The Director of International Macro at Fidelity Investments, Jurrien Timmer, not too long ago supplied insights into the potential of the flagship cryptocurrency, Bitcoin, and went so far as labeling the crypto token as “exponential gold.”

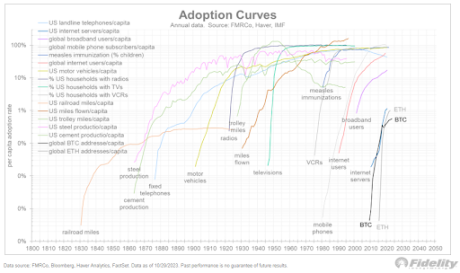

A Look At Bitcoin’s Adoption Curve

In a post launched on his X (previously Twitter) platform, Timmer talked about that Bitcoin’s shortage and adoption curve doubtlessly permit it to be a “high-powered hedge in opposition to financial shenanigans,” seemingly alluding to the truth that the token’s options make it an awesome choice to hedge against inflation. That’s the reason he sees the token as “exponential gold.”

Supply: X

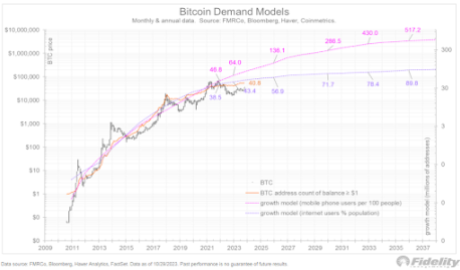

He additional elaborated on Bitcoin’s adoption curve, stating that it has to date adopted a “typical S-curve form,” which locations it in good firm with different main improvements that went via such an adoption journey. Considered one of them is cellphones, as Timmer famous that Bitcoin’s adoption curve in 2020 resembled that of cellphones within the ‘80s and ‘90s.

Supply: X

Bitcoin, nevertheless, appears to have moved to a different stage within the adoption curve, as Timmer said that the “real-rate narrative modified from dovish in 2020 to hawkish in 2022.” He additional prompt that Bitcoin has moved previous the stage of a speedy rise as its adoption curve has flattened out. With this, Timmer believes that it now shares similarities with the adoption curve of the internet within the 2000s because the crypto token “has not made a lot progress since 2021.”

Bitcoin Volatility: Good Or Unhealthy?

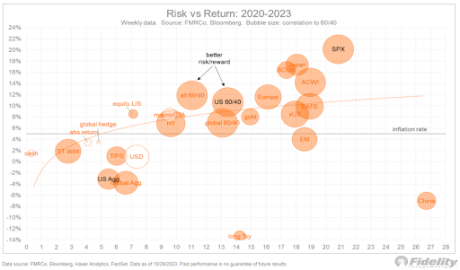

In a subsequent post, Timmer put Bitcoin’s volatility in perspective as he in contrast it with different asset courses. First, he shared a risk-reward chart for the pandemic and post-pandemic period starting from 2020 to this 12 months. The SPX appeared to supply the perfect risk-reward with near 24% return.

Supply: X

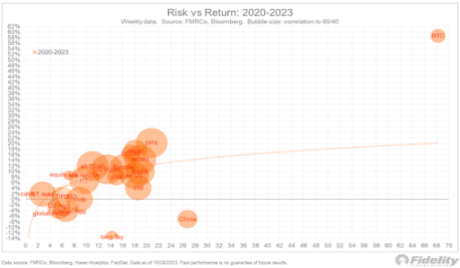

Timmer then went on to share one other chart, which included Bitcoin this time round. The foremost cryptocurrency notably stood out from the remainder, as he talked about that Bitcoin was “in a special universe,” with a 58% return.

Supply: X

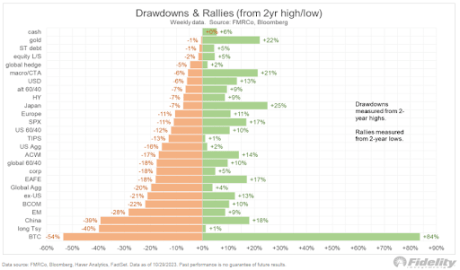

Bitcoin’s high volatility appears to have contributed to such returns in no small manner, as Timmer talked about that the crypto token’s enormous drawdowns additionally include giant positive factors. To drive house his level, he shared one other chart that confirmed drawdowns and rallies, which numerous asset courses have skilled from their 2-year excessive and low, respectively.

Supply: X

The chart confirmed that Bitcoin skilled a 54% drawdown from its two-year high however can also be up by 84% from its low in the identical interval.

That is extra spectacular when one considers how different asset courses have fared in the identical interval as Timmer said that Government bonds “can’t maintain a candle” to Bitcoin’s risk-reward math.

BTC jumps again to $34,800 | Supply: BTCUSD on Tradingview.com

Featured picture from Capital.com, chart from Tradingview.com