, respectively. Notably, over the past 4 hours, the general Bitcoin Futures OI soared 3.95%, reflecting a bullish sentiment available in the market.

Nonetheless, as of writing, the Bitcoin price was up 3.14% to $63,021,56, whereas its buying and selling quantity jumped over 70% within the final 24 hours to $22.47 billion. Over the past 24 hours, the crypto has touched a low of $60,769.84, indicating the still-volatile situation hovering available in the market.

Additionally Learn: What’s Happening With Ethereum Price Today?

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: