Information reveals the Bitcoin mining hashrate has been shifting sideways since 5 months now because the miners’ revenues stay low.

Bitcoin Mining Hashrate Hasn’t Moved A lot Since 5 Months In the past

In response to the newest weekly report from Arcane Research, the BTC hashrate proper now’s on the similar degree as again in Could of this yr.

The “mining hashrate” is an indicator that measures the full quantity of computing energy at the moment related to the Bitcoin community.

The hashrate will be considered the diploma of competitors between the person mining rigs on-line on the BTC blockchain.

Due to this fact, when the worth of this metric is excessive, it means miners are going through greater competitors on common in the mean time.

This idea of competitors arises due to the community’s “mining difficulty.” A characteristic on the BTC blockchain is that the block manufacturing fee (or just the speed of transactions being dealt with by the miners) stays typically fixed.

However at any time when the hashrate adjustments, so does this block manufacturing fee. For instance, if the hashrate goes up, transactions are hashed quicker as there may be now extra energy to deal with them.

To take the block manufacturing fee again to the fixed that the chain desires, the community will increase the aforementioned mining issue. And equally, if it was the other case, it might have made a detrimental issue adjustment as a substitute.

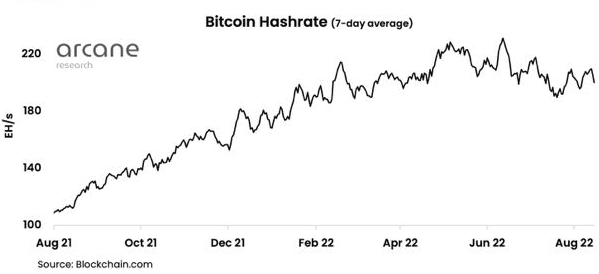

Now, here’s a chart that reveals the pattern within the Bitcoin mining hashrate over the previous yr:

Appears like the worth of the metric hasn't proven a lot motion in latest days | Supply: Arcane Research's The Weekly Update - Week 32, 2022

As you’ll be able to see within the above graph, the Bitcoin mining hashrate appeared to have been on a relentless uptrend, till Could of this yr.

Following Could, whereas the indicator has been going up and down continually, the general pattern has been that of sideways motion.

The principle motive behind this pattern is the struggling miner revenues. The BTC value has been down quite a bit throughout this era, which implies the miners’ USD earnings has been considerably smaller (miners pay their operating prices within the greenback, and never BTC).

One other issue at play right here is that the hashrate is definitely standing at a pretty big worth proper now. Due to this, the problem has been excessive, which has meant that the miners who aren’t capable of compete in opposition to others in increasing their rig capability are getting a lesser a part of the block rewards.

In consequence, miners who have been already beneath stress, like these with excessive electrical energy prices and/or these with low effectivity machines, have been compelled to plug off their machines.

That is why, whereas the hashrate hit a brand new ATH throughout this consolidation, it couldn’t keep there for too lengthy as miners began going offline. Nonetheless, the hashrate falling off after that result in a lower within the issue, which incentivized some miners to convey their machines again on-line.

Naturally, that solely result in the next hashrate, and therefore greater issue, which as soon as once more made some miners disconnect from the community. And so on this approach, each the hashrate and the problem have been flipping up and down, in the end forming a sideways pattern.

BTC Worth

On the time of writing, Bitcoin’s price floats round $23.5k, down 5% prior to now week. Over the previous month, the crypto has gained 13% in worth.

The worth of BTC has been taking place in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Arcane Analysis