Spot Bitcoin ETFs in america have recorded six consecutive days of outflows highlighting a pointy drop in institutional curiosity. On Tuesday, the web outflows stood at a staggering $937 million, marking the most important single-day outflows since inception. The outflows have escalated as BTC worth loses its essential assist ranges falling all the best way beneath $88,500 whereas extending its weekly losses to greater than 7.52%, resulting in an general crypto market crash.

Bitcoin ETF Outflows Shake Investor Sentiment

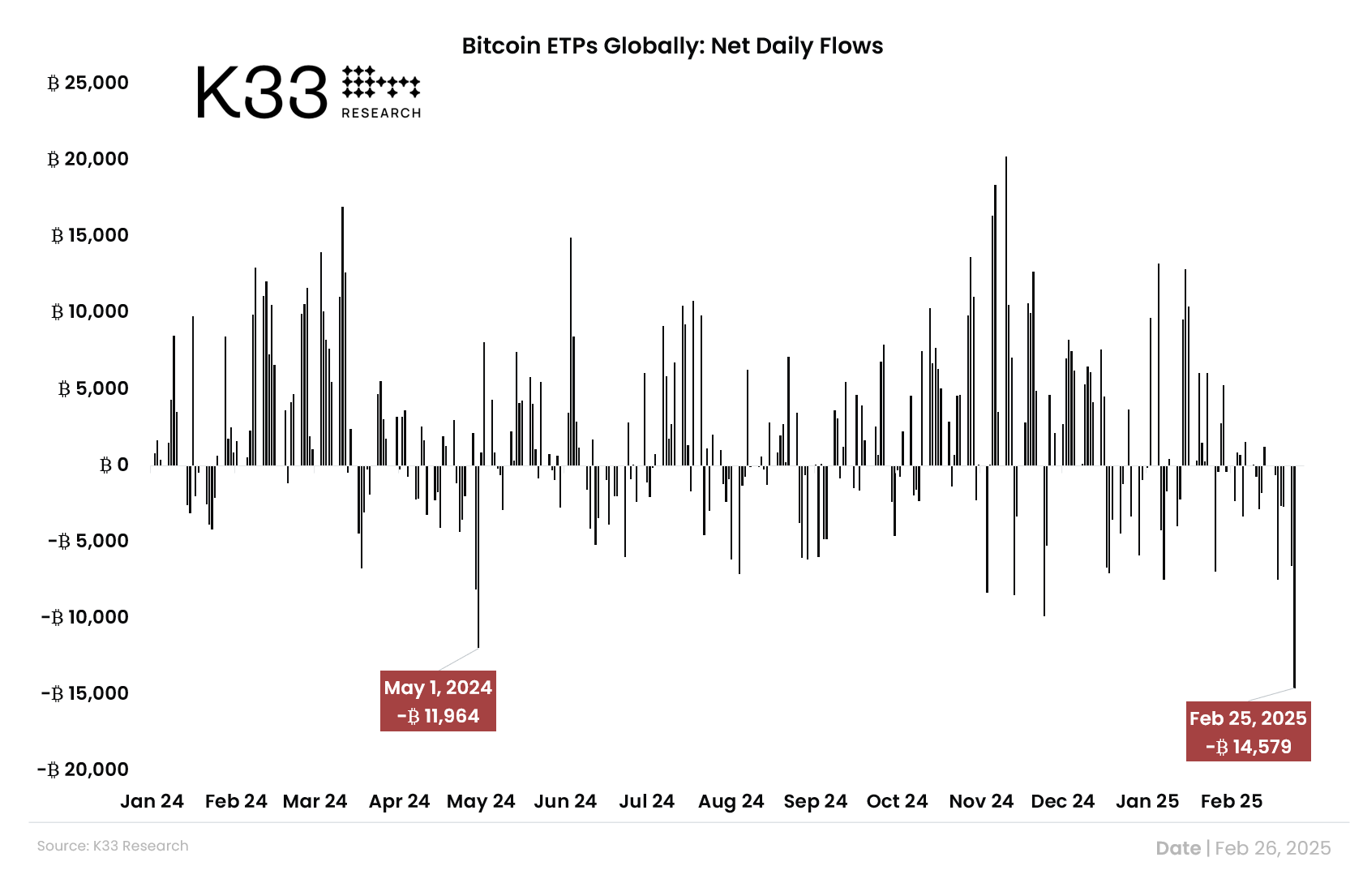

Amid the crypto market crash and BTC worth shedding essential assist ranges, US Bitcoin ETFs have witnessed a surge in outflows over the previous week. The Bitcoin exchange-traded product (ETP) market skilled its largest-ever single-day web outflow, with 14,579 BTC withdrawn globally, in response to Velte Lunde, Head of Analysis at K33 Analysis.

Lunde additional added that the ETFs have confronted sustained promoting strain all through February with 69% of the month’s buying and selling days seeing web outflows. This development underscores a constant discount in investor publicity to Bitcoin ETFs, reflecting cautious market sentiment amid broader crypto market volatility.

On Tuesday, Constancy’s FBTC led the entire ETF outflows with $344 million whereas BlackRock’s IBIT noticed $144 million in outflows, as per information from Farside Investors. Constancy has additionally recorded outflows for six consecutive days in a row. Buyers have pulled $1.7 billion from cryptocurrency exchange-traded merchandise (ETPs) and exchange-traded funds (ETFs) this week to date.

Bitcoin Alternate Inflows Surge, BTC Value Crash to $70K Imminent?

CryptoQuant analyst Amr Taha reported a notable spike in Bitcoin trade exercise, with the “Alternate Influx (High 10)” metric exceeding 5,000 BTC thrice in a single day following the discharge of the U.S. Shopper Confidence report.

Shopper confidence within the U.S. has dropped to an eight-month low, pushed by rising issues over inflation and the impression of latest tariffs launched beneath the second Trump administration. The elevated inflows counsel potential promoting strain as massive holders or establishments could also be transferring Bitcoin to exchanges for liquidation. This might probably set off additional outflows from Bitcoin ETFs forward.

BitMEX co-founder Arthur Hayes has advised that Bitcoin may retrace to pre-election ranges between $70,000 and $75,000 if former President Donald Trump fails to cross his proposed funds, which incorporates elevated spending and a debt ceiling hike.

“This can be a take a look at of how robust Trump’s maintain is on the Republican Celebration,” Hayes acknowledged, advising market individuals to “sit back, retrace, and wait” because the state of affairs unfolds. As of press time, BTC price is buying and selling at $88,488 with day by day buying and selling volumes dropping to $68 billion.

Disclaimer: The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: